In India, the concept of joint family has been prevalent since many decades. Also, many such joint families are into the same business as well. In such scenario, family arrangements are one of the efficient mode for succession planning. In the similar instance where the assets in the joint family are held through private family trust, whether needs to be added to the wealth of the beneficiary for determining wealth tax is under question. Details of such tax litigation are as under:

Facts of the case:

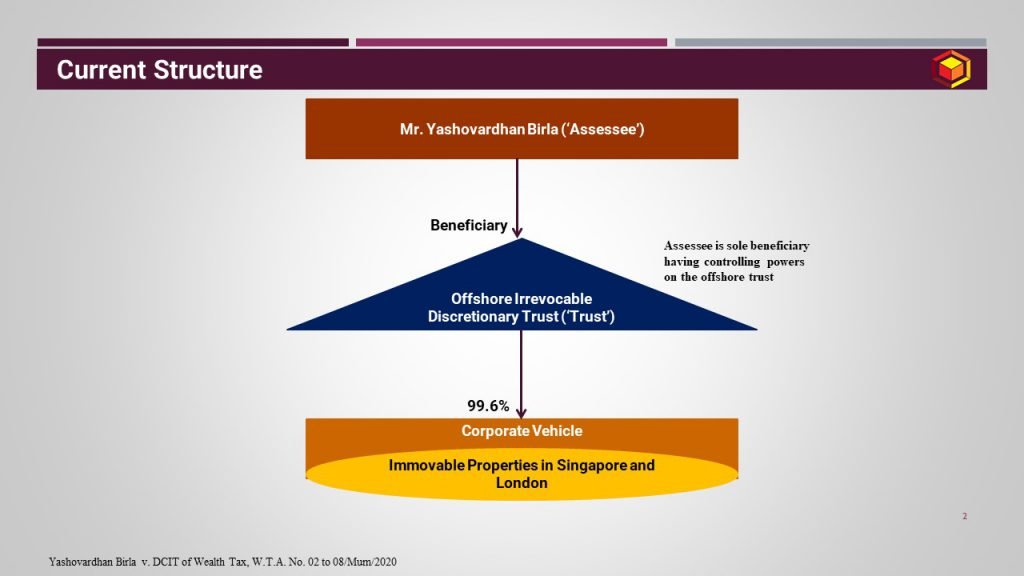

- Yashovardhan Birla, the Assessee, is one of the beneficiaries in an offshore irrevocable discretionary trust settled in 1989 by a non-resident relative (Settlor), in relation to offshore assets of the Settlor;

- The said offshore trust was executed by an offshore corporate trustee. The offshore trust comprised entirely of offshore assets, held through offshore corporate vehicles. Additionally, the Assessee is beneficiary in bank accounts held by such corporate vehicle overseas.

Assessment Proceedings:

- Assessing Officer (‘AO’) made additions to the wealth tax return of the assessee in respect of value of immovable properties held overseas through overseas corporate vehicle as assessee held entire controlling interest in the offshore trust in addition to being a sole beneficiary of such offshore trust.

- Similarly, addition of deposit balance in offshore bank accounts held in various corporate entities was also made as assessee was beneficiary in those bank accounts.

- CIT(A) upheld the order of AO towards addition in value of immovable properties as well as deposit in bank account.

- Aggrieved by the order of CIT(A), assessee preferred an appeal to Income Tax Appellate Tribunal, Mumbai Bench (‘Mumbai ITAT’)

Issue under Consideration for Mumbai ITAT:

Whether the holding of assets through an offshore private family trust is chargeable to wealth tax in the hands of beneficiary of such private offshore trust?

Order of Mumbai ITAT:

Mumbai ITAT passed order in favour of assessee and held that immovable properties controlled by an offshore trust through corporate vehicle is not chargeable to wealth-tax in the hands of beneficiary assessee.

Observations made by Mumbai ITAT are as under:

- It is the duty of the existing trustee to distribute the income and benefits among all the beneficiaries. The offshore irrevocable discretionary trust was settled in relation to private assets of the non-resident Settlor for the benefit of several beneficiaries and one of them is the assessee. Hence, even if individual beneficiaries other than assessee do not survive, still assessee alone is not a sole beneficiary.

- Even though the trust was established in Guernsey, the law related to administration of trusts are universally accepted and consistently followed worldwide. Even Indian Trusts Act, 1882 is followed consistently and it is enacted in pre-independence era. This shows that the provisions of trusts are universally accepted and there were no major amendments in the Indian Trusts Act, 1882. Therefore, the duties, responsibilities, liabilities and privileges of settlor, trustees and beneficiaries are standard. Therefore, sections 11, 73, 74 and 75 of Indian Trusts Act, 1882 are applicable to trustee of an offshore trust.

- Generally the power to appoint or re-appoint trustees lies with the settlor or vests in the declaration of trust itself. In the present case, the power to appoint / remove trustees were given to assessee’s father and mother. After their demise, it devolved on the assessee. Merely because such power is exercised by the assessee, it does not make the trust lose its identity. It is wrong to presume that the properties governed by the trustee will be considered as the properties of the individual beneficiary who exercises the appointment of trustees. Such a power does not change the status of the trust and its independent functioning. The entities controlled by the trust are independent taxable entities outside India. Therefore, assessee can only be a beneficiary and remain a beneficiary.

- Also, the definition of ‘assets’ under section 2(ea) of the Wealth-tax Act is exhaustive and does not permit exigibility of an assets of an offshore trust to wealth-tax in hands of the individual assessee. In a taxing statute, what is clearly mentioned has to be taken into consideration and nothing is to be read in or implied.

Mumbai ITAT, further held that Bank account held in corporate entities held by offshore trust is not subject to wealth tax provisions.

Observations in this regards, made by Mumbai ITAT are as under:

- As far as the bank balance in the offshore companies and trusts are concerned, since the ownership of these bank accounts are with the offshore entities, the tax authorities cannot treat the same to be part of wealth of the assessee. Also, the definition of the assets does not include bank balance as part of the taxable assets as per the Wealth-tax Act.

- Even though, in the KYC compliance, the assessee is mentioned as the beneficiary, it does not alter the fact that assessee is one of the beneficiaries, and not the only beneficiary. The actual legal ownership rather than deemed ownership is to be considered.

- The argument of the tax authorities that the undisclosed bank accounts in the foreign bank will be considered as cash in hand and it will be included in the taxable wealth of the assessee, is misplaced because the definition of assets in section 2(ea) of the Wealth-tax does not have a separate assets category for cash in bank. The AO cannot stretch the definition of cash in hand, which is not the intention of the legislature. The outstanding balance in the bank will remain outside the provisions of the assets as per Wealth-tax Act.

- Bank accounts (whether in India or abroad) not being specified assets under section 2(ea) of the Wealth-tax Act cannot be subjected to wealth-tax in India.

For detailed discussion on the above case study, please feel free to connect at Contact@devadhaantu.in