Reliance Industries Limited (“Transferor Company” or “RIL”) is a company incorporated under the Companies Act, 1956. RIL has multiple undertakings including digital services, retail, financial services, E&P and O2C undertakings. The equity shares and non-convertible debentures of RIL are listed on the Stock Exchanges (as defined hereinafter). The global depository receipts of RIL are listed on Luxembourg Stock Exchange and are traded on the International Order Book (IOB) (London Stock Exchange) and amongst qualified institutional investors on the over-the-counter (OTC) market in the United States of America. The foreign currency bonds of RIL are listed on the Singapore Stock Exchange and Luxembourg Stock Exchange.

Reliance O2C Limited (“Transferee Company” or “O2C Subsidiary”) is a company incorporated under the Companies Act, 2013. The equity shares of O2C Subsidiary are not listed on Stock Exchanges and O2C Subsidiary is a wholly-owned subsidiary of RIL.

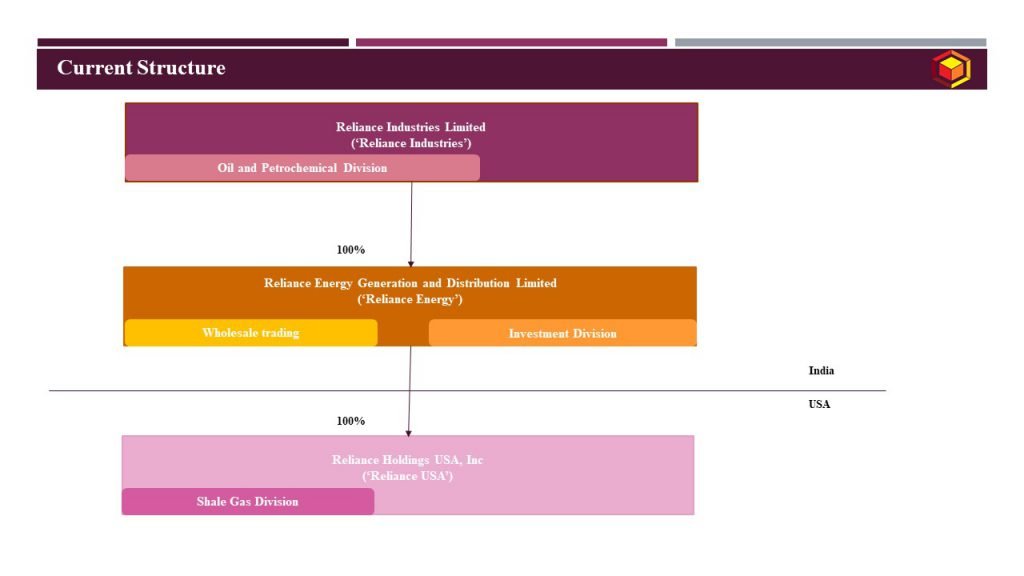

Current group structure is depicted as under:

Management of RIL has proposed to restructure business of the group by way of slump sale of O2C business undertaking of RIL into its Wholly owned subsidiary company followed by capital reduction in the books of RIL which arises due to transfer of O2C business undertaking via slumpsale.

O2C business undertaking means the entire oil-to-chemicals business of RIL consisting of refining, petrochemicals, fuel retail (majority interest only), aviation fuel (with proposed operatorship arrangement with Reliance BP Mobility Limited) and bulk wholesale marketing businesses. Further, O2C business undertaking includes equity interest in domestic and overseas subsidiaries of RIL.

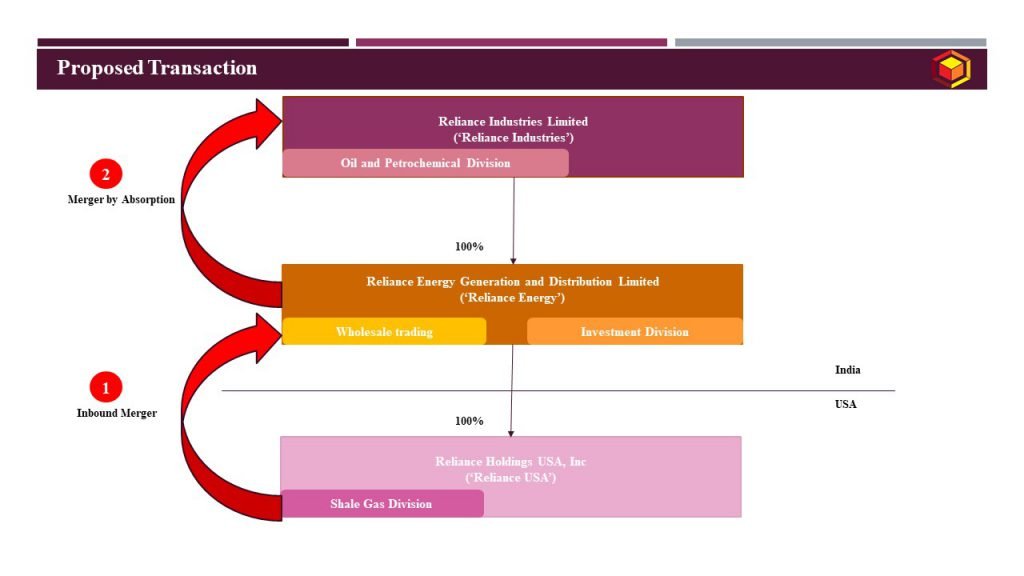

Proposed Transaction is depicted as under:

