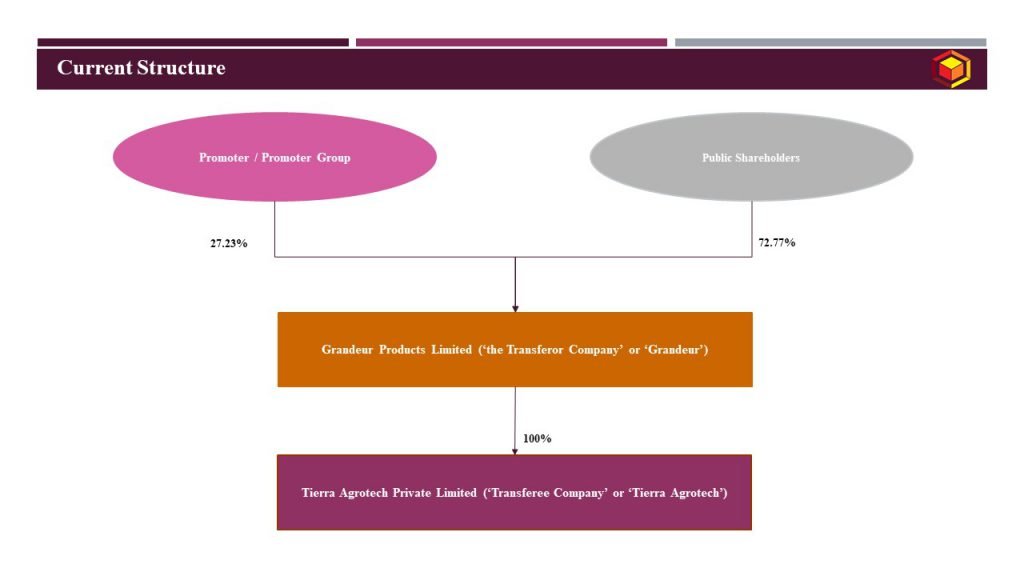

Grandeur Products Limited (‘the Transferor Company’ or ‘Grandeur’) is a company incorporated under the provisions of the Companies Act, 1956 on January 3, 1983 bearing corporate identification number, L15500TG1983PLC110115. The Transferor Company has its registered office situated at H. No. 1-62-192, 3rd Floor, Dwaraka Avenue Kavuri Hills, Madhapur, Hyderabad, Telangana- 500033. The Equity shares of the Transferee Company are listed on the Indian Stock Exchange(s). The Transferor Company is a Listed Company incorporated in the year 1983 and currently its main objects include seed research and development, production, sales and marketing. The Transferor Company, through two of its subsidiaries, has also forayed into developing innovative seeds stacked with proprietary traits that not only provide significant yields and cost advantage to farmers but also have a positive impact on the environment.

Tierra Agrotech Private Limited (‘Transferee Company’ or ‘Tierra Agrotech’) is a company incorporated under the provisions of the Companies Act, 1956 on September 13, 2013 bearing corporate identification number, U01119TG2013PTC090004. The Transferee Company has its registered office situated at H. No. 1-62-192, 3rd Floor, Dwaraka Avenue Kavuri Hills, Madhapur, Hyderabad, Telangana- 500033. 4.2. The Transferee Company is engaged in developing innovative seeds and agribusiness. Recognising the potential in such business, the Transferor Company acquired the entire Share Capital of the Transferee Company from its promoters and the Transferee Company is accordingly a wholly owned (100%) subsidiary of the Transferor Company.

Current structure of the group is as under:

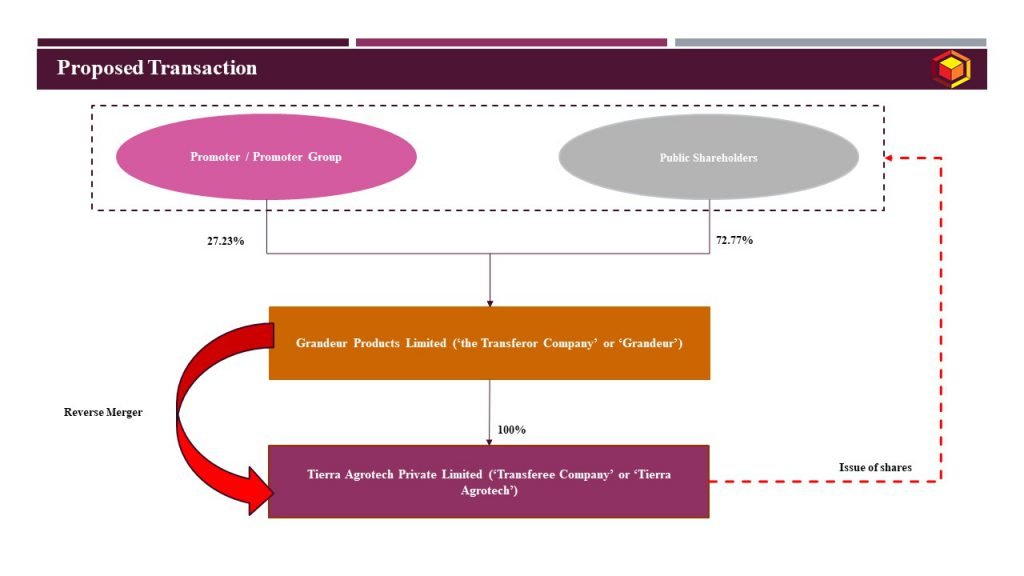

Management of the Company along with its group Companies has decided to restructure business and shareholding of the group by way of Amalgamation of Grandeur, being a listed company into Tierra Agrotech, being its wholly owned unlisted subsidiary.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Amalgamation |

