Untill Assessment Year 2020-21, if a Company declared dividend, it was Company’s liability to deduct tax on such dividend viz. Dividend Distribution Tax (‘DDT’). In such cases, if the shareholders are non-resident, whether to deduct DDT at rate prevalent under the provisions of the Income Tax Act, 1961 (‘the ITA’) or the rates prevalent under the Double Taxation Avoidance Agreement (‘the DTAA’), has been matter of debate and tax litigation. In one such instance, where Giesecke & Devrient [India] Pvt Ltd (‘the Assessee Company’) [1] has declared dividend and its parent company is non-resident, such question has been dealth with. Details of the case are as under:

Facts of the case:

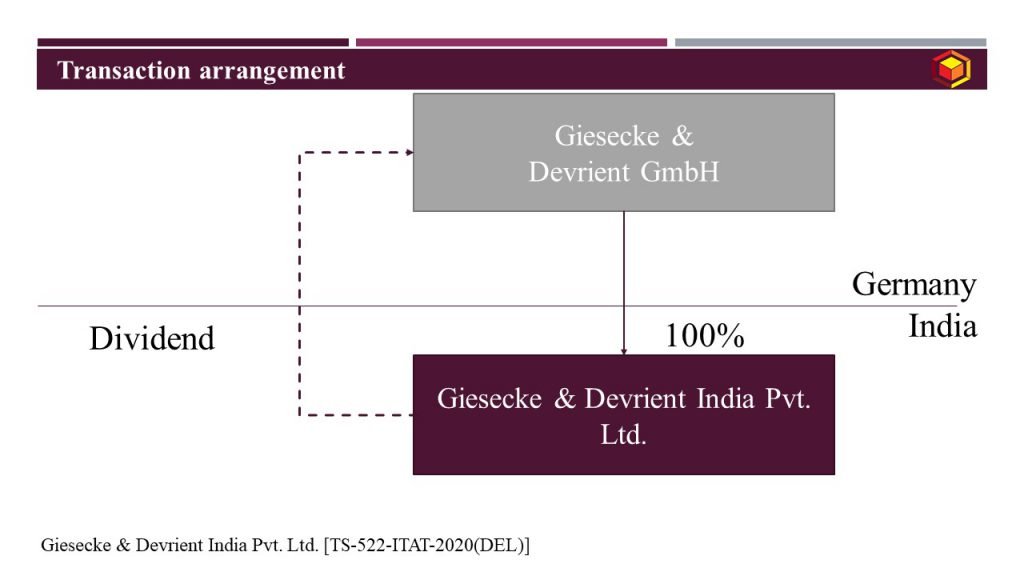

The Assessee Company was a wholly owned subsidiary of a German Parent, Giesecke & Devrient GmbH.

In the Assessment Year 2013-14, the Assessee had declared dividend and accordingly was liable to DDT.

Assessment Proceedings:

In the course of an appeal for AY 2013-14 on transfer pricing and corporate tax matters, the Assessee Company raised an additional ground, challenging the applicability of the higher rate of DDT instead of the beneficial Dividend tax rate provided under India-Germany DTAA.

Issue under Consideration:

Whether DDT on dividend declared to foreign shareholders is restricted to rates mentioned in the DTAA or rates under provisions of the ITA are applicable?

Order of Delhi ITAT:

Income Tax Appellant Tribunal, Delhi Bench (‘Delhi ITAT’) admitted the additional ground raised by the Assessee Company and also allowed the claim of the Assessee Company for beneficial rate of DDT as per DTAA. However, directions were given to Assessing Officer to verify the beneficial ownership condition, supporting documents, etc.

The observations made by Delhi ITAT are as under:

- Delhi ITAT held that the liability to DDT under the ITA which falls on the company declaring the dividend may not be relevant when considering applicability of rates of DDT set out in the DTAA.

- The generally accepted principles relating to interpretation of DTAA in the light of object of eliminating double taxation does not bar the application of DTAA to DDT.

- Delhi ITAT gave high weightage to the intent of the lawmaker while introducing the concept of DDT. Relying on the memorandum to Finance Bill 1997, 2003, it was stated that levy of additional tax on the company was driven by administrative considerations rather than legal necessity.

- It was emphasized that economically, the burden of DDT falls on the shareholders rather than on the company, as the amount of distributed profits available for shareholders stands reduced to the extent of DDT levied. Further, based on the reading of memorandum for 1997 and 2003, it was clear that the levy is for all intent and purposes, a charge on dividends.

- Further, it was also emphasized that additional Income tax is part of the tax as defined in Section 2(43) of the Act, and levy of the additional Income tax u/s 115-0 has its genesis in charging provision of Section 4 of the Act. The provisions of Sections 4 and 5 of the Act are expressly made ‘subject to the provisions of this Act’ which would include Section 90(2) of the Act that opens the gate for applying the rates under DTAA over rates provided in the ITA.

For detailed discussion on the above subject, please feel free to connect at contact@devadhaantu.in

___________________________________________________________________________________

[1] Giesecke & Devrient India Pvt. Ltd. [TS-522-ITAT-2020(DEL)]

[2]