Mastek Limited (“Mastek”) is a public limited company incorporated under the provisions of Companies Act, 1956, bearing corporate identification number L74140GJ1982PLC005215 and having its registered office at 804/805 President House, Opposite C N Vidyalaya, Near Ambawadi Circle, Ahmedabad, Gujarat – 380006. Mastek is inter alia, engaged in the business of providing information technology solutions and a leading IT player with global operations providing enterprise solutions to government, retail and financial services organizations worldwide and the equity shares of Mastek are listed on the Stock Exchanges.

Trans American Information Systems Private Limited (“TAISPL”) is a private limited company incorporated under the provisions of Companies Act, 1956, bearing corporate identification number U51505GJ1999PTC112745 and having its registered office at 804/805 President House, Opposite C N Vidyalaya, Near Ambawadi Circle, Ahmedabad Gujarat- 380006. TAISPL is a wholly owned subsidiary of Mastek Limited, engaged in the business of providing IT services in the areas like e-commerce website implementation, support, maintenance, and other complimentary services.

Evolutionary Systems Private Limited (“ESPL”) a private limited company incorporated under the provisions of the Companies Act 1956, bearing corporate identification number U17122GJ2006PTC049073 and having its registered office at 11th Floor, Kataria Arcade, Beside Adani Vidya Mandir School, S.G. Highway, Makarba, Ahmedabad- 380054, Gujarat, India. ESPL is engaged in the business of enterprise package implementation, upgrade and support for on-premise and cloud versions from Oracle and includes procuring Oracle enterprise package license on their behalf of client along with implementation / upgrade services. Enterprise packages include enterprise resource planning, human capital management, client relationship management, business intelligence, business analytics and equivalents.

ESPL is one of the leading and fastest-growing oracle cloud premier platinum partners and has proven expertise in all oracle solutions including ERP, HCM, Hyperion & BI, CX and PaaS through multiple success stories with marquee clients. ESPL having interests in various businesses, through itself or through its subsidiaries, which has been nurtured over a period of time and has significant potential for growth.

ESPL has strong presence in India and in the rest of the world which include United States, Europe, Middle East and Asia and has customers in various verticals such as professional services, healthcare, financial services, public sector, life sciences, engineering and construction, etc. TAISPL and Mastek, on the other hand, have strong client relationships in India and aforesaid jurisdictions.

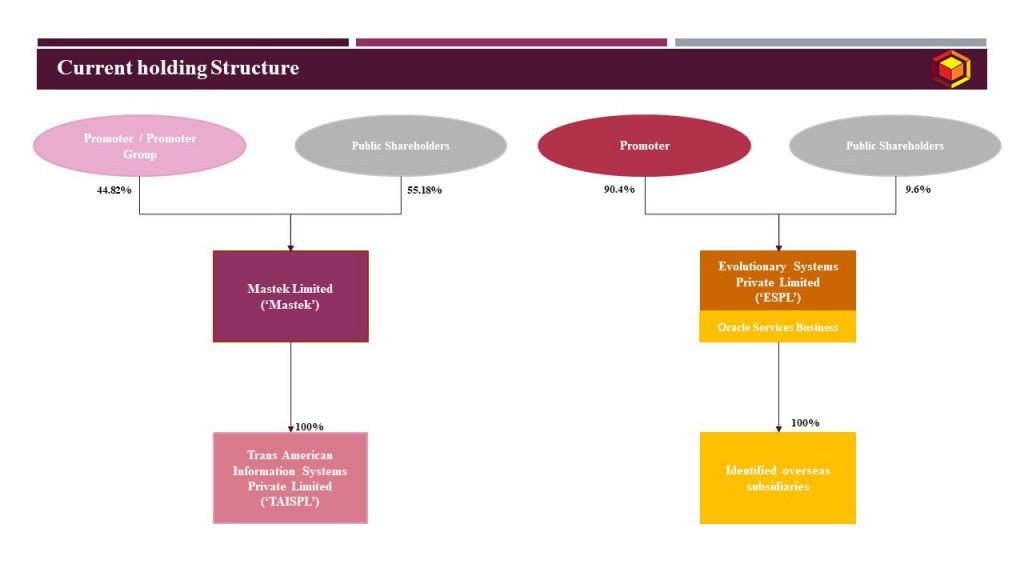

Current structure of the Company is as under:

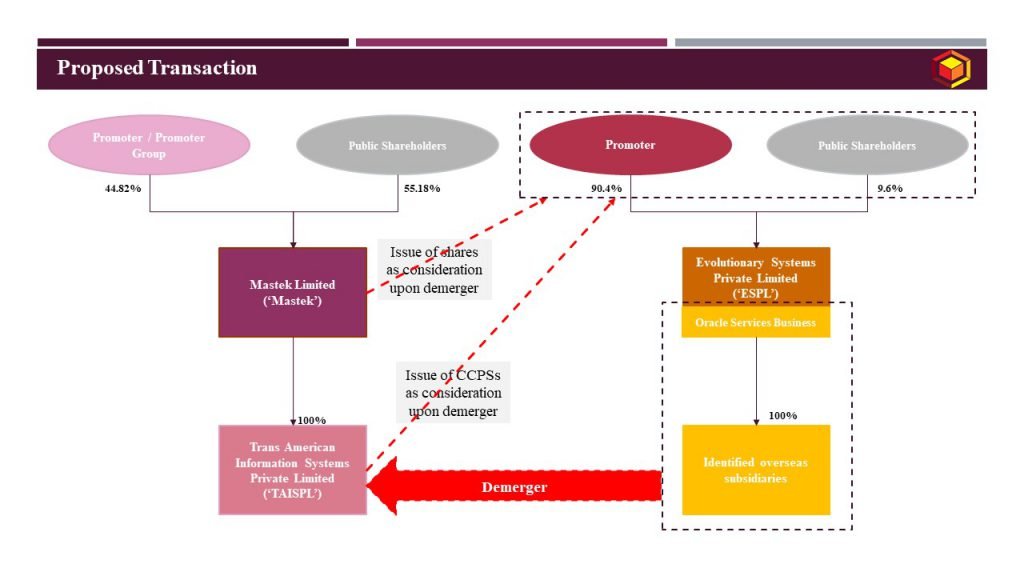

Management of Mastek has proposed to acquire Oracle Services business undertaking, including its ancillary and support services business of ESPL by way of demerger into TAISPL, wholly owned subsidiary of Mastek. Oracle Services Business undertaking includes services around enterprise package implementation, upgrade and support for on-premise and cloud versions from Oracle and includes procuring Oracle ERP license on behalf of client along with implementation/ upgrade services. Enterprise packages includes enterprise resource planning, human capital management, client relationship management, business intelligence, business analytics and equivalents. Alongwith the Oracle Business undertaking identified investment in overseas entities would also be transferred as under:

- Evolutionary Systems Corp (Woburn, USA) bearing Massachusetts Identification number 465452403,

- Newbury Cloud Inc. (Woburn, USA) bearing Delaware file number 5638703, Evolutionary Systems Co. Ltd (London, United Kingdom) bearing company number 07559069

- Evolutionary Systems B.V. (Amsterdam, Netherlands) bearing RSIN 858794081, Evolutionary Systems Qatar WLL (Doha, Qatar) bearing commercial registration number 55571,

- Evolutionary Systems (Singapore) Pte Ltd (Singapore) bearing entity identification number 201418775M,

- Evolutionary Systems Pty Ltd (Sydney, Australia) bearing ACN 615 406 221,

- Evolutionary Systems Saudi LLC (Riyadh, KSA), and

- Evolutionary Systems (Petaling Jaya, Malaysia) bearing company number 1140231;

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Demerger |

Appointed Date | February 1, 2020 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | National Company Law Tribunal (‘NCLT’), Ahmedabad bench; Registrar of Companies (‘ROC’), Gujarat Regional Director (‘RD’), Gujarat |

Consideration | Consideration in the combination of issuance of following instruments: 1. Mastek to issue equity shares in the ratio of 4235.3 : 10,000; 2. TAISPL to issue compulsorily convertible debentures (‘CCDs’) in the ratio of 15:10,000 |

Accounting Treatment | In the books of ESPL: Pooling of interest method.

