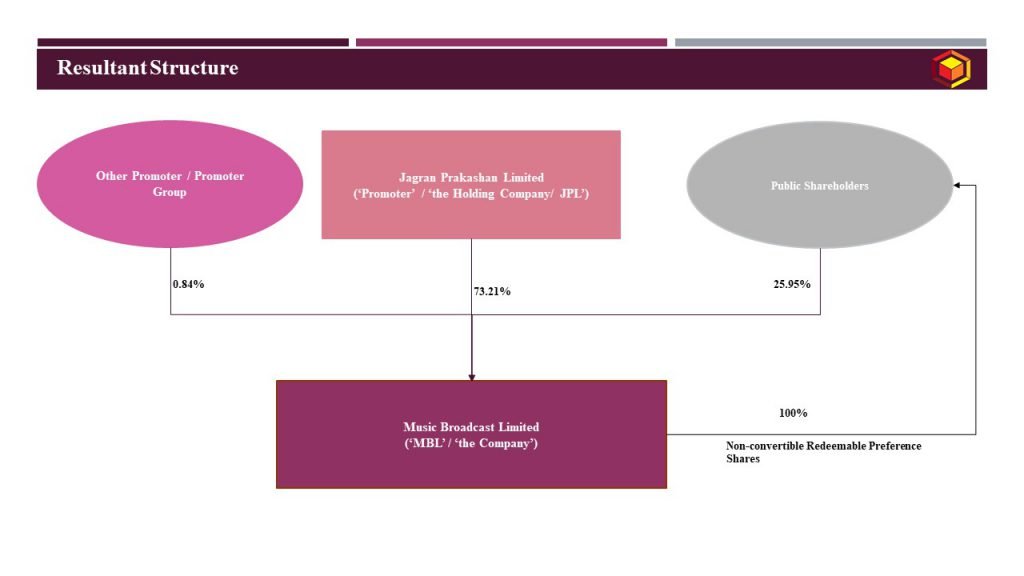

Music Broadcast Limited (“MBL/the Company”) is a public listed company incorporated under the Companies Act, 1956 bearing CIN: L64200MH1999PLC137729. The Company has its registered office at 5th Floor, RNA Corporate Park, Off Western Express Highway, Kalanagar, Bandra (East), Mumbai 400051. The Equity shares of MBL are listed on BSE Limited & National Stock Exchange of India Limited. MBL is a widely held public listed company in which public shareholders hold 25.95 % of the issued, subscribed, and paid-up equity share capital of the Company. MBL is a subsidiary of Jagran Prakashan Limited (“Promoter / Holding Company/JPL”) holding 73.21 % shares in MBL i.e. 253,074,137 shares of 2/- (Rupees Two) each.

MBL is inter alia engaged in operating FM radio stations across India under the brand of “Radio City “It js India’s first and leading FM Radio Station which started its operations in India in the year 2001. MBL currently has 39 stations. MBL, over the years, has consistently come up with tools and initiatives to raise social awareness over a spectrum of issues including but not limited to Women Empowerment, Voter Awareness, Road Safety, etc. and also acts as a medium to spread the awareness about government campaigns such as Covid -19 awareness program of public interest.

Current structure of the group is as under:

Management of the Company along with its group Companies has proposed to pass on the accumulated profits of the Company to its non-promoter public shareholders by way of issuing and allotting Bonus Non- Convertible Redeemable Preference Shares of INR 10 each, issued at premium of INR 90 per share and carrying dividend at the rate of 0.1% to,

- to Other Shareholders by utilizing Other Reserves and

- to the remaining non-promoter shareholders who are residing outside India by utilizing general reserves as required under regulation of Foreign Exchange Management (Debt Instruments) Regulations, 2019 issued vide RBI Notification No. FEMA 396/2019-RB dated October 17, 2019*,

by virtue of and in the manner provided in this Scheme.

* Regulations of the Foreign Exchange Management (Debt Instruments) Regulations, 2019 issued vide RBI Notification No. FEMA 396/2019-RB dated October 17, 2019, have permitted Indian Companies to issue non-convertible non-cumulative redeemable preference shares to non-resident Members including by way of distribution as a bonus from its general reserves under a scheme of arrangement approved by the National Company Law Tribunal/Competent Authority in India under the provisions of the Act, as applicable, subject to the terms and conditions of the aforesaid ‘RBI Notification’ that will be complied with by the Company..

