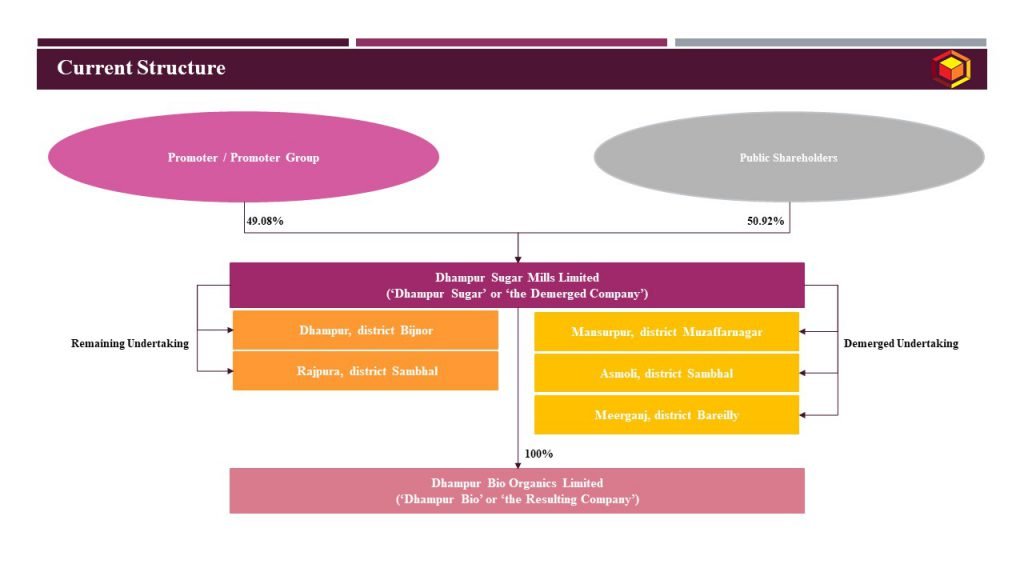

DHAMPUR SUGAR MILLS LIMITED (‘Dhampur Sugar’ or ‘the Demerged Company’) is a public company, limited by shares, incorporated under the provisions of the Companies Act, 1956 under Corporate Identity No. L15249UP1933PLC000511 and having its registered office at Dhampur, district Bijnor, Uttar Pradesh- 246761. At present, the Demerged Company has five manufacturing units situated at: (i) Dhampur, district Bijnor, (ii) Mansurpur, district Muzaffarnagar, (iii) Rajpura, district Sambhal, (iv) Asmoli, district Sambhal and (v) Meerganj, district Bareilly, all in the State of Uttar Pradesh, having manufacturing facilities of sugar, power, industrial alcohol, ethanol, chemicals and potable alcohol with different capacities. The equity shares of the Demerged Company are listed on BSE Limited and the National Stock Exchange of India Limited.

DHAMPUR BIO ORGANICS LIMITED (‘Dhampur Bio’ or ‘the Resulting Company’) is a public company, limited by shares, incorporated under the provisions of the Companies Act, 2013 under Corporate Identity No. U15100UP2020PLC136939 having its registered office at Sugar Mill Compound, Village Asmoli, District Sambhal, Moradabad – 244304, Uttar Pradesh. At present, all the shares of the Resulting Company are held by the Demerged Company and its nominees, such that the Resulting Company is a wholly owned subsidiary of the Demerged Company. The objects of the Resulting Company are similar to those of the Demerged Company, i.e. to carry out the dealing in and manufacturing of sugar, power and industrial alcohol* ethanol, chemicals and potable alcohol.

