Internal re-organization of multinational companies are effective tool to streamline the shareholding patterns and process of businesses. However, any such group company incorporated in tax heaven country(ies) often attracts attention from revenue authorities. In one such case in case of Redington (India) Limited (‘the Assessee’) [1], an internal group reorganization has been questioned as it was entered immediately prior to entering into a business transaction with third party. Details of such case is discussed hereinunder:

Facts of the Case:

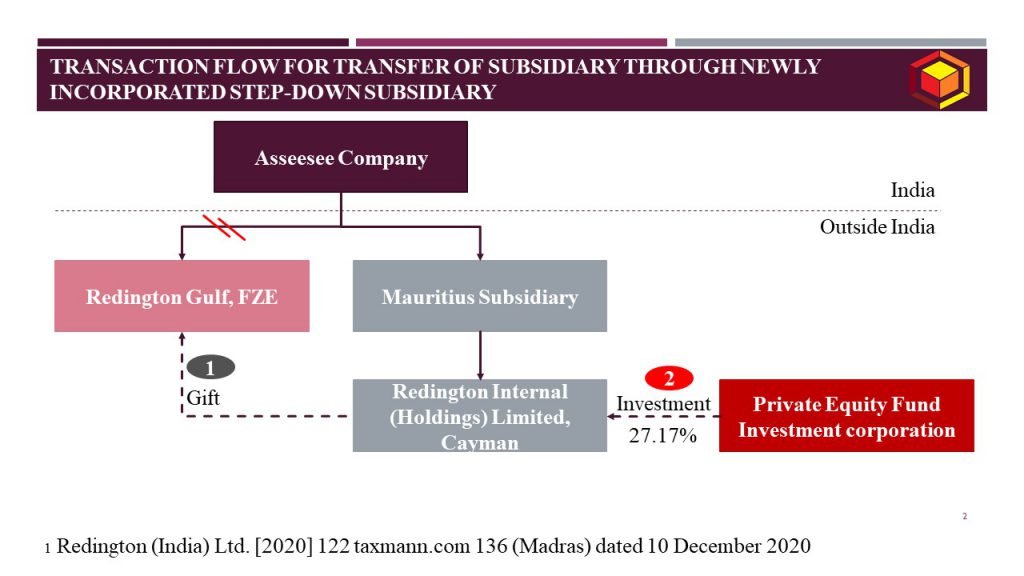

Assessee gifted by way of transfer, its wholly owned subsidiary, which was incorporated in Dubai (‘Redington Dubai’) 4 years ago to another newly incorporated step down wholly owned subsidiary incorporated which is incorporated in Cayman Islands (‘Redington, Cayman Island’). Within just 4 days of such gift, a private equity fund investment corporation invested USD 65 million for 27.17% stake in Redington, Cayman Island.

The Assessee claimed that the transfer of Redington, Dubai was gift u/s 47(iii) of the ITA and accordingly, exemption was claimed from paying any taxes on above transfer.

Assessment Proceedings:

Assessee’s case was selected for scrutiny on the ground that the Assessee had entered into an international transactions exceeding INR15 Crores and the case was referred to the Transfer Pricing Officer (TPO) for computation of Arms Length Price (ALP). After hearing the Assessee, the draft assessment order was passed proposing the addition of INR 610 Crores towards long term capital gains (‘LTCG’).

Aggrieved by the order of AO, further appeal was filed with Dispute Resolution Panel, Madras (‘DRP’). DRP upheld the order of AO.

Upon further appeal to Income Tax Appellate Tribunal, Madras Bench (‘Madras ITAT’), it was held that the transfer of shares made by the Assessee without consideration was a valid gift and the transfer of shares cannot be regarded as transfer for capital gains taxation as provided in Section 47(iii) of the ITA. The Madras ITAT accepted the contention raised by the Assessee that the transfer of shares made by the Assessee to its step down subsidiary Redington International (Holdings) Limited, Cayman (RC) is gift eligible for exemption under Section 47(iii) of the ITA and no capital gain tax is imputable to the said transfer of shares.

Aggrieved by the order of Madras ITAT, further appeal was filed by Revenue to the High Court of Madras (‘Madras HC’).

Issue under consideration:

Whether gift of shares to another group company under internal re-organisation is to be considered as gift and accordingly exempt under section 47(iii) of the ITA?

Order of Madras HC:

Revenue’s submission:

- Revenue submitted that the transfer of shares by the Assessee was not a gift falling under Section 47(iii) of the ITA for the reason that the Assessee transferred the shares only by way of re-structuring the investment made in Redington Dubai.

- Reference was made to the minutes of the Board Meeting as well as Deed of Share Transfer and it was submitted that neither in the minutes of the Board Meeting, nor in the Share Transfer Deed, the word “gift” has been mentioned and the document shows that the entire transaction is in the form of re-structuring the Redington Group.

- the Board Resolution towards re-structuring the concern of the Board be and hereby, accorded to transfer the investments held by Assessee in Redington, Dubai to inter-se subsidiary companies with or without consideration.

- Further, revenue submitted that re-structuring as above, even if falls under Section 47(iv) or Section 47(v) of the ITA, the specific condition that the subsidiary company should be an Indian company does not get fulfilled.

- Revenue stated that the CFO himself admitted that the cross border transaction was structured for business reasons for deriving commercial benefits. Therefore, it can be concluded that the transaction is not voluntary as it was done with certain expectations from the receiver and therefore, does not qualify as ‘gift’.

- Revenue contended that the entire transaction of transfer of shares by way of alleged gift was to avoid the capital gain and to erode the tax effect in India as the Assessee cherry picked Cayman Island for tax avoidance and the said country has been black listed by the Council of European Union by referring to the Article in Globe Tax Alert dated February 19, 2020.

- Further, referring to the decision of Hon’ble Supreme Court in case of McDowell & Co. Ltd [2] and Durga Prasad Mored [3], it was submitted that the tax planning may be legitimate, if it was within the framework of law, colourable device cannot be part of tax planning.

Madras HC held that the transaction of transfer was not merely a gift to subsidiary company under section 47(iii) of the ITA. The Madras HC observed that since a step-down subsidiary was created by the Assessee in a tax haven to act as a conduit to escape rigour of Indian Tax Laws and sole intention of assessee was for corporate re-structuring, transaction was in fact transfer of capital asset by the Assessee to its subsidiary and the same would be liable to tax under section 45 of the ITA.

For detailed analysis of the above case study, please feel free to connect at contact@devadhaantu.in

_______________________________________________________________________________________________________________________

[1] Redington (India) Ltd. [2020] 122 taxmann.com 136 (Madras) dated 10 December 2020

[2] McDowell & Co. Ltd. vs. Commercial Tax Officer [AIR 1986 SC 649]

[3] CIT vs. Durga Prasad Mored [(1971) 82 ITR 540 (SC)]