The SEBI has formulated the SEBI (IFSC) Guidelines to facilitate and regulate financial services relating to securities market in an IFSC set up under Section 18(1) of SEZ Act. The SEBI (IFSC) Guidelines, 2015 provide the following:

1. Applicability and scope:

The SEBI (IFSC) Guidelines govern stock exchange, clearing corporation, depositaries, intermediaries, funds desirous of operating in IFSC, issue of capital by entities (both debt and equity) in IFSC. In order for an entity engaged in above activities, to operate in an IFSC, requirements as below needs to be fulfilled:

· Prior permission of SEBI is required to be obtained in case any entity is intending to organise or assists in organising any stock exchange or clearing corporation or depository, or desirous of undertaking any other financial services relating to securities market in order for it to be considered as a recognised entity;

· Any entity desirous of operating in an IFSC for rendering financial services relating to securities market, shall comply with the provisions relating to registration or recognition, as the case may be, of applicable regulations of the SEBI;

· All provisions related to application of securities law shall apply to a financial institution operating in an IFSC, except as otherwise provided in these SEBI (IFSC) Guidelines;

· The SEBI (IFSC) Guidelines are subject to guidelines of GoI on foreign investment.

2. Criteria for operating in IFSC:

The provisions of SEBI (IFSC) Guidelines in relation to securities market have been elaborated below:

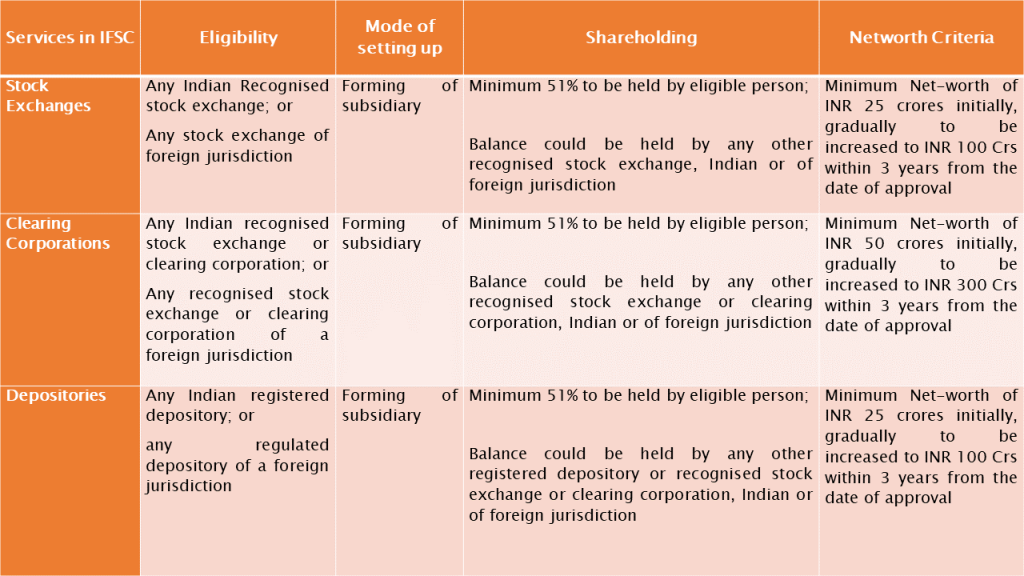

· The SEBI (IFSC) Guidelines inter-alia provides that following are the eligibility criteria, shareholding conditions and net-worth criteria for setting up services in relation to securities market in IFSC:

· The Bombay Stock Exchange and National Stock Exchange have already set up their exchanges in the GIFT City – India INX Ltd. and NSE IFSC Ltd., respectively;

· The stock exchanges operating in IFSCs are permitted to deal in securities and products in any currency other than INR with a specified lot size on their trading platform. Types of securities permitted to be traded into includes, (i) equity shares of a company incorporated outside India, (ii) depository receipt(s), (iii) debt securities issued by eligible issuers, (iv) currency and interest rate derivatives, (v) index-based derivatives and such other securities as may be specified by the board.

· The SEBI (IFSC) Guidelines also regulate intermediaries, who by forming a company can cater to provide financial services to,

i. a person not resident in India;

ii. a non-resident Indian;

iii. a financial institution resident in India who is eligible under FEMA to invest funds offshore subject to FEMA regulations; and

iv. a person resident in India who is eligible under FEMA to invest funds offshore as permitted under Liberalised Remittance Scheme subject to minimum investments as specified by IFSC board.

Such Intermediaries are permitted to provide investment advisory services and portfolio management services in IFSC.