Current structure of the Company is as under:

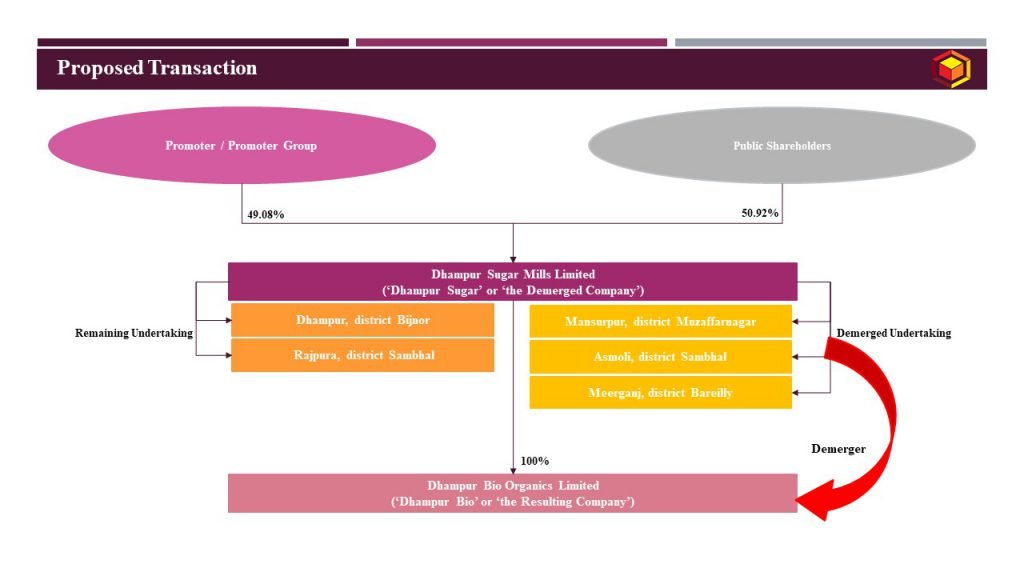

Management of Dhampur Sugar and Dhampur Bio have proposed to restructure business operations and shareholding of promoters family group in order to segregate the management and ownership of the different integrated manufacturing facilities/units of the Demerged Company for cane crushing, co-generation of power and industrial alcohol, ethanol, chemicals and potable alcohol between the Demerged Company and Resulting Company without splitting any of such standalone manufacturing units. Accordingly, the transfer of the Demerged Undertaking shall be on a going concern basis and in accordance with the conditions, if any, notified under subsection (5) of section 72A of the IT Act, by the Central Government in this behalf. Pursuant to the proposed Demerger as above, Scheme also covers clause for transfer of shares amongst promoter families in such a way that segregation of shareholding is achieved between the members of 2 promoter families within the limit of trigger of open offer requirement.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Demerger |

Appointed Date | April 1, 2021 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | National Company Law Tribunal, Allahabad Bench Registrar of Companies, Kanpur, Uttar Pradesh Regional Director, Kanpur, Uttar Pradesh |

Consideration | Dhampur Bio shall issue 1 equity shares to the shareholders of Dhampur Sugar for 1 equity shares held in Dhampur Sugar Further, existing shareholding of Dhampur Sugar into Dhampur Bio shall get cancelled pursuant to capital reduction. |

Accounting Treatment | In the books of Dhampur Sugar and Dhampur Bio – Pooling of interest method |

Taxation | Tax neutral transaction; Further, as per section 72A of the Income Tax Act, 1961, where company engaged in the business of manufacture of processing of goods, demerges its business undertaking into another company engaged in the similar business, fresh period of 8 years for carrying forward of business losses pertaining to such demerged undertaking is allowed in the hands of resulting company from date of demerger taking effect. |

