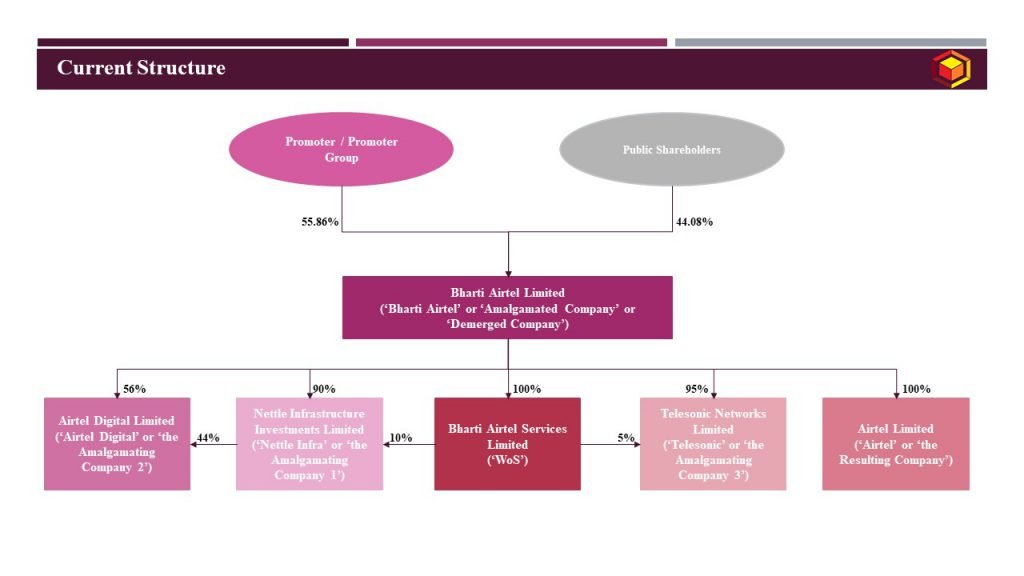

Bharti Airtel Limited (‘Bharti Airtel’ or ‘Amalgamated Company’ or ‘Demerged Company’), is a public limited company incorporated on July 7, 1995 under the Companies Act, 1956, having its registered office at Airtel Center, Plot No. 16, Udyog Vihar, Phase-IV, Gurgaon, Haryana – 122015. The equity shares of Bharti Airtel are listed on the Stock Exchanges.

Headquartered in India, Bharti Airtel is a global telecommunications company with operations in 18 countries across South Asia and Africa. Bharti Airtel ranks amongst the top three mobile operators globally and its mobile network covers a population of over two billion people. Bharti Airtel is India’s largest integrated telecom provider and the second largest mobile operator in Africa (‘Telecom Business Undertaking’).

Bharti Airtel’s portfolio, offered through Bharti Airtel and its subsidiaries, includes high speed 4G/ 4.5G mobile broadband, ‘Airtel Xstream Fiber’ that promises speeds up to 1Gbps, converged digital TV solutions through the ‘Airtel Xstream 4K Hybrid Box’, digital payments through ‘Airtel Payments Bank’ as well as an integrated suite of services across connectivity, collaboration, cloud and security that serves over one million businesses. Bharti Airtel’s OTT services, housed in its subsidiary, the Amalgamating Company 2, include ‘Airtel Thanks’ app for self-care, ‘Airtel Xstream’ app for video, ‘Wynk Music’ for entertainment and ‘Airtel BlueJeans’ for video conferencing.

Nettle Infrastructure Investments Limited (‘Nettle Infra’ or ‘the Amalgamating Company 1’), is an unlisted public limited company incorporated on October 1, 2010 under the Companies Act, 1956, having its registered office at Airtel Center, Plot No. 16, Udyog Vihar, Phase-IV, Gurgaon, Haryana – 122015. As on April 14, 2021, the Amalgamated Company and Bharti Airtel Services Limited (a wholly owned subsidiary of the Amalgamated Company), respectively, hold 90% and 10% of the equity share capital of the Amalgamating Company 1.

The Amalgamating Company 1 is engaged in the business of promoting, establishing and funding companies engaged in the business of providing telecom services and other companies engaged in the activities ancillary to the telecom industry.

