Minda Industries Limited (‘the Transferee Company’ or ‘Minda’), is a public company incorporated on September 16th, 1992 under the provisions of the Companies Act, 1956 bearing Corporate Identification Number, L74899DL1992PLC050333, and is having its registered office at B-64/1, Wazirpur Industrial Area, New Delhi – 110 052. The Transferee Company is engaged inter alia in the business of manufacturers, fabricators, assemblers and sub-assembler processors, agents, importers, exporters, holders, stockists, distributors, buyers and sellers, dealer and suppliers of automobile parts and related equipments in India or abroad whether by itself or in collaboration whether Indian or Foreign

Minda I Connect Private Limited (‘the Transferor Company’ or ‘Minda I Connect’) is a Private company incorporated on September 30th, 2014 under the provisions of the Companies Act, 2013 bearing CIN U35900DL2014PTC272202, and is having its registered office at B-64/1 Wazirpur, Industrial Area, New Delhi – 110052. The Transferor Company is engaged inter alia in the business of development of software, hardware and designing, programming in automotive mobility and Information technology segment, Automation providing product and solution.

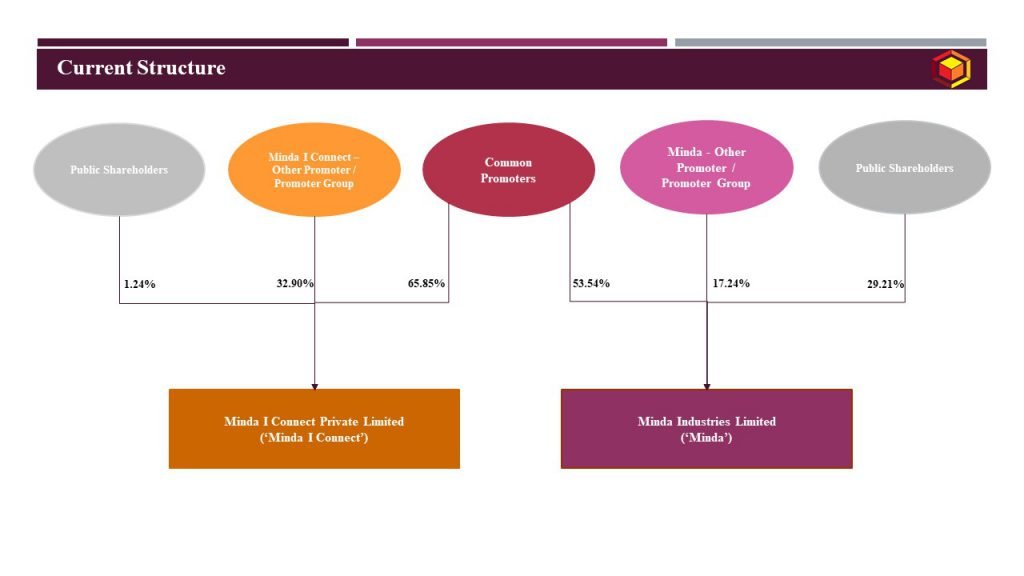

Current structure of the group is as under:

Management of Minda and Minda I Connect are proposing to restructure business and shareholding of the group by merging Minda I Connect with Minda. As can be observed from above, both Minda and Minda I Connect are held by common promoters holding 53.54% and 65.85% in Minda and Minda I Connect respectively.

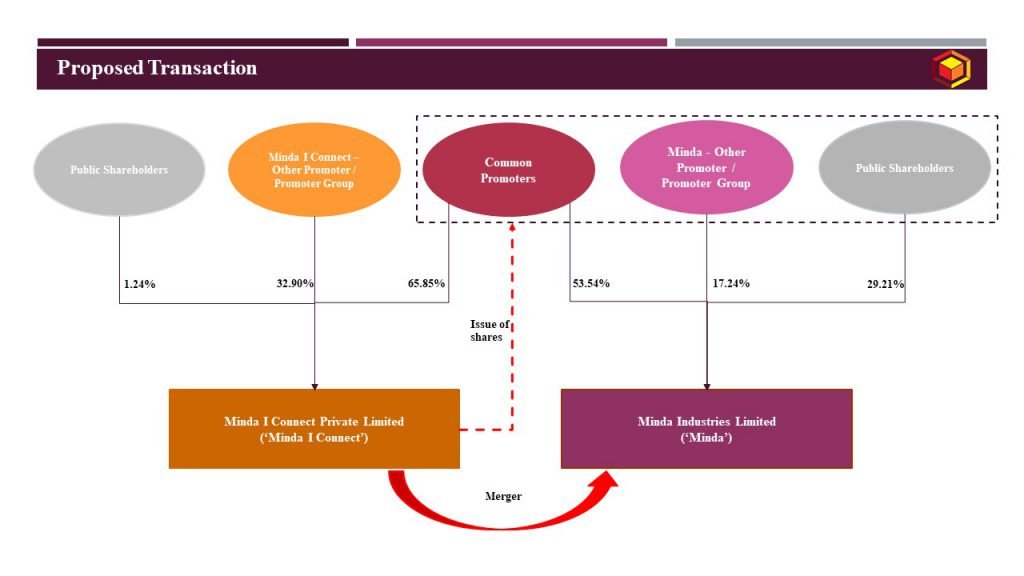

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Merger |

Appointed Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | BSE Limited; National Stock Exchange of India Limited; Securities and Exchange Board of India Limited; National Company Law Tribunal (‘NCLT’), New Delhi bench; Registrar of Companies (‘ROC’), NCT of Delhi and Haryana Regional Director (‘RD’), NCT of Delhi and Haryana |

