In India, in order to determine tax liability, it is important to determine residential status under the tax provisions of the Income Tax Act, 1961 (‘the ITA’).

The ITA provisions in relation to determination of tax residency status in India are not simple. Provisions are designed in such a manner that emphasis on source-based taxation whether such income is received in India or not. Taxation of income earned by a person, whether in India or outside India, whether received or accrued or deemed to be received or deemed to be accrued or not, depends on tax residency of such person. Thus, it is vital to identify tax residency of a person in relation to tax residency before determining tax liability in India.

Provisions for determination of tax residency of a person is provided by section 6 of, which provides for criteria to determine tax residency for Individuals, Hindu Undivided Family (‘HUF’), Company and other persons.

Tax residency of a HUF and other persons is always resident unless, control and management of such HUF and other persons is outside India. For domestic company, in order to determine its residential status, its incorporation in India is vital. For company incorporated outside India, if the place of effective management of such company is in India, such person would be considered as deemed resident in India. Place of effective management would hold interpretation that a place where key management and commercial decisions that are important for the conduct of a business are taken.

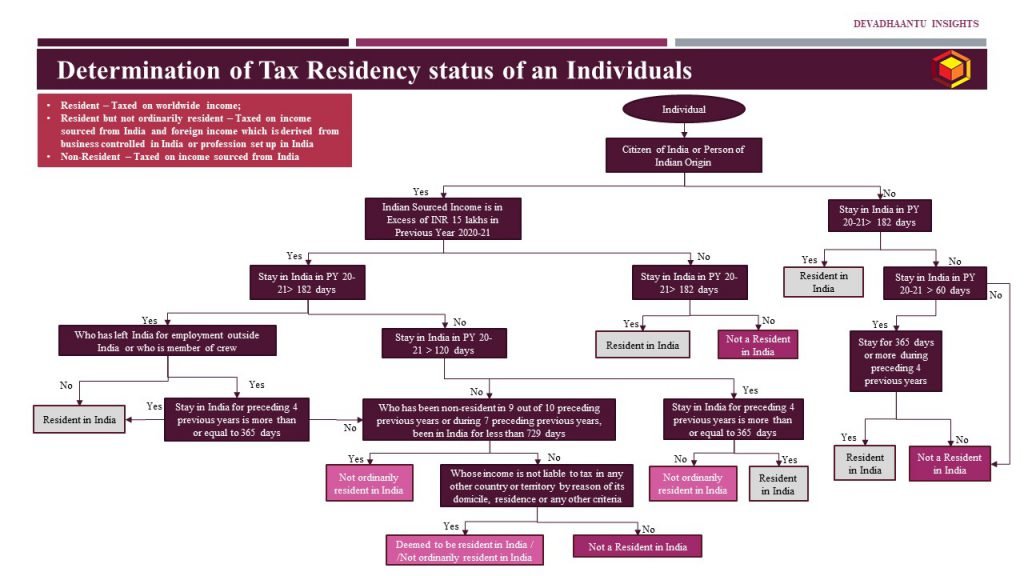

For an Individual to determine its residency status, the provisions outline 3 categories of tax residency, viz. (i) Resident in India; (ii) Resident but not ordinarily resident in India; and (iii) Non-Resident in India.

While a resident in India is taxed on a world-wide income (subject to benefits of Double Taxation Avoidance Agreements), resident but not ordinarily residents would be liable to tax for income derived from India and foreign sourced income only if it is derived from business controlled from India or profession set up in India. Whereas non-residents are taxed only on specific income which is sourced from India. Although the charging provisions are not based on citizenship in India, but tax residency provisions are based on citizenship, no. of days of stay in India in year under consideration and years prior to such year. Thus, determination of residential status under all the three categories is depicted in the chart below:

From the above it is very evident that, generally, an individual will become resident in India for a year under consideration, only if stay in India is 182 days or more unless covered by exceptions as mentioned above. Thus, in case stay of such individual in India is less than 182 in a year under consideration, such individual can still be considered as resident in India considering any other condition gets fulfilled. Thus, for an individual who travels a lot more needs to determine tax residency every year in order to determine tax chargeability. Also, similarly, a non-resident individual, say, he stays in India for less than 182 days but more than 120 days, tax residency for such person can also become resident in India, even though he might actually be citizen/resident of other country. In such case, question arises, whether such individual would liable to pay tax in India as well as country of his resident.

In order to avoid double taxation of same income, ITA provides for DTAA benefits where provisions beneficial to an individual can be considered while determining tax liability subject to provisions of ITA and relevant DTAA. Generally, most of the countries have the condition of stay for 182 days or more for determining residency. Considering this, in most of the situations, a person will be resident in only one country during a previous year. In countries, where such condition of stay of 182 days is reduced, in such cases, DTAAs provides an article for tie-breaker rule, in order to avoid double residency.

For eg. DTAA between India and USA protects an individual from double residency criteria as it covers Article 4(2), which provides for Tie-Breaker rule, where an individual will become resident of only one country as per ‘tie-breaker’ rule in the DTAA. However, in following circumstances, an Individual can become resident of India as well as USA,

(i) Individual has a permanent home available to him in both countries or in none of the countries; and

(ii) Centre of vital interest cannot be determined; and

(iii) He has a habitual abode in both states or in neither of them; and

(iv) He is a national of both states or of neither of them

All the above conditions need to be satisfied in order for an Individual to become tax resident in India as well as in USA. As it is very rare possibility for an individual to fall under the above category, possibility of trigger of dual residency is almost negligent.

Thus, it become essential to determine tax residency status of a person as it will drive chargeability in India. Recently, Finance Act 2020 had introduced amendment to the tax residency provisions by inserting clause for deemed residency for a citizen of India who is earning income from India for more than INR 15 lakhs in a year, but is not liable to tax in other country due to reason of domicile, residence or other criteria of similar nature. Such person gets status of resident but not ordinarily resident and gets taxed accordingly, even if in 4 preceding previous years, such person has visited India for less than 365 days in total. Intention behind such anti-abuse provisions is to bring within the tax provisions, a stateless person.

So, for example, if Mr. X is a citizen of India and for PY 2021-22, he stays in India for say 119 days, USA for 80 days, UAE for 166 days, Mr. X would not be resident in any country for that particular year. In such case, provisions of deemed residency gets triggered in India, if Mr. X has earned income of INR 15 Lakhs in a year as India sourced income, such as capital gains, rental income, etc. And accordingly, status of Mr. X is now considered as resident but not ordinary resident and consequential tax consequences will follow. So accordingly, if Mr. X has any foreign sourced income which is derived from business controlled from India or profession set up in India would be liable to tax in India in the hands of Mr. X, in addition to India sourced Income. In such an event, onus lies on Mr. X to demonstrate whether source of income that he earns is derived from business controlled from India or not or place of effective management of business is not in India or not. One important thing to note that any income derived by Mr. X in USA and UAE, would not be liable to be taxed in India in such case. Also, had his income lesser than INR 15 lakhs from capital gains and rental income, he would still be outside of deemed residency provisions.

Thus, even if an individual is non-resident in India for the criteria mentioned, but can become resident but ordinarily resident due to above provision. Thus, such an individual may also be exposed to other laws such as The Black Money (Undisclosed Foreign Income and Assets) And Imposition of Tax Act, 2015, whereby disclosure needs to be made for foreign derived income and assets.

Thus, although the charging sections under Income Tax Laws emphasis on source-based taxation, chargeability is determined based on residential status which depends on various factual measures. It becomes very essential to evaluate each and every case on facts basis.

For more detailed discussion on the above subject, please do not hesitate to connect at contact@devadhaantu.in