Key features of the Scheme for Amalgamation is as under:

Key features | Transaction: Slump Sale |

Appointed Date | January 1, 2021 |

Effective Date | Date of filling of certified copy of approving authority being National Company Law Tribunal with Registrar of Companies |

Jurisdictional Authority(ies) | RIL:

Reliance O2C:

|

Consideration | Consideration for the proposed slump sale of O2C business undertaking is equivalent to tax networth of the O2C business undertaking Tax Networth means the aggregate value of assets reduced by the aggregate value of liabilities of O2C Business Undertaking as on the Appointed Date, transferred pursuant to this Scheme. For this purpose, − ‘Aggregate Value of Assets’ shall be: (a) in the case of depreciable assets, the written down value of the block of assets, determined in accordance with the provisions of the Income Tax Act, 1961; and (b) in the case of other assets, the book value of such assets, ignoring revaluation, if any, of the O2C Undertaking; and − ‘Aggregate Value of Liabilities’ shall be the value of liabilities of the O2C Undertaking appearing in the books including the Identified Borrowings. |

Accounting Treatment | In the books of RIL – Net assets pertaining to O2C business undertaking shall be debited at its book value and corresponding debit effect shall be given in the profit and loss account. Such loss arising due to transfer shall be set off in the following order,

In the books of Reliance O2C- Net assets received pursuant to slump sale shall be recorded at book value at which it appeared in the books of RIL. Difference between the consideration and net asset of O2C business undertaking shall be credited to capital reserve account |

Taxation | No adverse tax implication upon slump sale as transfer of O2C Business Undertaking is for a consideration equivalent to tax net-worth of O2C business undertaking. For the purposes of taxing capital gains on slump sale transactions, any consideration over and above tax net-worth of the business undertaking transferred pursuant to slump sale is taxed @ 23.30%. Since in the instant case, such excess is nil, no capital gains shall be leviable. (It is assumed that a set of investors would be invited to invest in Reliance O2C in the future, thereby Reliance O2C no longer to continue to remain wholly owned subsidiary of RIL. Thus, we are not discussing about provisions relating to section 47(iv) of the Income Tax Act, 1961.) |

Stamp duty Costs | Registered office of RIL is situated in the State of Maharashtra and registered office of Reliance O2C is situated in the State of Gujarat. Since 2 separate NCLT orders sanctioning the slump sale transaction would be issued, by respective benches of NCLT, stamp duty on such slump sale transaction would also need to be paid in both the State, i.e. the State of Maharashtra as well as in the State of Gujarat. |

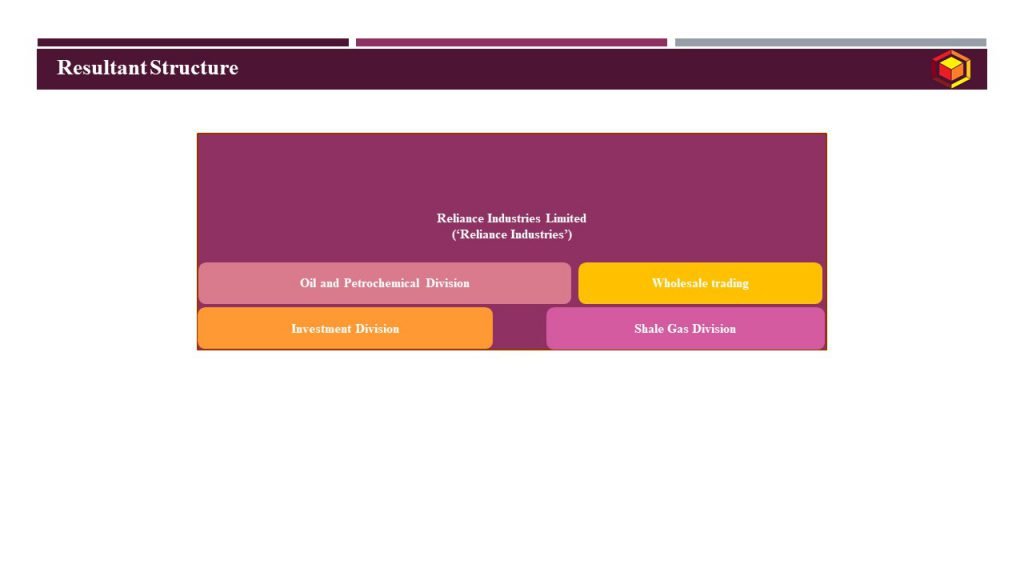

Resultant Structure after giving effect to the above transactions is as under:

Purpose of slump sale transaction:

- Proposed Slump sale attracts different set of investors and strategic partners for O2C business undertaking as the nature of risk and returns involved in the O2C Business are distinct from those of the other businesses of RIL and the O2C Business.

- Additionally proposed slump sale would provide segregation of management role whereby resources possessing domain expertise can be hired to manage the business and look after same, while control remains with RIL.

- Further, it provides flexibility to Reliance O2C to raise capital from strategic / other investors in the O2C business, who would be interested specifically in O2C business. Capital can also be raised in the form of differential voting rights to avoid dilution of stake of RIL and also protection of interests of Reliance group holding. As raising of funding with differential voting rights is not permissible for listed companies under the provisions of SEBI LODR regulations, one of the benefits of housing O2C business under Reliance O2C can be to raise funding with differential voting rights.

For more detailed discussion on the above case study, please feel free to connect at contact@devadhaantu.in