Large enterprise groups often delves into internal restructurings in order to align the multiples businesses and achieve business synergies. Such internal restructurings often results in tax litigations due to misalignment in the interpretation by assessee and revenue. One such internal restructuring undertaken by Asian Satellite Broadcast Pvt Ltd (‘the Assessee’)[1] has resulted into tax dispute with revenue authority, details which is as under:

Facts of the Case:

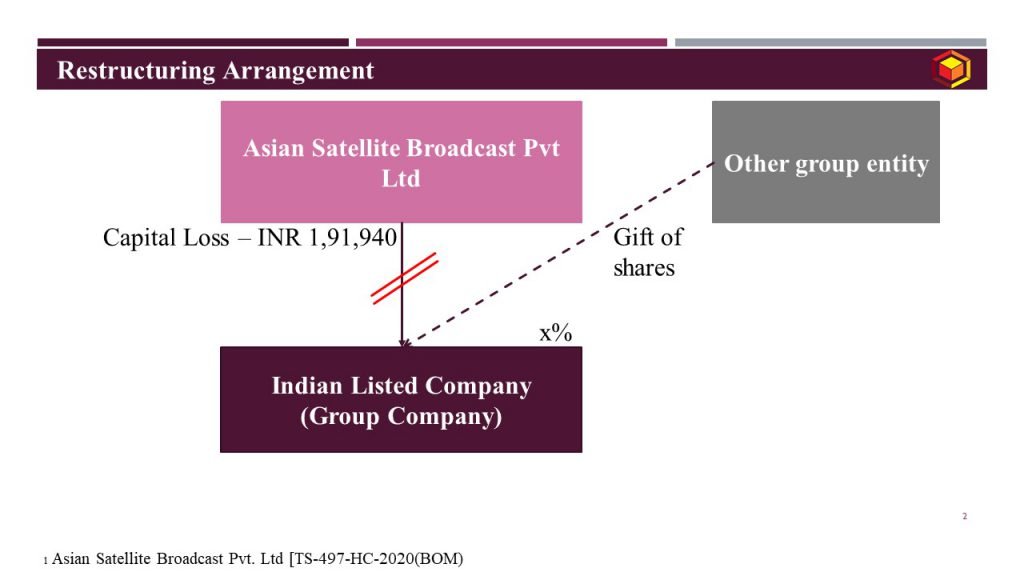

In AY 2012-13, the Assessee had transferred its shareholding in a group company (listed) to its associate company as a part of internal restructuring. Assessee had claimed loss in the profit and loss accounts towards cost of acquisition of shares in such group company. However, none of such losses were claimed while filling tax return.

Assessment Proceedings:

During the Scrutiny assessment, Assessing Officer (‘AO’) observed that transfer of shares of listed entity at nil consideration amongst unlisted group entity was made with the sole purpose of evading payment of capital gains tax and such transfer fell within the scope of a colourable device. Accordingly, AO made an addition to capital gains at INR 3.36 crs for the above gift transaction in the hands of Assessee.

After several rounds of tax litigations, and aggrived by the order of Income Tax Appellate Tribunal, Mumbai Bench, assessee has preferred an appeal to High Court of Mumbai (‘Mumbai HC’).

Issue under consideration:

Whether corporate gift under internal group restructuring is liable to capital gains tax?

Decision of Mumbai HC:

The Mumbai HC held that fair market value of shares gifted by a company cannot be liable to capital gains tax owing to a specific exemption u/s 47(iii) of the Income Tax Act, 1961 (‘the ITA’), which provides for exemption from capital gains tax. Mumbai HC made decision based on the assessee’s contention which mentions that,

- These shares were gifted via a board resolution and there was no requirement of a gift deed and there is no provision in the law which prohibits a company from giving or receiving gifts;

- Further, there was no embargo on a company to gift any property in order for a “transfer” not to be considered as a transfer exigible to the capital gains tax u/s u/s 47(iii) of the ITA.

For detailed discussion on the above subject, please feel free to connect at contact@devadhaantu.in

___________________________________________________________________________

[1] Asian Satellite Broadcast Pvt. Ltd [TS-497-HC-2020(BOM)