Prayag Chemicals Private Limited (“the Transferor Company 1”) is a private limited company incorporated under the provisions of the Companies Act, 1956 on October 05, 1993 in the name of “Kaushico Chemical Works Private Limited”. Subsequently on March 17, 1994, the name of the Transferor Company 1 was changed to “Prayag Chemicals Private Limited”. Equity shares of the Transferor Company 1 are not listed. The Transferor Company 1 is carrying on business as manufacturers, importers and exporters of Chlorinated Paraffin (CP) (a widely used plasticizer) and Hydro Chloric Acid (HCL). Transferor Company 1 is in the process of shifting its Registered Office from National Capital Territory of Delhi (i.e. from the jurisdiction of Registrar of Companies, NCT of Delhi and Haryana) to the Union Territory of Chandigarh (i.e. to the jurisdiction of Registrar of Companies, Punjab and Chandigarh).

V.S. Polymers Private Limited (“the Transferor Company 2”) is a private limited company incorporated under the provisions of the Companies Act, 1956 on November 29, 1996. Equity shares of the Transferor Company 2 are not listed. The Transferor Company 2 is carrying on business as manufacturers, importers and exporters of Chlorinated Paraffin (CP) (a widely used plasticizer) and Hydro Chloric Acid (HCL). Transferor Company 2 is in the process of shifting its Registered Office from National Capital Territory of Delhi (i.e. from the jurisdiction of Registrar of Companies, NCT of Delhi and Haryana) to the Union Territory of Chandigarh (i.e. to the jurisdiction of Registrar of Companies, Punjab and Chandigarh).

Punjab Alkalies & Chemicals Limited (“Transferee Company”) is a public limited company incorporated under the provisions of the Companies Act, 1956 on December 01, 1975. Equity shares of the Transferee Company are listed on BSE. The Transferee Company has facilities for manufacturing of Caustic soda lye, Liquid Chlorine, Hydrochloric Acid, Sodium Hypochlorite and Hydrogen Gas. Main products of the Transferee Company are caustic soda lye, liquid chlorine, hydrochloric acid, hydrogen gas and sodium hypochlorite.

The Transferor Company 1, Transferor Company 2 and Transferee Company are affiliate entities of each other and have a common promoter group.

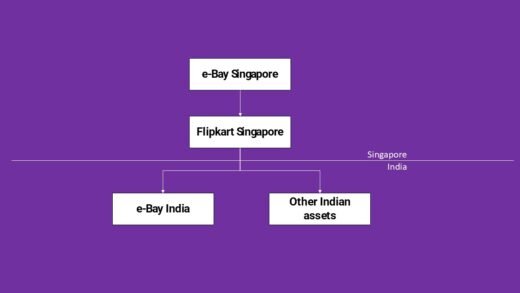

Current structure of the Company is as under:

The management of the Transferor Companies is of the view that the chemical industry is poised for substantial growth in the near medium-term opportunity which can be better capitalised as a consolidated entity with a bigger balance sheet, larger portfolio of products and a more streamlined structure. The management of the Companies further believes that the proposed consolidation will result into better efficiencies and economies in the post pandemic world and a single unified organisation is likely to have a faster growth trajectory. The consolidated organisation is also expected to create more value for all the stakeholders. Accordingly, management of the Transferor Company 1, the Transferor Company 2 and the Transferee Company have decided to consolidate the business structure of the 3 companies by way of entering into a scheme of amalgamation of Transferor Company 1 and the Transferor Company 2 with and into the Transferee Company.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Amalgamation of the Transferor Company 1 and the Transferor Company 2 with and into the Transferee Company |

Appointed Date | April 1, 2021 |

Effective Date | Same as appointed date i.e. April 1, 2021 |

Jurisdictional Authority(ies) | Jurisdictional National Company Law Tribunal Jurisdictional Registrar of Companies Jurisdictional Regional Director Jurisdictional Official Liquidator |

Consideration | The Company to issue shares to the shareholders of the Transferor Promoter Holding Company in the ratio based on the valuation report |

Accounting Treatment | In the books of the Company – Pooling of interest method; In the books of Promoter Holding Companies – NA |

Taxation | Tax neutral transaction |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Prayag Chemicals Private Limited (“Transferor Company 1”) | 100% | – | NA, since amalgamated | |

V.S. Polymers Private Limited (“the Transferor Company 2”) | 100% | – | NA, since amalgamated | |

Punjab Alkalies And Chemicals Limited (the Transferee Company) | 31.35% | 68.65% | 34.10% | 65.90% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

The management of the respective Companies are of the view that the amalgamation proposed in this Scheme is, in particular, expected to have following benefits:

- Opportunity to increase the production of Caustic Soda by PACL, by having own facilities to use chlorine for manufacture of downstream products and therefore have a better control over the supply chain management for disposal of chlorine;

- Consolidation of businesses under the Transferee Company providing an increased capability to offer a wider portfolio of products on a single platform to effectively address the issue of cyclical nature of business and market dynamics with a combined ability to integrate, innovate, customize and bundle the products of Transferee Company and Transferor Companies under a single platform. Its enhanced resource base and client relationships are likely to result in better business potential and prospects for the consolidated entity and its stakeholders;

- Integrated value chain to enhance degree of vertical integration in the chemical business;

- Consolidation of funds and resources will lead to optimisation of working capital utilisation and stronger financial leverage given the simplified capital structure, improved balance sheet and optimised management structure;

- Consolidation of businesses under Transferee Company will provide impetus to growth, enable synergies and productivity gains, increase operational efficiencies, centralisation of inventory, reduce operational costs and enable optimal utilisation of various resources as a result of pooling of financial, managerial, technical and human resources, thereby creating stronger base for future growth and value accretion for the stakeholders;

- Elimination of the need for inter-company transactions between Transferee Company and Transferor Companies;

- Amalgamation will result in simplification of the group and business structure and will enable to consolidated entity to have stronger presence in the market, more extensive network for deeper market penetration and enhancement of the overall customer satisfaction, engagement and retention; and

- Create value for the stakeholders including the respective shareholders, customers, lenders and

- Since the Transferee Company and Transferor Companies belongs to the same promoter group which are engaged in the business of manufacture of products from chemicals, the amalgamation will enable them to bring together their respective synergies in manufacturing of such various products in the same value chain thereby enhancing the value for all the stakeholders.

Commercial considerations:

- The scheme enables listing of unlisted company without following the requirement of undergoing the IPO procedures which are lengthy, time consuming and costlier.

- Additionally, amalgamation is a tax neutral thereby eliminates any adverse tax liability in the hands of companies involved under the Scheme as well as in the hands of shareholders of such companies.

- Scheme facilitates expansion of businesses, thereby providing greater flexibility to each of the business units and growth potential by attracting right talent pool and investors funding.

For detailed discussion on the above case study, please feel free to connect at Contact@devadhaantu.in