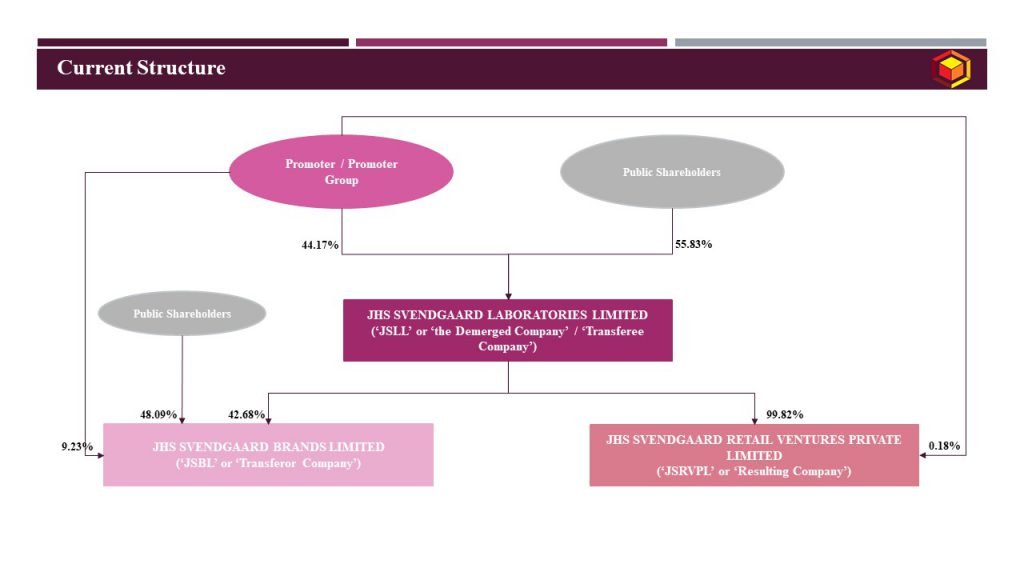

JHS SVENDGAARD LABORATORIES LIMITED (‘JSLL’ or ‘the Demerged Company’ / ‘Transferee Company’), bearing CIN L24230HP2004PLC027558, was incorporated on October 8th, 2004 under the provisions of Companies Act, 1956. The Registered office of JSLL is situated at Trilokpur Road, Kheri (Kala Amb), Tehsil – Nahan, Distt. Sirmour, Himachal Pradesh – 173030, India. JSLL is widely held listed company and the shares are listed on BSE Limited and National Stock Exchange of India Limited.

JSLL is engaged in the business manufacturing and selling of Toothbrushes, Toothpastes, Mouthwash, Denture Tablets and other allied oral care product. Apart from working on its own brands the company also offers Contract Manufacturing Partnership to brands in the domestic and the international market.

JHS SVENDGAARD RETAIL VENTURES PRIVATE LIMITED (‘JSRVPL’ or ‘Resulting Company’), bearing CIN U52100DL2007PTC159306 was incorporated on February 15th, 2007 under the provisions of the Companies Act, 1956. The Registered office of the Company is situated at B-l/E-23 Mohan Co-operative Industrial Area, Mathura Road New Delhi — 110044, India.

Resulting Company is carrying the Retail Business of selling the complete range of Patanjali branded products at major airports in India. The Demerged Company holds 99.82% equity shares of the Resulting Company.

The Resulting Company is under processes to shift the registered office from New Delhi to Gurgaon, Haryana

JHS SVENDGAARD BRANDS LIMITED (‘JSBL’ or ‘Transferor Company’), bearing CIN U52100DL2008PLC176320, was incorporated on April 3rd,2008 under the provisions of Companies Act, 1956. The Registered office of the Company is situated at B-l/E-23 Mohan Co-operative Industrial Area, Mathura Road New Delhi — 110044, India. The company is engaged in selling of toothbrushes, toothpastes, mouthwash and other allied oral care products under its proprietary brand “aquawhite” only.

The JHS Svendgaard Laboratories Limited (Demerged Company/ Transferee Company) holds 42.68% equity shares of the Transferor Company.

The Transferor Company is under processes to shift the registered office from New Delhi to Gurgaon, Haryana.