Airtel Digital Limited (‘Airtel Digital’ or ‘the Amalgamating Company 2’), is an unlisted public limited company, incorporated on January 13, 2015, under the Companies Act, 2013, currently having its registered office at Bharti Crescent, 1, Nelson Mandela Road, Vasant Kunj, Phase – II, New Delhi – 110070. As on April 14, 2021, the Amalgamated Company and the Amalgamating Company 1, respectively, hold 56% and 44% of the equity share capital of the Amalgamating Company 2. Additionally, the Amalgamating Company 2 is in process of shifting its registered office to the State of Haryana.

The Amalgamating Company 2 is engaged in the business of procurement, aggregation and provision of content services to its B2B and B2C customers and also in the provision of OTT services which include ‘Airtel Thanks’ app for self-care, ‘Airtel Xstream’ app for video, ‘Wynk Music’ for entertainment and ‘Airtel BlueJeans’ for video conferencing.

Telesonic Networks Limited (‘Telesonic’ or ‘the Amalgamating Company 3’), is an unlisted public limited company, incorporated on June 26, 2009, under the Companies Act, 1956, currently having its registered office at Bharti Crescent, 1, Nelson Mandela Road, Vasant Kunj, Phase – II, New Delhi – 110070. As on April 14, 2021, the Amalgamated Company and Bharti Airtel Services Limited (a wholly owned subsidiary of the Amalgamated Company), respectively, hold 95% and 5% of the equity share capital of the Amalgamating Company 3. Additionally, the Amalgamating Company 3 is in the process of shifting its registered office to the State of Haryana.

The Amalgamating Company 3 is engaged in the business of designing, planning, deploying, optimizing and managing broadband and fixed telephone networks across India. The Amalgamating Company 2 also holds a registration certificate for infrastructure provider category-I (IP-I) and is engaged in the business relating to optical fiber cable (including underground and over ground cables).

Airtel Limited (‘Airtel’ or ‘the Resulting Company’), is an unlisted public limited company, incorporated on March 16, 2021, under the Companies Act, 2013, having its registered office at Airtel Center, Plot No. 16, Udyog Vihar, Phase-IV Gurgaon, Haryana – 122015. The Resulting Company is a newly incorporated company and as on April 14, 2021, it is a wholly owned subsidiary of the Amalgamating Company 2.

The Resulting Company is a newly incorporated company and is yet to commence any business operations. Further, upon the Effective Date, the Resulting Company would be engaged in the telecom business in India pursuant to the demerger of the Telecom Business Undertaking into the Resulting Company.

Current structure of the Company is as under:

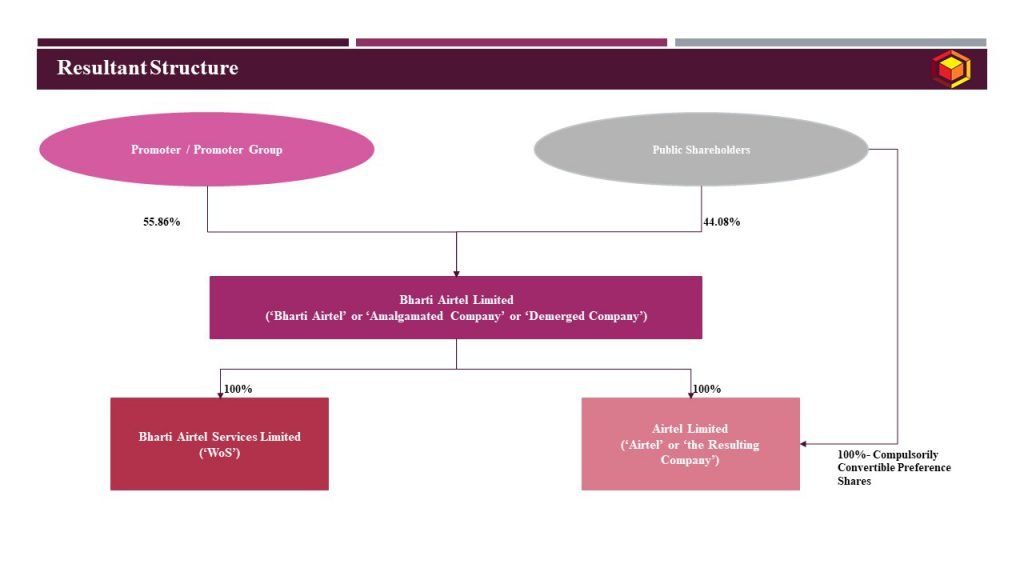

Management of the Company along with its group Companies has decided to restructure business and shareholding of the group as under:

