A scheme of arrangement is usually conditional upon the satisfaction of specified conditions as mentioned under the provisions of the Companies Act, 2013. Once all the conditions of the Scheme of Arrangement are satisfied, it shall be deemed to have become effective on an identified date (which is not necessarily the same as the effective date) – this is usually referred to as the ‘appointed date’ of the scheme. Accordingly, while the conditions to a scheme are satisfied on an effective date, the transactions under the scheme are deemed to have occurred on an appointed date.

The concept of appointed date and effective date are evolved through various case laws and are relevant for the purposes of giving effect to the accounting requirements, tax considerations and commercial objectives of the Scheme of Arrangement.

In the past, various cases have been litigated around the Appointed date. In the recent past, NCLT, Mumbai in case of East West Pipeline Limited and Pipeline Infrastructure Private Limited (‘Pipeline Case’) [1] dealt with same, which contemplated a prospective appointed date, to which the NCLT has not raised objections. Further, subsequent to the above order, Ministry of Corporate Affairs, with a view to addressing the various queries in relation to appointed date, issued a clarificatory circular (‘MCA Circular’) [2].

In furtherance to the above, in case of Orient Refectories Limited (‘the Transferee Company’), RHI India Pvt Ltd (‘the Transferor Company 1’) and RHI Clasil Pvt Ltd (‘the Transferor Company 2’) (together referred to as ‘the Appellant Companies’), the issue of determining appointed date has been dealt with again [3].

Details of the case is discussed hereunder:

Facts of the Case:

- The Transferor Company 1 is primarily engaged in business of purchase, sale, import, export and marketing of refractories, refractory products, chemicals, formulations and related equipment required in industries such as steel plants, furnaces, power house and cement plants.

- The Transferor Company 2 is engaged in the business of manufacturing and marketing of refractories and allied products.

- The Transferee Company is engaged in the business of manufacture and marketing of refractory products, systems and services and has various global partners for its international quality products.

The Appellant Companies had filed Scheme of Amalgamation with National Company Law Tribunal, Mumbai Bench (‘NCLT, Mumbai Bench’) with an appointed date as ‘January 1, 2019 or any other date as may be fixed by Tribunal’ for the merger of the Transferor Company 1 and the Transferor Company 2 with and into the Transferee Company (‘the Scheme’).

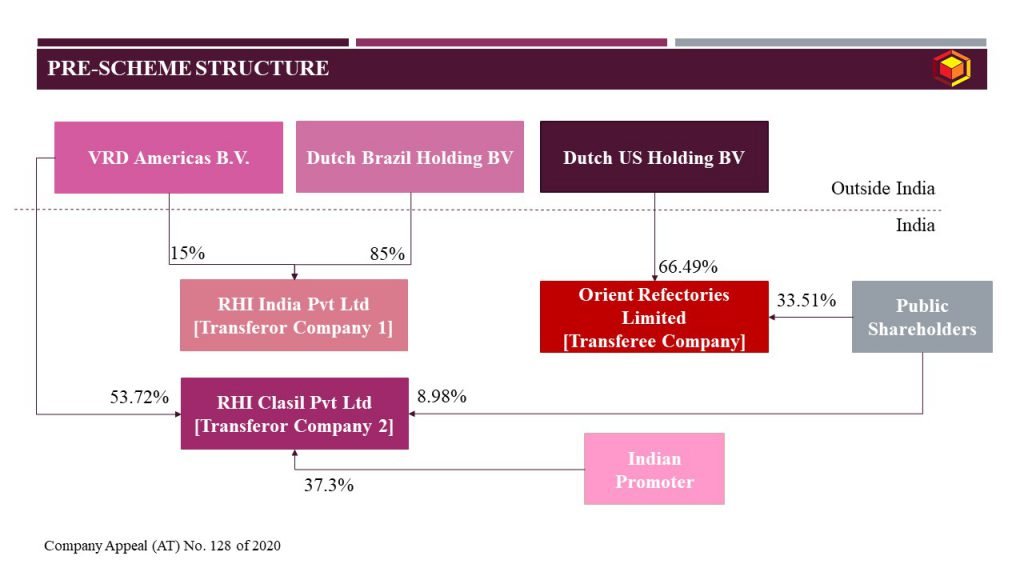

Pre-Scheme Structure of the Appellant Companies, under the Scheme is as under:

Restructuring Flow of the proposed Scheme is as under:

Post-Scheme Structure of the Scheme, if approved is depicted as under:

NCLT Proceedings and NCLT Order:

The Appellant companies complied with all the requirement of Companies Act, 2013 for serving notices to respective authorities. However, during the final hearing, Regional Director, Western Region and Ministry of Corporate Affairs, Mumbai, filed an adverse report for non-compliance by the Appellant Companies. After the round of arguments, NCLT, Mumbai bench rejected the Scheme.