Current structure of the Company is as under:

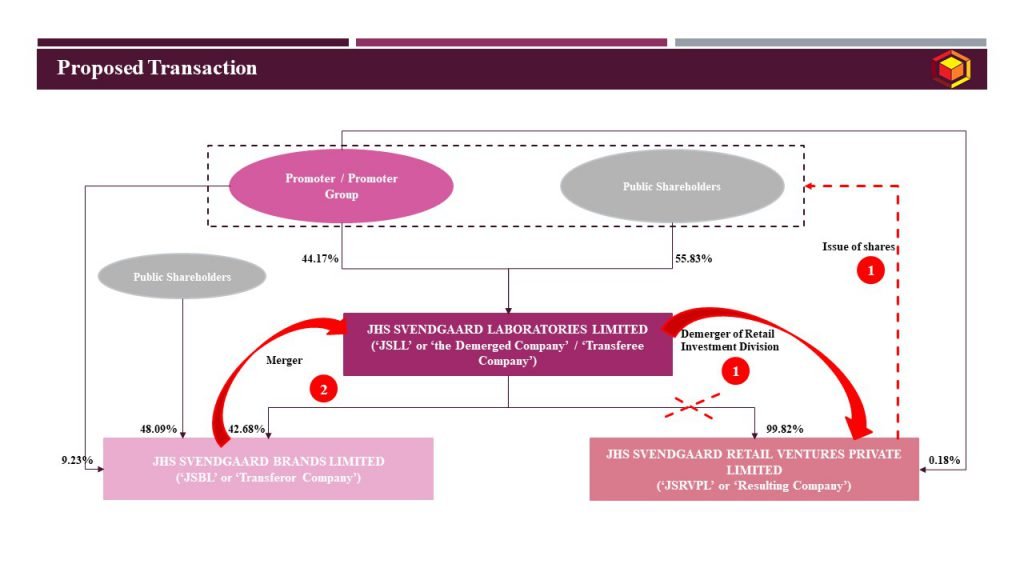

Management of the Company along with its group Companies has decided to restructure business and shareholding of the group as under:

Transaction 1: Demerger of the Retail Investment Division (Demerged Undertaking) of the JHS Svendgaard Laboratories Limited (‘Demerged Company / Transferee Company’) and vesting of the same with the JHS Svendgaard Retail Ventures Private Limited (‘Resulting Company’), on a going concern basis; and

Transaction 2: Following the Demerger referred hereinabove, Amalgamation of JHS Svendgaard Brands Limited (‘Transferor Company’) with JHS Svendgaard Laboratories Limited (‘Transferee Company’).

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction 1: Demerger | Transaction 2: Merger |

Appointed Date | April 1, 2020 | April 1, 2020 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC, immediately after effectiveness of Transaction 1 | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | Securities and Exchange Board of India; BSE Limited; National Stock Exchange of India Limited National Company Law Tribunal, Chandigarh Bench Registrar of Companies – NCT of Delhi and Haryana, New Delhi or Himachal Pradesh Regional Director, NCT of Delhi and Haryana, New Delhi or Himachal Pradesh | |

Consideration | In consideration of Demerger, the Resulting Company to issue its 1 equity share to the shareholders of Demerged Company for every 10 equity shares held in the Demerged Company. The share exchange ratio has been determined using Asset approach. Such equity shares shall be listed at the stock exchange in accordance with the applicable regulation of SEBI. | In consideration of merger, Transferee Company shall issue 150 equity shares to the Shareholders of the Transferor Company for every 100 shares held by such shareholder(s) in the Transferor Company The share exchange ratio has been determined using Asset approach.

|

Accounting Treatment | In the books of Demerged Company and Resulting Company – Pooling of interest method | In the books of the Transferee Company – Pooling of interest method; In the books of the Transferor Company – NA |

