Esaar (India) Limited (‘Esaar’ or ‘the Company’), a Public Company, Limited by Shares having Corporate Identification Number, L67120MH1951PLC222871, was originally incorporated on August 23, 1951. The registered office of the Company is situated at 204 B-Wing, New Prabhat SRA CHS LTD, Chikuwadi, Plot-115, Next to Bisleri Factory, W. E, Highway Andheri (East), Mumbai – 400099. The Company is listed on the Bombay Stock Exchange Limited on March 4, 1996 and is also a registered Non-Banking Financial Institutions with Reserve Bank of India under the Reserve Bank of India Act, 1934.

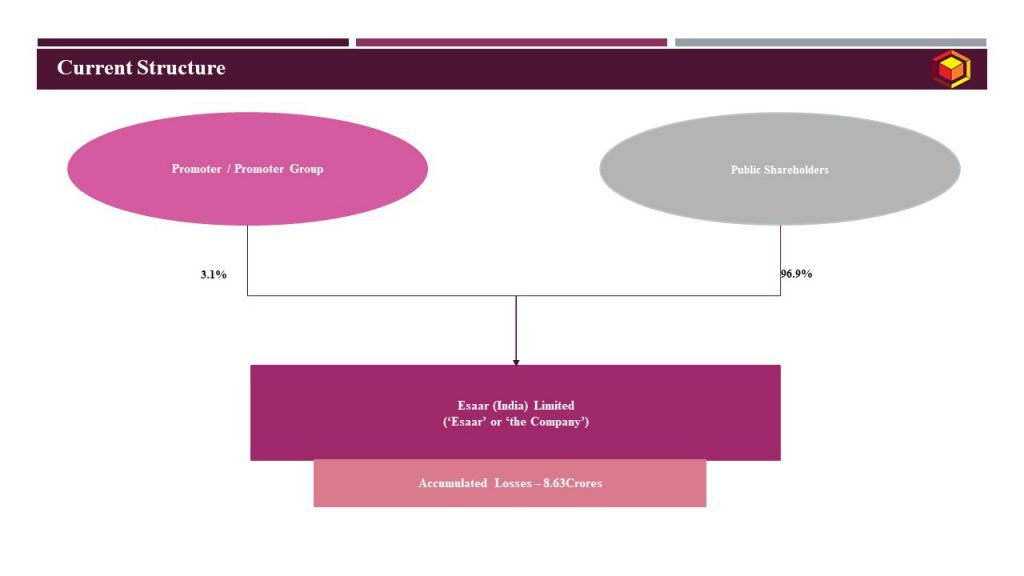

Current structure of the Company is as under:

The Company has incurred substantial losses since F.Y. 2013-14 and has not been able to scale its full potential for growth and profitability. As per the Audited Financial Statements for the year ended March 31, 2020, the Company has accumulated losses amounting to Rs. 8.63 Crores. The said accumulated losses have wiped off the value represented by the share capital. Thus, the financial statements of the Company are not reflective of the financial position of the Company.

In view of the accumulated carry forward losses that the Company’s Balance Sheet is not reflecting at its actual value and with the future prospect of growth and value addition to the shareholders. The Company has proposed to clean its books thereby enabling the Company to raise future resources considering the expansion programs that have been considered for development would need huge amount of investment both in terms of equity as well as debt.

Due to huge accumulated losses of the prior years, the financial statements do not reflect the turnaround in the business of the Company. Thus, with a view to ensure that,

- The financial statements of the Company reflect its true and fair financial healthy position; and

- To obliterate the share capital being lost and not represented by available assets of the Company, it is necessary to carry out reduction of share capital of the Company.

- The proposed reduction of share capital in the manner proposed herein would enable the Company to rationalise its capital structure and present a true and fair financial position of the Company, commensurate with its business and assets.

- Hence, the proposed reduction of share capital is in the interest of the Company and its shareholders, creditors and all concerned.