Transaction 1: Amalgamation of Amalgamating Company 1, Amalgamating Company 2 and Amalgamating Company 3 into the Amalgamated Company;

Transaction 2: Demerger of Telecom Business Undertaking of Demerged Company into the Resulting Company, and listing of the Resulting Company.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction 1: Amalgamation | Transaction 2: Demerger |

Appointed Date | Date of filling of certified copy of approving authority being NCLT with ROC | Date of filling of certified copy of approving authority being NCLT with ROC |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC | Date of filling of certified copy of approving authority being NCLT with ROC, immediately after effectiveness of Transaction 1 |

Jurisdictional Authority(ies) | Securities and Exchange Board of India; BSE Limited; National Stock Exchange of India Limited; National Company Law Tribunal, Chandigarh Bench; Registrar of Companies, NCT of Haryana and Delhi; Regional Director, NCT of Haryana and Delhi | |

Consideration | No consideration shall be issued by the Amalgamated Company as it directly or indirectly holds 100% equity shares in Amalgamated Company 1, Amalgamated Company 2 and Amalgamated Company 3 | The Resulting company shall issue compulsorily convertible preference shares to the public shareholders of the Demerged Company as per share exchange ratio report obtained from the registered valuer based on Income Approach whereby fair market value of the Telecom Business Undertaking has been arrived at by applying Discounted Cash Flow Methodology. |

Accounting Treatment | In the books of the Company – Pooling of interest method; In the books of Amalgamated Company 1, Amalgamated Company 2 and Amalgamated Company 3 – NA | In the books of the Company and the New Company – Pooling of interest method |

Taxation | Tax neutral transaction | Tax neutral transaction |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Promoter Holding Companies | ||||

Nettle Infrastructure Investments Limited | 100% | – | NA, since amalgamated | |

Airtel Digital Limited | 100% | – | NA, since amalgamated | |

Telesonic Networks Limited | 100% | – | NA, since amalgamated | |

Bharti Airtel Limited | 55.86% | 44.14% | 55.86% | 44.14% |

Airtel Limited (Equity Shares) | 100% | – | 100% | – |

Airtel Limited (Compulsory Compulsorily Convertible Preference Shares) | – | – | – | 100% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

Insofar as the amalgamation is concerned, it shall provide benefits as under:

- Consolidation of entire operations of the Amalgamating Companies into the Amalgamated Company;

- Simplification of the group structure by aligning the interest of various stakeholders into the Amalgamated Company;

- Cost reduction, retention of talent, optimization of support functions, efficiencies and productivity gains by pooling the resources of the Amalgamated Company and the Amalgamating Companies, thereby significantly contributing to future growth and maximizing shareholders value;

- Consolidate all fibre assets (owned and leased) of the Amalgamated / Demerged Company in a single entity and position the Demerged Company to effectively leverage such core infrastructure required across multiple businesses/legal entities thereby delivering greater shareholder value.

Insofar as the demerger of the Telecom Business undertaking is concerned, it shall provide following benefits:

- Each has distinct business segments and associated market dynamics, like competition, distinct geographic focus, distinct strategy and distinct capital requirements. As a result, there are differences in the way in which the activities of the Telecom Business and the Residual Business are required to be organised and managed;

- The segregation and transfer of the Telecom Business Undertaking into the Resulting Company, as envisaged in this Scheme, will, without disturbing the current value accretion to the shareholders of the Demerged Company, enable sharper focus towards the Telecom Business, better alignment of Telecom Business and the Residual Business to their customers and the respective businesses to improve competitiveness, operational efficiencies and strengthen their position in the relevant marketplace, resulting in a more sustainable long term growth and competitive edge;

- The segregation and transfer of the Telecom Business Undertaking to the Resulting Company will also align the interests of key stakeholders, which will benefit the strategic direction of the Resulting Company in the long term, thereby creating greater value for the shareholders/ stakeholders of the Demerged Company and the Resulting Company;

- It will also lead to sharper focus on the Telecom Business resulting in logistics alignment, creation of efficiencies and optimization of capital and operational expenditure;

- One of the distinct advantages of carving out the Telecom Business into a standalone entity is its integration under the fold of the Demerged Company’s digital platform;

- Separately, the demerger of Telecom Business to the Resulting Company is expected to result in the segregation of non-telecom Residual Business from Telecom Business.

Commercial Considerations:

- hhhh

For mode detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in