Private Family Trusts are the popular way for succession planning since arrangement for protection of wealth through such trusts provides flexibility and control to the trustee(s) of the Trust for allocation of assets. Under Income Tax Act, 1961 (‘the ITA’), no specific provision has been given for determining the tax liability of such trusts. Whether such private discretionary trusts are taxable as akin to Individual or as an AOP ? In one such instance, the question has been dealt with by Hon’ble Mumbai High Court. So lets discuss the same in detail through this case study:

Facts of the case:

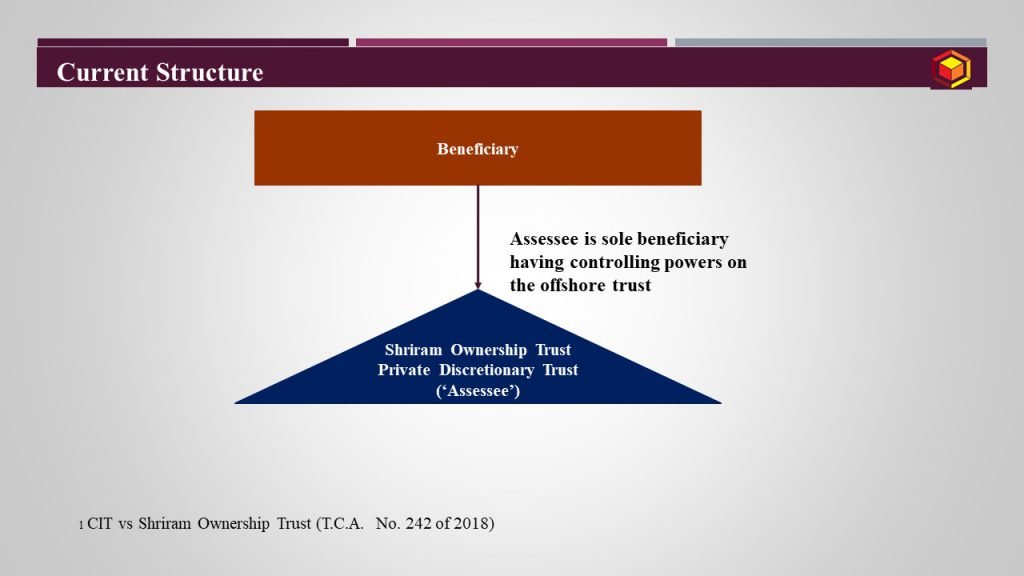

Assessee being a private discretionary trust had received the amount of Rs.25 Crores as voluntary contribution from 6 group companies of Shriram Group which was credited to its balance sheet under the nomenclature “addition to corpus”.

Assessment Proceedings:

- Upon assessment under section 144A of the ITA, Joint Commissioner of Income-Tax (‘JCIT’) made addition u/s 2(24)(via) of the ITA for the amount received by the Assessee under the head ‘ Income from other sources’ considering the sum of money as benefit or perquisite, treating Trust as Individual since beneficiaries of the Trust are also Individuals.

- Against the order of JCIT, Assessee preferred an appeal to first appellate authority (‘CIT(A)’). CIT(A) upheld the order of JCIT by referring to Section 161(1) and held that the assessee being a representative assessee, has to be taxed in the like manner and to the same extent as it would be in respect of the beneficiaries and the status of the assessee is to be determined with reference to the status of the beneficiaries and the beneficiaries being individuals, the assessee’s status is also that of an individual. Reliance was placed on the decision in the case of SEA Head Office Monthly Paid Employees Welfare Trust[2].

- Aggrieved by the order of CIT(A), revenue preferred an appeal to Income Tax Appellate Tribunal, Madras Bench (‘Madras ITAT’). Madras ITAT passed order in favour of the Assessee.

- Aggrieved by the order of Madras ITAT, revenue further preferred an appeal to High Court of Madras (‘Madras HC’).

Issue under Consideration for Madras HC:

Whether the Private Discretionary Trust is to be assessed as an individual when it represents its beneficiaries as individual only? Whether contribution received by Trust is taxable?

Decision by Madras High Court :

Madras High Court held that Trust is representative assessee representing its beneficiaries and accordingly, it should be taxed as an ‘Individual’ only; Further Madras High Court held that contribution received by the Trust from the companies is to be assessed under the head ‘Income from Other Sources’. Observations made by Madras HC are as under:

- Placing reliance in case of Hon’ble Supreme Court decision in case of Indira Balkrishna[3] Madras HC reiterated meaning of AOP as an association of person joining in an action, with a common purpose or for a common action. In the instant case, as none of the beneficiaries or Trustees have come together for a common purpose, it can not be construed to mean an AOP;

- Trustee are representative of the beneficiaries and income of the trust is required to be taxed in the like manner and to the same extent as it would be in respect of the beneficiaries. In the instant case, all the beneficiaries are individuals, therefore income of trust needs to be assessed in same manner like an individual only. Referring to section 160(1)(iv) of the ITA, it was mentioned that since Trust is a representative assessee, on behalf of its beneficiaries being an Individual, income of Trust is assessed akin to ‘Individual’ only.

- Further its was held that status shown by the assessee in the return of income is irrelevant as the Income Tax Rules, 1962 only prescribes the forms and this cannot in any manner control the operation of the provisions of the ITA.

For detailed discussion on the above subject, please feel free to connect at contact@devadhaantu.in

__________________________________________________________________________

[1] CIT Vs Shriram Ownership Trust [2020] TCA No. 242 of 2018 (Madras High Court) dt. December 8, 2020

[2] CIT vs. SEA Head Office Monthly Paid Employees Welfare Trust [(2004) 141 Taxman 364 (Delhi)]

[3] Indira Balkrishna [1960] 39 ITR 546 (Supreme Court) dt. April 14, 1960