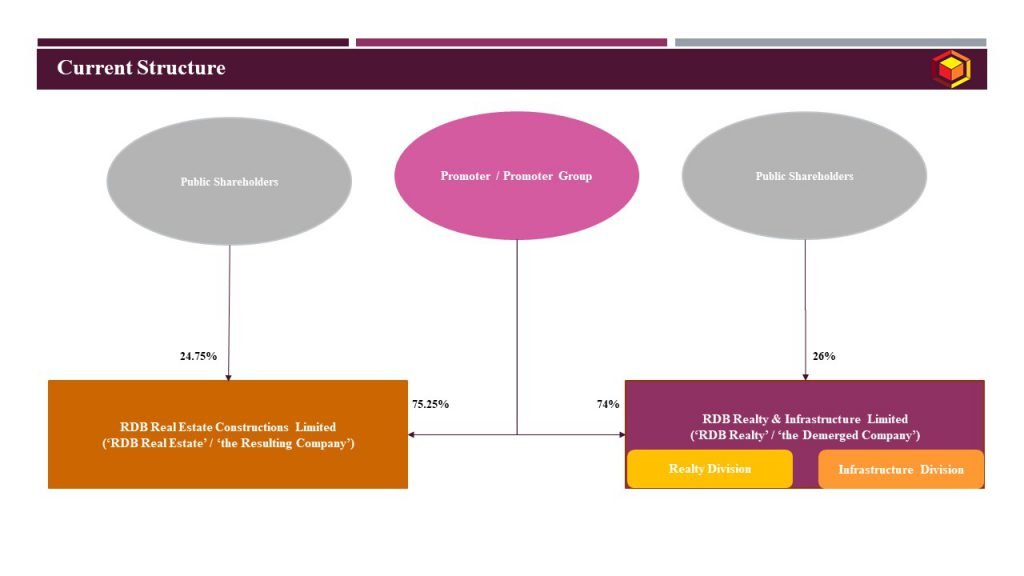

RDB Realty & Infrastructure Limited (‘the Demerged Company’ or ‘RDB Realty’) is an existing company registered under the provisions of the Companies Act, 1956 and having its registered office at Bikaner Building, 8/1 Lalbazar Street, 1st Floor, Room No. 10, Kolkata 700 001. RDB Realty is engaged in following business activities as under:

- Realty Division (Demerged Undertaking): Real estate development business involved in real estate development projects for domestic markets, generally for non-government sector;

- Infrastructure Division (Remaining Undertaking): Infrastructure development projects for domestic market. It is core activity of RDB Realty.

RDB Realty is listed on the Indian stock exchanges, viz. the National Stock Exchange of India and on Bombay Stock Exchange;

RDB Real Estate Constructions Limited (‘the Resulting Company’ or ‘RDB Real Estate’), is a company incorporated under the provisions of the Companies Act, 2013 having its registered office at Bikaner Building, 8/ 1 Lal Bazaar street, 1st Floor, Room No.11, Kolkata – 700001. RDB Real Estate is an unlisted public company, intending to go for IPO in future.

Current structure of the Company is as under:

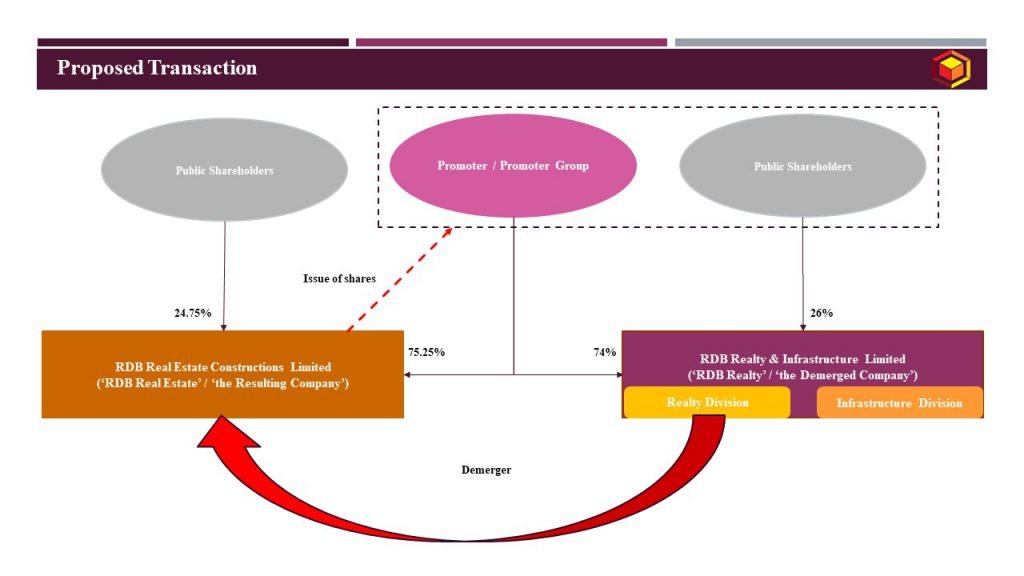

Management of the Company along with its group Companies has proposed to restructure business by demerger of Realty Division of RDB Realty into RDB Real Estate, and subsequently, RDB Real Estate is intending to get listed on the stock exchange.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Demerger |