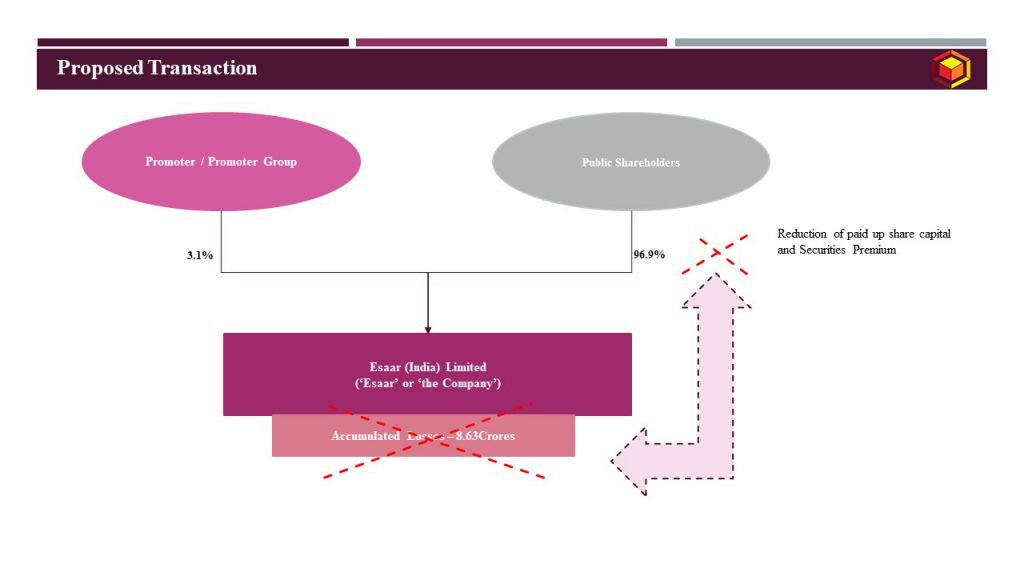

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Capital Reduction |

Appointed Date | To be decided by approving authority while passing the Scheme of Arrangement |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | Securities and Exchange Board of India Limited; BSE Limited; National Company Law Tribunal, Mumbai Bench Registrar of Companies, Mumbai Regional Director, Mumbai |

Consideration | No consideration shall be discharged by the Company for cancellation of share capital |

Accounting Treatment | In the books of the Company – debit share capital account against the accumulated profit and loss account |

Taxation | No adverse tax implications |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Esaar (India) Limited | 3.1% | 96.9% | 3.1% | 96.9% |

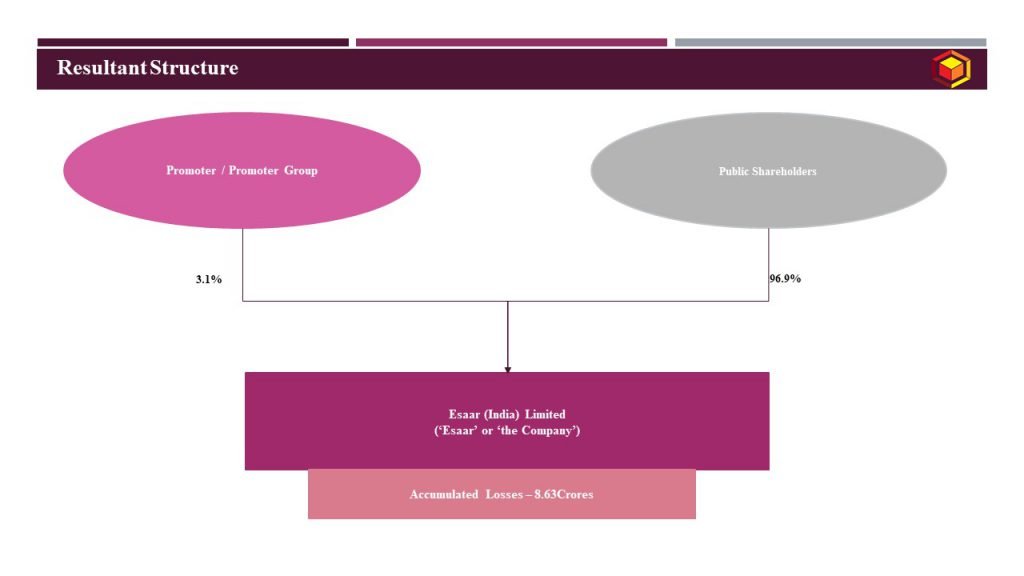

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

The proposed capital reduction benefits the Company as under:

- Representation of the true financial position which would benefit both Shareholders as their holding will yield better results and value and also enable the Company to explore opportunities to benefit of the Shareholders of the Company including in the form of dividend payment as per the applicable provisions of the Act.

- Further, the Scheme does not involve any financial outlay / outgo and therefore, would not affect the ability or liquidity of the Company to meet its obligations/ commitments in the normal course of business. Further, this Scheme would also not in any way adversely affect the ordinary operations of the Company.

- Further, the true financial statement of the Company would ensure the Company to expand and smoothen the business activity and to attract new source of avenue and in turn enhancement of its shareholders’ value.

- The proposed reduction of the paid-up share capital of the Company does not involve any payment of the paid-up share capital to the Shareholders of the Company nor does it result in extinguishment of any liability or diminution of any liability. The Scheme does not envisage transfer or vesting of any of the properties and/or liabilities of the Company to any person or entity. The Scheme also does not involve any conveyance or transfer of any property of the Company. Thus, the proposed capital reduction mitigates the possibility of imposition of adverse tax on the capital reduction.

For more detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in