In the books of TAISPL: Acquisition method of accounting.

In the books of Mastek

|

Taxation | Tax neutral transaction |

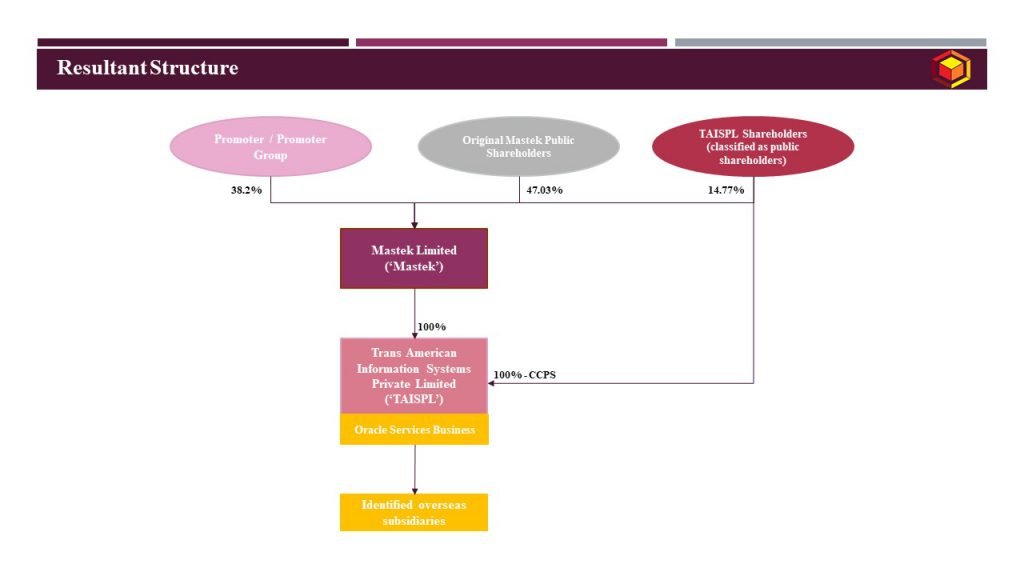

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

ESPL | 90.40% | 9.60% | 90.40% | 9.60% |

TAISPL | 100% | – | 100% | – |

Mastek | 44.82% | 55.18% | 38.20% | 61.80% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

The proposed demerger of the Oracle Services Business Undertaking from ESPL to TAISPL pursuant to this Scheme facilitates,

- more industry-specific value propositions and the local and global presence of ESPL to enable rapid, cost-effective Oracle Cloud solutions across verticals;

- realisation of benefits of greater synergies between the businesses of ESPL, TAISPL and Mastek and use of the financial, managerial, technical and marketing resources of each other towards maximising stakeholder value;

- synergy of operations will result in incremental benefits through sustained availability and better procurement terms of components, pooling of resources, thus leading to better utilisation and avoidance of duplication;

- creation of focused platform for future growth of TAISPL and Mastek being engaged, among other things, in the business of Oracle Services Business;

- opportunities for employees of ESPL and TAISPL to grow in a wider field of business;

- improvement in competitive position and also achieving economies of scale including enhanced access to marketing networks/customers; and

Commercial considerations:

- The Scheme caters to the third-party deal scenario whereby acquisition of a business undertaking is taking place without any cash outgo from TAISPL and / or Mastek.

- Interest of shareholders of demerged company is shifted from its domain specific field to the Mastek being listed entity catering to various other services.

- Shareholders of ESPL are categorized as public shareholders and accordingly, there is increase in the public shareholding, thereby dilution of promoter holding.

- The arrangement for issuance of CCPS by TAISPL has been made in a manner such that shareholders ESPL’s interest in the TAISPL doesn’t get adversely affected.

- The arrangement for the issuance of financial instruments by Mastek and TAISPL has been made such that there are lesser complexity and lesser tax outgo in the hands of shareholders of ESPL. Further, there is no lock-in period for holding equity shares in Mastek as well as holding of CCPS in TAISPL and accordingly, shareholders of ESPL are at their discretion to sell the equity shares and CCPSs received pursuant to the proposed demerger.

For more detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in