Tips Industries Limited (‘the Demerged Company’ or ‘TIL’) is a listed public limited company incorporated on May 8th, 1996 under the Companies Act, 1956 with CIN L92120MH1996PLC099359 having its registered office at 601, Durga Chambers, 6th Floor, 278/E, Linking Road, Khar (West}, Mumbai – 400052. The equity shares of Demerged Company are listed on BSE and NSE. The company is engaged in the business of Production and Distribution of motion pictures (“Film Division”) and acquisition and exploitation of Music Rights (“Music Division”). Classifying it on the basis of content, it consists of two main sectors-film and non-film music. The Company earns revenue from royalties on songs that are played on radio, mobiles, internet, etc.

Tips Films Limited (‘the Resulting Company’ or ‘TFL’) is an unlisted public limited company incorporated on June 5th, 2009 under the Companies Act, 1956 with CIN U74940MH2009PTC193028 and having its registered office at 501, Durga Chambers, 5th Floor, Linking Road, Khar (West), Mumbai- 400052 and has not yet commenced any significant business operations but will house Film Division of the Demerged Company.

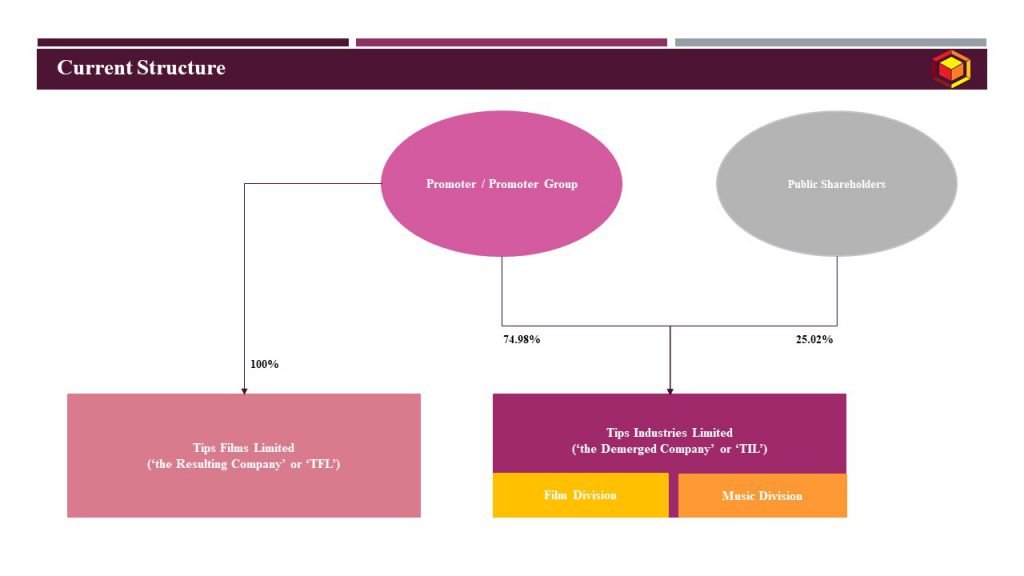

Current structure of the Company is as under:

Management of TIL and TFL has proposed to restructure business and shareholding of the group by demerging Film Division business undertaking of TIL into TFL, and listing of TFL.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Demerger |

Appointed Date | April 1, 2021 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | Securities and Exchange Board of India; BSE Limited; National Stock Exchange of India Limited; National Company Law Tribunal, Mumbai Bench Registrar of Companies, Mumbai Regional Director, Mumbai |

Consideration | TFL shall issue 1 equity shares for every 3 equity shares held in TIL to the shareholders of TIL Further, existing shareholding of TFL shall get cancelled pursuant to capital reduction. |

Accounting Treatment | In the books of TIL and TFL – Pooling of interest method |

Taxation | Tax neutral transaction |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Tips Industries Limited | 74.98% | 25.02% | 74.98% | 25.02% |

Tips Films Limited | 100% | – | 74.98% | 25.02% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

As TIL primarily operates in two business segments through separate business divisions: (i) Music Division and (ii) Film Division, the proposed demerged would essentially provide following benefits:

- Creation of separate, distinct and focused entity housing Film division business undertaking leading to greater operational efficiencies for both the business undertakings;

- Independent setup of each of the Music division business undertaking and Film division business undertaking of the Company to ensure required depth and focus on each of the business undertaking and adoption of strategies necessary for the growth of the respective businesses. The structure shall provide independence to the management in decisions regarding the use of their respective cash flows for dividends, capital expenditure or other reinvestment in their respective businesses;

- Unlocking of value for shareholders of the Company by transfer of the Film division business undertaking, which would enable optimal exploitation, monetization and development of both the business undertakings by attracting focused investors having the necessary ability, experience and interests in these sectors and by allowing pursuit of inorganic and organic growth opportunities in such businesses; and

- Enabling the business and activities to be pursued and carried on with greater focus and attention through two separate companies each having its own separate administrative set up and dedicated management.

Commercial considerations:

- The scheme enables back-door listing without requirement of following IPO procedures which are lengthy, time consuming and costlier.

- Additionally, demerger is tax neutral thereby eliminates any adverse tax liability in the hands of companies involved under the Scheme as well as in the hands of shareholders of such companies.

- Scheme facilitates monetization of Film division business undertaking and segregation of management for both the business undertaking, thereby providing greater flexibility to each of the business units and growth potential by attracting right talent pool and investors funding.

For more detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in