Further, a portfolio manager is permitted to invest securities as mentioned below:

i. Securities which are listed in IFSC;

ii. Securities issued by companies incorporated in IFSC; and

iii. Securities issued by companies belonging to foreign jurisdiction.

3. Raising of Capital:

Further, the SEBI (IFSC) Guidelines provide the manner of raising equity capital by domestic companies and companies of foreign jurisdiction.

· Domestic companies intending to raise capital, in a currency other than Indian Rupee, in an IFSC shall comply with the provisions of Foreign Currency Depository Receipts Scheme, 2014.

· Companies of foreign jurisdiction, intending to raise capital, in a currency other than Indian Rupee, in an IFSC shall comply with the provisions of the Companies Act, 2013 and relevant provisions of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009.

· It is also provided that domestic companies or companies of foreign jurisdiction, may list and trade their securities as per the norms specified by SEBI. In relation to debt capital, it provides details of the eligibility issuer, mandatory listing requirements, credit rating requirements etc.

4. Alternative Investment Fund (“AIF”) in an IFSC:

The SEBI (IFSC) Guidelines regulate activities in relation to AIF or mutual funds operating in IFSC as well.

· For eligibility to invest in AIF in IFSC, following persons can make investments:

o A person resident outside India;

o A non-resident Indian;

o Institutional investor resident in India who is eligible under FEMA to invest funds offshore subject to FEMA provisions;

o Person resident in India having a net worth of at least USD 1 million during the preceding financial year who is eligible under FEMA to invest funds offshore as permitted under the LRS regulations of RBI and subject to RBI Approval.

· Investment in AIF shall be made only in currency other than INR.

· Further, AIF is permitted to invest in securities such as,

i. Listed securities in IFSC;

ii. Securities issued by company incorporated in IFSC;

iii. Securities issued by companies incorporated in India or foreign jurisdiction;

iv. Units of other AIF;

v. Investments in LLP, REIT, INVIT, derivatives, etc.

Also, it has been clarified that IFSC AIF can invest in India under Foreign Venture Capital Investment (“FVCI”) route, Foreign Direct Investment Route (“FDI”) and Foreign Portfolio Investment Route (“FPI”). This flexibility has been given with an intention to attract offshore funds accessibility under IFSC regime.

5. Foreign Portfolio Investors (‘FPI’):

· The SEBI has notified that SEBI registered foreign portfolio investors (“FPIs”), proposing to operate in IFSC, shall be permitted, without undergoing any additional documentation and / or prior approval process. In case of participation of FPIs in IFSC, a trading member of the recognized stock exchange in IFSC, may rely upon the due diligence process already carried out by a SEBI registered intermediary during the course of registration and account opening process in India.

· FPIs, who presently operate in Indian securities market and propose to operate in IFSC also, shall be required to ensure clear segregation of funds and securities. The custodians shall, in turn, monitor compliance of this provision for their respective FPI clients. Such FPIs shall keep their respective custodians informed about their participation in IFSC. The SEBI recently repealed the erstwhile SEBI (Foreign Portfolio Investor) Regulations, 2014 and introduced SEBI (Foreign Portfolio Investor) Regulations, 2019 (“SEBI (FPI) Regulations”).

· The SEBI (FPI) Regulations have extended certain leeway to entities established in IFSC, in terms of the eligibility norms required to be fulfilled by FPIs for registration with SEBI.

· Exemption in eligibility criteria for FPIs in IFSC:

Certain eligibility norms in relation to the registration of an applicant with SEBI as an FPI, under Regulation 4 of the SEBI (FPI) Regulations, i.e. the applicant should

a. not be a resident Indian;

b. be a resident of the country whose securities market regulator is a signatory to the International Organization of Securities Commission’s Multilateral Memorandum of Understanding or a signatory to the bilateral Memorandum of Understanding with SEBI; and

c. in case the applicant is a bank, then it should be a resident of a country whose central bank is a member of the Bank for International Settlements, have been exempted for applicants incorporated or established in IFSC.

An applicant incorporated or established in IFSC shall be deemed to be appropriately regulated, for the purposes of the SEBI (FPI) Regulations. Therefore, an applicant incorporated or established in IFSC can apply for registration as a Category-I FPI.

Thus, SEBI is determined and committed towards strengthening development of the IFSC at the GIFT City as an attractive investment regime. This would not only enhance investment prospects for investors at worldwide level, but also help India see its growth journey in dynamic manner.

For more detailed discussion on the above subject, please feel free to connect at contact@devadhaantu.in