Any acquisition / diversification, be it strategic or financial investment, needs deep deliberation in tax, regulatory, legal and commercial considerations. The legal conditions and protocols, coupled with regulatory restrictions often results as obstacle in future business matters. In the instant case, restructuring mode adopted for the acquisition of 20% stake in Shriram Capital Limited by Piramal Enterprises Limited has been questioned by tax authorities. The restructuring mode is labeled as convoluted transaction by the tax authorities. Although same was adopted owing to restriction in the shareholders agreement of Shriram Capital Limited. The details of the case are discussed hereinbelow.

Facts of the Case:

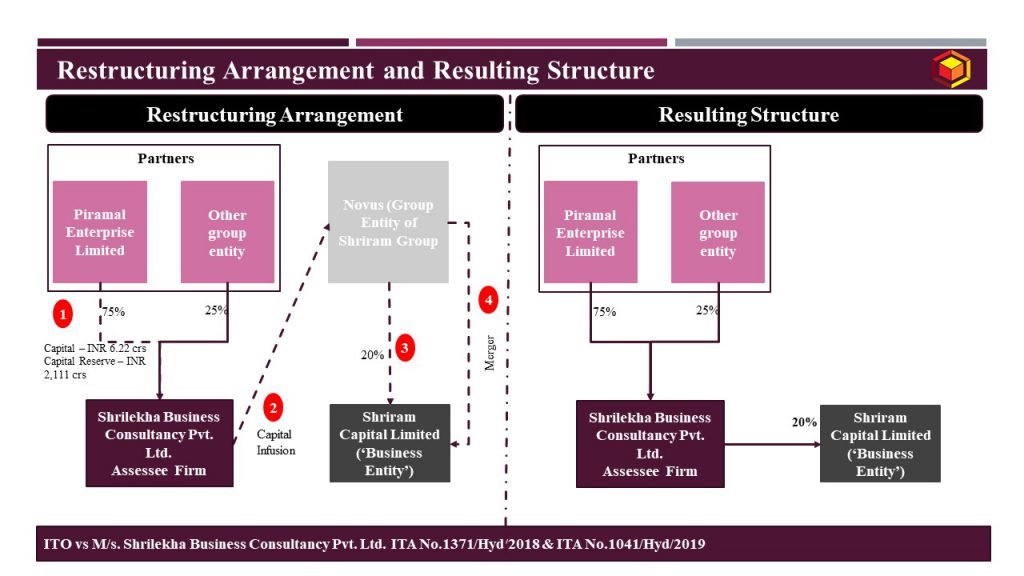

- During FY 2014-15, Piramal Enterprises Limited (‘Piramal’) proposed to acquire an effective 20% stake in M/s Shriram Capital Limited (‘the Business Entity’);

- For the above purpose, Piramal along with its other group companies, incorporated Shrilekha Business Consultancy Pvt. Ltd. (‘an Assessee Firm’) [1] for 75:25 share;

- Assessee Firm received INR 6.22 Crs towards partners contribution and INR 2,111 crs towards capital reserve from Piramal and other group companies with an intention to acquire such Business Entity;

- In order to acquire the Business Entity, Assessee Firm infused these funding into Ms/ Novus Cloud Solutions Pvt Ltd (‘Novus’);

- Subsequently, a Scheme of Amalgamation was filed for merger of Novus into the Business Entity with an Appointed date as April 1, 2014, which was approved by Madras High Court on March 31, 2015.

The Restructuring steps and Resultant Structure is depicted as under:

Assessment Proceedings:

- Assesseing Officer (‘AO’) was of the opinion that an additional INR 2,111 crs brought in by Partner was towards acquisition of business entity and business entity as a whole ought to have paid tax on this sale. Restructuring as above is a mechanism to avoid taxes on the sale of transaction.

- AO also argued that INR 2,111 crs invested in the Assessee Firm towards capital reserve, was without any consideration and therefore sought to tax the same u/s 56(1) of the ITA and alternatively, u/s 56(2)(via) of the ITA.

- Upon making an appeal to CIT(A), CIT(A) reversed the order of AO.

- Aggrieved by the order of CIT(A), revenue preferred an appeal to Income Tax Appellant Tribunal, Hyderabad Bench (‘ITAT, Hyderabad’).

Issue under consideration:

Whether the addition made by AO towards contribution of capital reserve u/s 56 of the ITA is justified?

Order of ITAT, Hyderabad:

Assessee Firm contended that other investors in the Business Entity had imposed conditions, per which the allotment of shares could not be made to any shareholders other than existing shareholders and / or group companies. In order to comply with the conditions, restructuring arrangement was made in the above manner.

Above contention of Assessee Firm was accepted by ITAT, Hyderabad bench. ITAT, Hyderabad bench held that the transaction was not colourable devise.

Further, Hon’ble ITAT, Hyderabad bench held that the receipt of capital contribution from partner is capital receipt and therefore cannot be brought to tax u/s 56(1) of the ITA. Also, Section 56(2)(via) of the ITA cannot be applicable in the present case merely because the Assessee Firm used the consideration to invest in Novus on same day.

For detailed discussion on the above case, please feel free to connect at contact@devadhaantu.in

______________________________________________________________________________

[1] ITO vs M/s. Shrilekha Business Consultancy Pvt. Ltd. ITA No.1371/Hyd/2018 & ITA No.1041/Hyd/2019