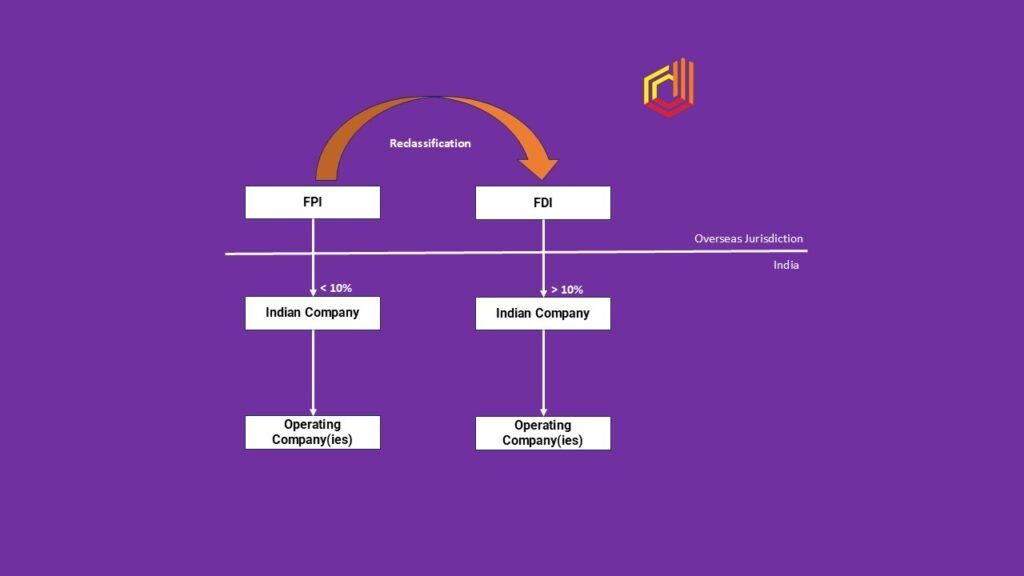

The Reserve Bank of India (RBI), in consultation with the Government of India (GoI) and the Securities and Exchange Board of India, has, vide its circular[1] dated 11 November 2024, issued the operational framework for reclassification of Foreign Portfolio Investment made by Foreign Portfolio Investors (FPIs) as Foreign Direct Investment (FDI) under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (NDI Rules), with immediate effect, as amended.

The operational framework is issued in order to provide necessary clarity and requirements for the purposes of fulfilment of compliance requirements upon breach of the investment limits by concerned FPI.

Rule 10 of Schedule II of the NDI Rules prescribes maximum limit of 10% of paid up equity capital on a fully diluted basis, for investment by any FPI or investor group (individual limit) in an Indian listed company. Upon breach of the prescribed limit as above, an FPI shall have an option to either divest its holding or reclassify the holding as FDI. Upon opting for reclassification of holding FPI, operational framework is required to be complied with by such an investor.

As per the said operational framework, the following conditionalities / guidance has been provided for necessary compliance:

- No reclassification shall be permitted in any sector prohibited for FDI.

- FPIs and their investor groups are treated as one entity for reclassification purposes.

- The concerned FPI shall seek consent from the Indian investee company to confirm compliance with the NDI Rules and also seek prior approvals from the GoI as necessary for the sector or acquisition and for investments from land-bordering countries, ensuring compliance with the NDI Rules.

- FPIs shall declare their intent to reclassify investments as FDI along with the necessary approvals to their custodian, who shall freeze further purchases for such FPIs until the reclassification process is complete. Without prior approvals, excess investment by such FPIs in the Indian company must be divested within the prescribed time-limit.

- For reclassification, the entire investment held by the FPI shall be reported within the timelines as specified under the Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 in the following manner: –

- The Indian company will report new equity issuances in Form FC-GPR.

- FPI will report secondary market acquisitions in Form FC-TRS. 1 A.P. (DIR Series) Circular No. 19 dated 11 November 2024

- The concerned Authorised Dealer Category-I will report the amount of reclassified foreign portfolio investment as divestment under LEC (FII) reporting to the RBI.

- The date of the investment limit breach will be regarded as the reclassification date.

- Post completion of reporting, the FPI should approach its custodian for transfer of equity instruments of the Indian company from its demat account for foreign portfolio investments to its demat account for holding FDI.

- Post-reclassification, Schedule I of the NDI Rules governing FDI will govern the investment, and such investment will be treated as FDI even if it falls below the 10% limit later.

The operational framework has been issued to streamline the process of reclassification from portfolio investment to FDI and ensuring ease in compliance with the NDI Rules by FPIs and Indian listed companies.

[1] A.P. (DIR Series) Circular No. 19 dated 11 November 2024

____________________________________________________________________________________

For detailed discussion on the above circular, please do feel free to connect at devadhaantu@devadhaantu.in