Appointed Date | April 1, 2020 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | Securities and Exchange Board of India Limited; BSE Limited; National Stock Exchange of India Limited; National Company Law Tribunal (‘NCLT’), Kolkata Bench Registrar of Companies (‘ROC’) – West Bangal Regional Director – West Bengal |

Other Approvals | Approvals of Board of Directors and Audit Committee has already been obtained; Approval of Shareholders and majority of public shareholders needs to be obtained. |

Consideration | RDB Real Estate to issue 27 equity shares to the shareholders of RDB Realty for every 50 equity shares held in RDB Realty. Above share exchange ratio has been arrived at by determining book value of Realty Business undertaking |

Accounting Treatment | In the books of RDB Realty and RDB Real Estate – Pooling of interest method |

Taxation | Tax neutral transaction |

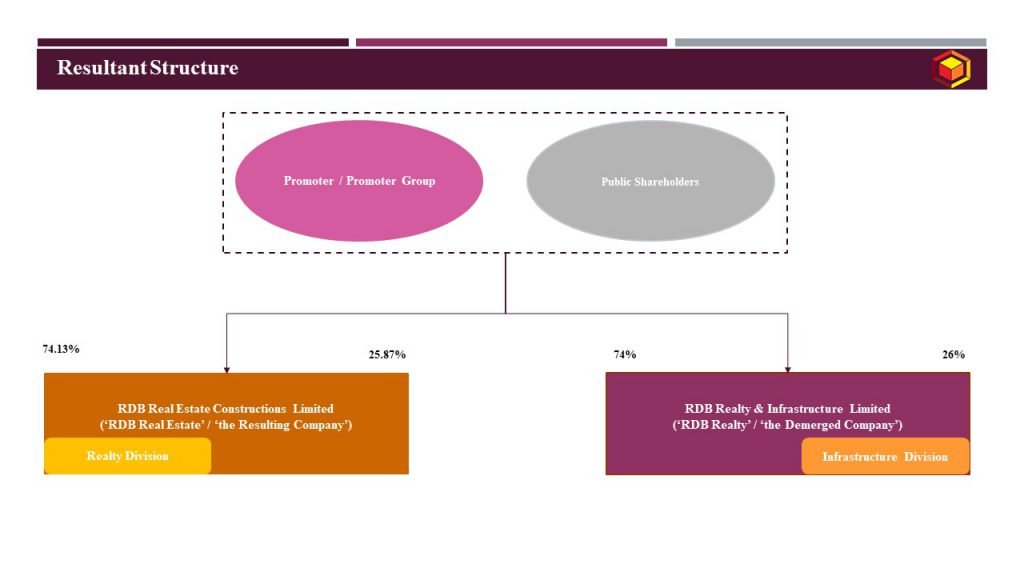

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

RDB Realty | 74% | 26% | 74% | 26% |

RDB Real Estate | 75.25% | 24.75% | 74.13% | 25.87% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

Proposed demerger facilitates,

- Demerger of Realty division of RDB Realty in favour of another group company under the same management namely RDB Real Estate which is also a real estate development company;

- RDB Realty intends to develop/restructure its two businesses to achieve optimum growth and development of both the business separately and to have separate concentrated focus on both the Realty and Infrastructure activities;

- RDB Real Estate is a newly incorporated company desirous of engaging in the business of real estate development and is empowered by the Objects Clause of its Memorandum & Articles of Association to undertake the business of real estate development. RDB Real Estate is planning to expand its business operations and is desirous of expanding in various real estate development activities. In future RDB Real Estate will also go for listing.

- The nature of risk and competition involved in both the Divisions of RDB Realty divergent and consequently each Division is capable of attracting different sets of investors. Moreover, the activities which have been so far carried out by RDB Realty, have potential for growth and development, and require large infusion of funds and require undivided care and attention. Therefore, both the businesses needs separate set of directions and investment for development, expansion and optimum growth of their respective businesses and maximization of shareholders’ value.

- Infrastructure development carried out at Infrastructure Division is the core business of RDB Realty which needs special attention of the Management to seize the new opportunities which this segment offers. To be competitive and maintain its market share in domestic, it is necessary to improve operational and administrative efficiency and create the requisite infrastructure for obtaining good business. The scheme for separation of Realty Division of RDB Realty, will lead to better and more efficient management of its core Infrastructure activity having better focus and undivided attention in the best interests of its stakeholders.

- The proposed scheme will enable RDB Real Estate to undertake real estate development business currently being carried out by RDB Realty, under separate umbrella of management having greater focus and attention in an efficient manner. Furthermore, RDB Real Estate will avoid the gestation period involved in acquiring and developing new ventures. The proposed scheme will enable RDB Real Estate to effectively raise financial resources through equity and debt capital on the basis of financial assets for better operation and greater realization of the potential of RDB Realty’s real estate development business

Commercial considerations:

- The scheme enables back-door listing without requirement of following IPO procedures which are lengthy, time consuming and costlier.

- Additionally, demerger is tax neutral thereby eliminates any adverse tax liability in the hands of companies involved under the Scheme as well as in the hands of shareholders of such companies.

- Scheme facilitates monetization of Realty business undertaking and segregation of management for both the business undertaking, thereby providing greater flexibility to each of the business units and growth potential by attracting right talent pool and investors funding.

For more detailed discussion on the above scheme, please do not hesitate to connect at contact@devadhaantu.in