Accumulated Reserves as on March 31, 2020 in the books of the Company are as under:

Particulars | Amount (in Crores) |

Capital Reserve | 14.83 |

Securities Premium | 340.02 |

General Reserves | 49.09 |

Retained Earnings | 16.74 |

Other Reserves | 141.97 |

Total other Equity | 562.65 |

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Amalgamation |

Appointed Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | Securities Exchange Board of India Limited; BSE Limited; National Stock Exchange of India Limited; National Company Law Tribunal (‘NCLT’), Mumbai Bench Registrar of Companies (‘ROC’), Mumbai Regional Director, Mumbai |

Consideration | Issue of listed non-convertible non-cumulative redeemable preference shares (‘NCRPS’) of the Face Value of 10/- (Rupees Ten) issued at a premium of 90 (Rupees Ninety) per NCRPS carrying a dividend of 0.1 % (Zero point one percent) by way of bonus in the ratio of 1 bonus NCRPS for every 10 equity shares held in the Company Allotee for the bonus NCRPS are non-promoter shareholders. Such bonus NCRPS shall be issued by utilizing general reserves and other reserves of the Company. Key terms of the NCRPS is as under:

|

Accounting Treatment | In the books of the Company –

Note:

|

Taxation | Issue of NCRPS in the manner contemplated in this Scheme will not entail declaration or payment of any dividend for any purposes including for the purposes of section 123 of the Act or any other relevant provision of the Companies Act, 2013 and accordingly the provisions pertaining to the Companies (Declaration and Payment of Dividend) Rules, 2014 are not applicable. Thus since the issuance of NCRPS does not involve any release of assets by the Company to its shareholders and no tax shall be leviable on such issuance. |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

This Scheme is presented under the provisions of Section 230 and other applicable provisions of the Companies Act, 2013, and in accordance with the regulations of the Foreign Exchange Management (Debt Instruments) Regulations, 2019 issued vide RBI Notification No. FEMA 396/2019-RB dated October 17, 2019. The Scheme provides for the following;

- Promoter of the Company, being extremely investor-friendly and has been consistent in rewarding its shareholders meaningfully, successfully rewards public shareholders of the Company by way of issuance of bonus NCRPS. It was this reputation that helped MBL close successfully it’s initial public offering in 2017 at a premium which was over 32 times of the then face value of 10 each.

- The radio industry is undergoing a transformation right now and the turn of event in the industry has also impacted MBL. In the recent past, its performance has not been commensurate to the potential of the company and is reflected in its market performance as well.

- MBL intends to ensure that it continues to get the support of its esteemed public shareholders who have supported the company so far.

- In view of the above, the Board of Directors of MBL has formulated this Scheme of Arrangement for issuance of non-convertible non-cumulative redeemable preference shares (“NCRPS”) to its non-promoter shareholders on a preferential basis by way of bonus.

- The Company has a strong net worth with no debt. MBL is also confident in running the business profitably and generating sufficient cash to meet its future requirements. However, it is considered prudent to conserve the cash to meet any unforeseen requirement that may arise during and aftermath of the Covid 19 pandemic which has created an unprecedented challenging business environment.

- The above-mentioned Scheme is beneficial to MBL, its promoter (JPL being the holding company of MBL), and non-promoter shareholders as it strengthens the image of MBL as well as JPL in the market as it commits itself for higher distributions going forward. This will also augur well for future fundraising requirement, if any, of JPL and M3L.

Commercial considerations:

- Through this scheme, the Company not only rewards its public shareholders but also gains trust from the promoters and management of the Company for being ever investor friendly and consistent in its efforts;

- The issuance of bonus NCRPS does not create any liability on the public shareholders to pay tax at the time of allotment;

- Since the NCRPS are to be listed on the stock exchange, and also none of the NCRPS are under any lock-in period, NCRPSs are easily transferable prior to its mandatory redemption;

- Upon redemption, tax at applicable rates shall be deducted by the Company on payment of dividend and/or from the consideration to be paid on redemption/buyback (as the case may be) of NCRPS.

For more detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in