Appointed Date | April 1, 2020 |

Effective Date | Date of filling of certified copy of approving authority being Regional Director with ROC |

Jurisdictional Authority(ies) | Securities and Exchange Board of India Limited; BSE Limited; National Stock Exchange of India Limited; National Company Law Tribunal, Hyderabad Bench Registrar of Companies (‘ROC’), Hyderabad Regional Director, Hyderabad Official Liquidator as appointed by NCLT, Hyderabad bench |

Other Approvals | Approvals of Board of Directors and Audit Committee has already been obtained; Approval of Shareholders and majority of public shareholders needs to be obtained. |

Consideration | Tierra Agrotech to issue equity shares to the shareholders of Grandeur in the ratio of 1:1. The above rario has been determined using asset approach. Equity shares held by Grandeur into Tierra Agrotech would be cancelled pursuant to the amalgamation. |

Accounting Treatment | In the books of Transferee Company – Pooling of interest method; In the books of Transferor Company – NA |

Taxation | Tax neutral transaction |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

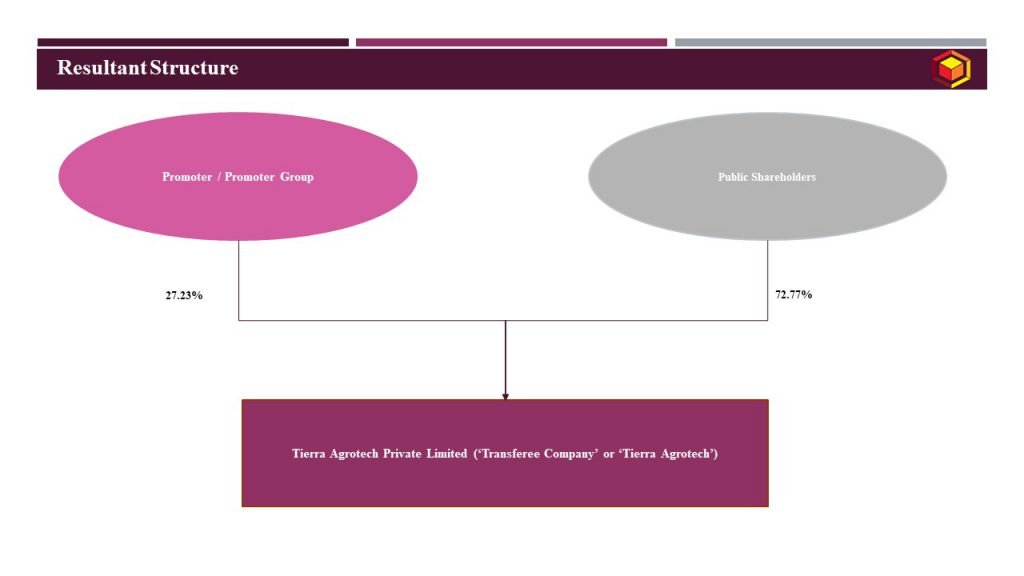

Grandeur Products Limited | 27.23% | 72.77% | NA, since merged | NA, since merged |

Tierra Agrotech Private Limited | 100% | – | 27.23% | 72.77% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

The proposed amalgamation benefits the group in the following manner:

The undertakings and business of the Transferor Company and the Transferee Company can be combined, held and pursued in one entity more conveniently and advantageously with better capacity for fund raising, growth and expansion.

- In the circumstances, it is considered desirable and expedient to amalgamate the Transferor Company with the Transferee Company resulting in benefits of economies of scales, reduction in multiplicity of legal and regulatory compliances, rationalisation, standardisation and simplification of business processes leading to increase in operational feasibility in future, reduction of multi- company inefficiencies and optimal utilisation of resources.

- The amalgamation will enable appropriate consolidation and integration of the operations and activities of the Transferor Company and the Transferee Company and result in the formation of a larger and more broad-based company having greater capacity to raise and access funds for growth and expansion of its business, marketing and selling its products and services and conducting trade on more favourable terms.

- The business of the amalgamated entity will be carried on more efficiently and economically as a result, inter alia, of pooling and more effective utilisation of the combined resources of the said companies and substantial reduction in costs and expenses. As such the amalgamation of the Transferor Company with the Transferee Company will enable greater realisation of the potential of the business of the Transferor Company and the Transferee Company in the merged entity and have beneficial results for the said Companies, their shareholders and all concerned.

Commercial Considerations:

- As on the date of filling of this scheme, market capitalization of Grandeur stands at approx. 750 crores on BSE Limited. Considering fresh shares would be issued by Tierra to the shareholders of Grandeur, stamp duty liability would be attracted on the market value of shares that gets issued to the shareholders of Grandeur. On the contrary, had scheme been filled for merger of Tierra into Grandeur, no stamp duty would have been attracted.

- Further, such merger of Grandeur being listed company with its unlisted wholly owned subsidiary would be time consuming and costlier. On the contrary, had scheme been filled for merger of Tierra into Grandeur, it would have attracted lesser compliances and would have resulted into lesser time consumption.

- The reverse merger of Grandeur into Tierra instead of merger of Tierra into Grandeur seems to be inefficient from tax and regulatory perspective. However, from the commercial angle, it might be a best mode to rebrand the business of Grandeur which gets housed in Tierra pursuant to this Scheme.

For more detailed analysis on the above case study, please do not hesitate to connect at Contact@devadhaantu.in