Taxation | Tax neutral transaction | Tax neutral transaction |

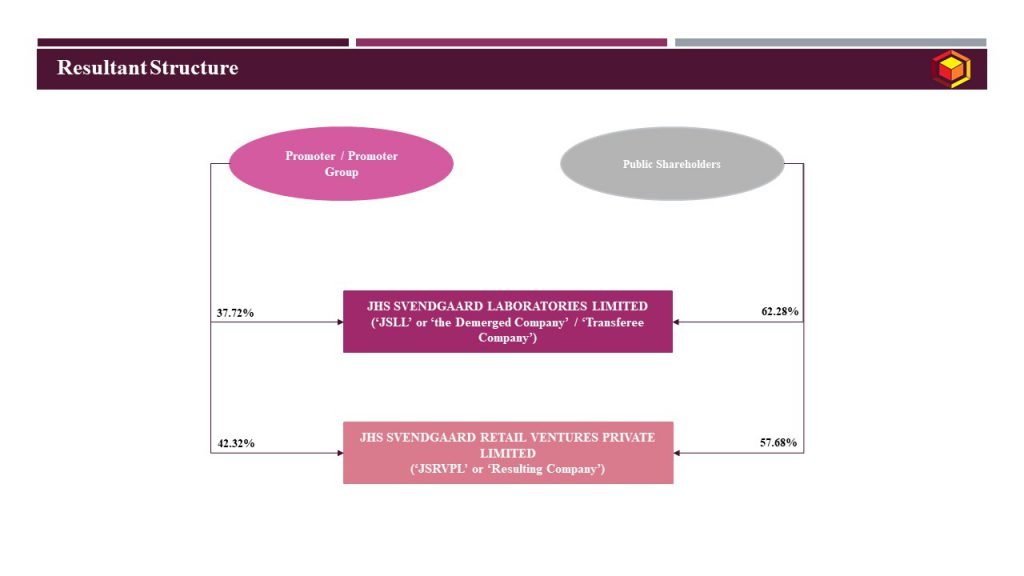

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

JHS SVENDGAARD LABORATORIES LIMITED | 44.17% | 55.83% | 37.72% | 62.28% |

JHS SVENDGAARD RETAIL VENTURES PRIVATE LIMITED | 100% | – | 42.32% | 57.68% |

JHS SVENDGAARD BRANDS LIMITED | 51.91% | 48.09% | NA, since merged | NA, since merged |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

Through this Scheme, following benefits are derived ,

Demerger:

- This restructuring is intended to provide greater business focus to Demerged Company in the ‘Manufacturing of oral and dental care products’ business and provides an opportunity to Resulting Company to focus on the retail business separately.

- Creation of a separate, distinct and focused entity housing the Retail Business leading greater operational efficiencies for the Retail Business;

- Independent setup of each of the undertaking of the Demerged Company and the Resulting Company to ensure required depth and focus on each of the companies and adoption of strategies necessary for the growth of the respective companies. The structure shall provide independence to the management in decisions regarding the use of their respective cash flows for dividends, capital expenditure or other reinvestment in their respective businesses;

- Unlocking of value for shareholders of the Demerged Company by transfer of the Retail Business, which enables optimal exploitation, monetization and development of both, Residual Undertaking and the Retail Business by attracting focused investors, joint venture partners and strategic partners having the necessary ability, experience and interests in this sector and by allowing pursuit of inorganic and organic growth opportunities in such businesses; and

- Enabling the business and activities to be pursued and carried on with greater focus and attention through two separate companies each having its own separate administrative set up and dedicated management.

Merger:

- The Transferor Company and Transferee Company are engaged in similar nature of business, i.e. Oral Care Products. Hence, the amalgamation of Transferor Company with Transferee Company to result in the consolidation of similar line of business and result in saving of administrative costs and various other overheads.

- Apart from above, the merger shall result in following benefits –

- Financial strength and flexibility for the Transferee Company, which results in maximising overall shareholder value, and to improve the competitive position of the combined entity.

- Achievement of greater efficiencies in operations with optimum utilization of resources, better administration and reduction in costs.

- Cost savings are expected to flow from more focused operational efforts, rationalization, standardization and simplification of business processes, productivity improvements, and the elimination of duplication, and optimum rationalization of administrative expenses and utilization of human resources.

- Improved organizational capability and leadership arising from pooling of financial, managerial and technical resources.

Commercial considerations:

- The Scheme is designed to provide elimination of multi-tier holding structure, thereby reducing any adverse compliance burden under the Companies Act, 2013, as it eliminates the need of undertaking voluntary liquidation of such multi layered companies.

- Further, scheme enables back-door listing without requirement of following IPO procedures which are lengthy, time consuming and costlier.

- Additionally, amalgamation and demerger are tax neutral thereby eliminates any adverse tax liability in the hands of companies involved under the Scheme as well as in the hands of shareholders of such companies.

- Scheme facilitates monetization of LSI business undertaking and segregation of management for both the business undertaking, thereby providing greater flexibility to each of the business units and growth potential by attracting right talent pool and investors funding.

For more detailed understanding of the above case study, please do not hesitate to connect at contact@devadhaantu.in