Objection raised for rejecting the Scheme:

The Appointed Date of the Scheme is January 1, 2019, whereas the valuation date is July 31, 2018.

The reason for the rejection as above primarily related to the objection that the profit earning capacity and other financials of the Transferor Company 1 and Transferor Company 2, the share exchange ratio as per the valuation given by the Auditor and the Fairness Opinion given by the Merchant Banker appeared to be too high which could result in undue advantage/ enrichment to the shareholders of both the Transferor Companies and to the shareholders of the ultimate holding Company RHI Magnesita.

Order of NCLAT:

On the issue of rejection of Scheme by NCLT, Mumbai bench:

NCLAT directed the NCLT, Mumbai Bench to approve the proposed scheme without any further delays in order to meet the ends of justice. Further, directions were also given to the Regional Director, Western Region, Ministry of Corporation Affairs, Mumbai to monitor that the scheme is implemented according to appointed date as 31.7.2018. Observations made by NCLAT are as under:

The Appellant Companies brought to their notice that all the procedures prescribed u/s 230-232 of the Companies Act, 2013 were followed as under:

- The Appellant companies have served notices to all the regulatory authorities concerned as required under Section 230(5) of the Companies Act, 2013;

- The Appellants have also submitted a copy of the Chairman’s report together with an admitted copy of the petition and order for admission of the petition;

- The Transferee Company undertakes that in addition to compliance of AS-14, the Transferee Company shall pass such accounting entries which are necessary in connection with the Scheme to comply with other applicable accounting standard;

- The Appellant Companies undertake to comply with provisions of Section 232(3)(i) of the Companies Act, 2013;

- The Appellant Companies confirm and undertake that the Appointed Date has been fixed as the January 1, 2019 which is in compliance with section 232(6) of the Companies Act, 2013 and the Scheme shall be effective from such Appointed Date but shall be operative from the Effective Date;

- Further it was also noted that the the Official Liquidator has filed his report stating therein that the affairs of the Transferor Company 1 and the Transferor Company 2 have been conducted in a proper manner and that both the companies may be ordered to be dissolved;

- Attention was given to the fact that, at the statutory meetings 139 public shareholders including public institutions voted either in person or by postal ballots or by remote e-voting and over 92% of the public institutions and over 81% of other public shareholders participated by voting. All Public institutions and 99.73% of other public shareholders voted in favor of the scheme, making the tally at 99.74%. Further no minority shareholders have come forward to oppose the scheme.

- No objections have been raised by SEBI or any regulatory authority to whom notices had been issued under section 230(5) of the Companies Act, 2013 and also, as the scheme has been accorded an approval by an overwhelming majority of 99.95% of the relevant stakeholders (which includes 96.05% of the Public Shareholders).

By impugned order dated 02.03.2020, the NCLT rejected the Scheme of Amalgamation on certain ground which was not required to be noticed for determination of Amalgamation u/s 230-232 of the Companies Act, 2013.

NCLAT stated that while passing the impugned order, NCLT, Mumbai bench have overreached its scope of Judicial Intervention in determination of the Scheme of Amalgamation u/s 230-232. NCLT have failed to point out any material illegality under the scheme and also accepted the clarifications submitted by the Appellant against the objections raised by the Regional Director, Western region. Since no minority shareholders have raised any objections against the scheme thus, the commercial wisdom of the shareholders shall not be overlooked by the NCLT. NCLAT stated its view that the scheme cannot be said to be violative of public policy just on the ground that NCLT considered that the scheme appears to benefit only a few shareholders of Transferor Company without giving any reasonable findings for the same.

On the issue of fixation of Appointed Date:

NCLAT determines the Appointed Date as July 31, 2018, which is same as valuation date. Observations were made as under:

- Reference was given to the case of Pipeline Case, wherein it was ordered that the appointed date can be the date on which the Valuation Report was prepared and the Fairness Opinion was given by the Merchant Banker i.e. July 31, 2018.

- Further, reference was also given to the MCA Circular, which enables the companies in question to choose and state in the scheme an ‘appointed date’. This date may be a specific calendar date or may be tied to the occurrence of an event such as grant of license by a competent authority or fulfilment of any preconditions agreed upon by the parties, or meeting any other requirement as agreed upon between the parties, etc., which are relevant to the scheme.

- NCLAT also acknowledged that since the Transferee Company will be allotting the shares which are listed and being regularly traded on the Stock Exchanges, on consideration, the share exchange ratio would undergo change significantly in view of the market price on which the cut-off date i.e. appointed date is considered.

For detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in

____________________________________________________________________________

[1] CSA No. 719/2018

[2] Ministry of Corporate affairs in its General Circular bearing No. 09/2019 dated 21.08.2019

[3] Company Appeal (AT) No. 128 of 2020