Consideration | Minda to issue 10 (Ten) fully paid equity share of INR 2 (Indian Rupees Two) each for every 179 (One Hundred Seventy Nine) fully paid up equity shares of INR 10 (Indian Rupees ten) each to the shareholders of Minda I Connect |

Accounting Treatment | In the books of Minda: In the books of Minda, the proposed amalgamation would be recorded by following acquisition method of accounting. In the instant case, it can be noted that both Minda and Minda I Connect are controlled by common promoters for holding of more than 51%. However, based on our research it is assumed that during financial year 2018-19, control over Minda I Connect was freshly acquired. Accordingly, any merger immediately followed by controlling acquisition would still be recorded by following acquisition method of accounting. In the books of Minda I Connect – NA, since merged |

Taxation | Tax neutral transaction |

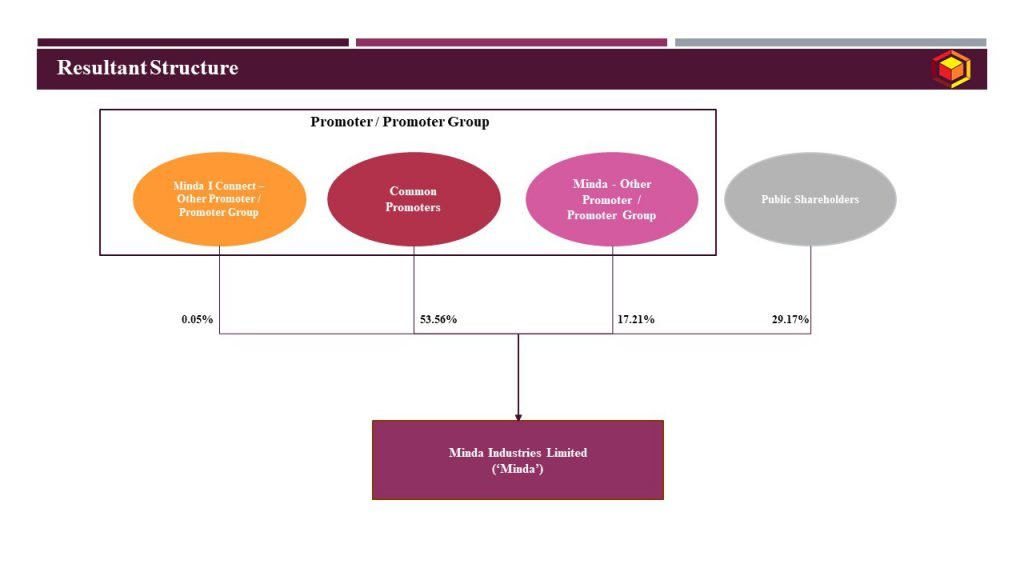

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Minda | 70.79% | 29.21% | 70.83% | 29.17% |

Minda I Connect | 98.76% | 1.24 | NA | NA |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

- Both, the Transferor Company and the Transferee Company are engaged in auto component business and both companies are of the same group. The Transferor Company is a developer of software, hardware and designing, programming in automotive mobility and information technology segment, automation providing products and solutions and consultancy services incidental thereto. The Transferor Company is in business of development of software, hardware, designing, programming in automotive mobility and information technology segment and automation providing products. Transferor Company Brand – I Connect and Carrot have been established as a leading telematics brand in India (HW and IT);

- The Transferee Company desires to expand its business in automotive components and the proposed amalgamation in their opinion would lead to improved customer connect and enhanced market share across product segments relating to auto sector. The Transferor Company’s products like software, hardware, designing, programming in automotive mobility and information technology segment will synergize well with the product groups of the Company;

- The amalgamation will help the Transferee Company in creation of platform for a new business / product and to act as a gateway for growth and will ensure better operation management and expansion of business operations;

- By this amalgamation and through enhanced base of product offerings, the Transferee Company would serve as One-stop solution for wide range of components / products to the original equipment manufacturers (OEMs) and others;

- The proposed amalgamation of the Transferor Company with the Transferee Company in accordance with this Scheme would enable both the companies to realise benefits of greater synergies between their businesses and avail of the financial, managerial, technical, distribution and marketing resources of each other towards maximising stakeholder value;

- Further, proposed amalgamation would provide,

- opportunities for employees of the Transferee Company and Transferor Company to grow in a wider field of business;

- improvement in competitive position of the Transferee Company as a combined entity and also access to marketing networks/customers.

For more detailed discussion on the above case study, please do not hesitate to connect at Contact@devadhaantu.in