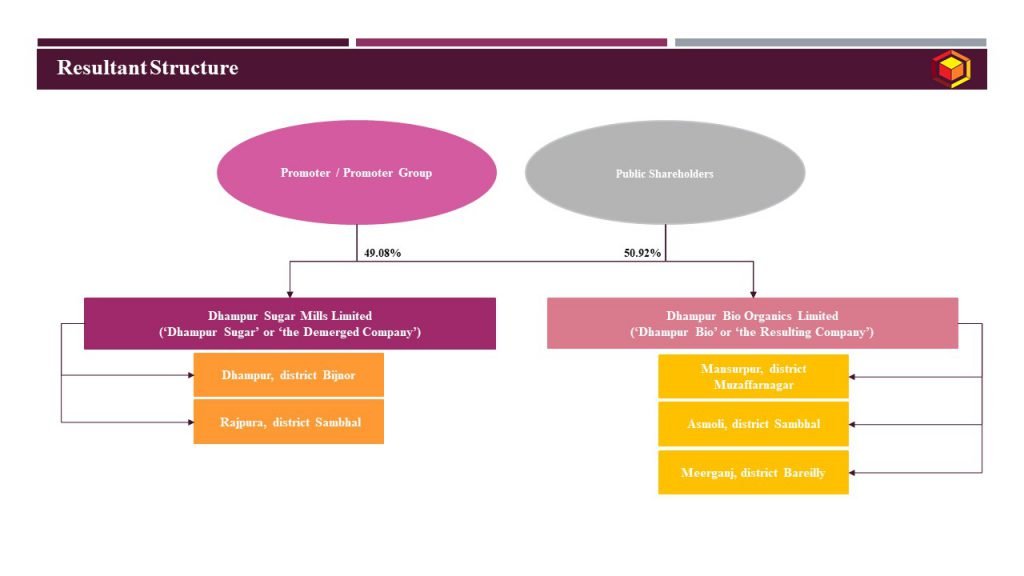

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Dhampur Sugar Mills Limited | 49.08% | 50.92% | 49.08% | 50.92% |

Dhampur Bio Organics Limited | 100% | – | 49.08% | 50.92% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

The Scheme will enable creation of two separate platforms for maximum exploitation of each of the above business opportunities through each of the Companies (as defined below), including in particular by streamlining management and administration and enabling the pursuit of diverse and independent strategic aspirations, in a manner that unlocks and maximises value for all shareholders and drives future strategic growth under the overall Dhampur legacy.

- The proposed Demerger will create an opportunity for pursuing independent growth and expansion strategies in the segregated businesses and effectively unlock value of each of the manufacturing units. The Demerger also represents an opportunity for the public shareholders to exploit the individual potential of both Companies.

- The segregation will allow each of the Companies to create a strong and distinctive platform with more focused management teams, which will enable greater flexibility to pursue long-term objectives and independent business strategies. The structure will streamline management and provide diversity in decisions regarding the use of respective cash flows for dividends, in capital expenditure or other reinvestment in their respective business, and in being able to explore varied investment opportunities and attract various investors and strategic partners.

- The business units of the Demerged Company are independent, self-sufficient in raw material, and standalone integrated, and would continue to function with efficiency, efficacy and synergies after the Demerger, and transition will be largely seamless.

- The Demerger at this juncture will also create a framework for succession planning including long term leadership of each Company with a view to ensure that the management and ownership model of the Demerged Company is not hindered by fragmentation of ownership and dispersed leadership over time as the promoter manager families move closer to a generational shift, which may be detrimental to the Demerged Company, business and stakeholders. Instead, following the Demerger, the management of each Company and ownership of the promoter-managers in each Company will remain consolidated within a family group and will be lean and agile. This will also ensure long term stability including through continued maintenance of goodwill and harmony and allow for succession planning in an orderly and strategic manner without any business disruption.

- The shareholding of public shareholders following the Demerger will remain the same in both Companies and shareholder value, across Companies, will be preserved and remain unchanged.

Commercial Considerations:

The demerger is tax neutral thereby eliminates any adverse tax liability in the hands of companies involved under the Scheme as well as in the hands of shareholders of such companies. However, it is to be noted that demerged undertaking is manufacturing plant at 3 locations. Transfer of such manufacturing plants could tantamount to heavy stamp duty outflow. Further, scheme does not specify specific business segment that gets demerged as from the documents it appears that all the activities are been carried out at each location. Segregation of business segment in a demerged undertaking assists in mitigating risks of litigations in future.

For more detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in