Quess Corp Limited (‘Transferee Company’ or ‘Quess’) is a company incorporated under the Companies Act, 1956 vide corporate identification number, L74140KA2007PLC043909 and and having its registered office at 3/3/2, Bellandur Gate, Sarjapur Main Road, Bangalore 560 103. Equity shares of the Transferee Company are listed on the Indian Stock Exchange(s).

Greenpiece Landscapes India Private Limited (‘The Transferor company 1’ or ‘Greenpiece’) is a company incorporated under the Companies Act, 1956, vide corporate identification number U01403KA2008PTC044865 and having its registered office at S2, 104, 13th Main, 5th Sector, H S R Layout, Bangalore — 560 034.

Golden Star Facilities and Services Private Limited (‘Transferor Company 2’ or ‘Golden Star’) is a company incorporated under the Companies Act, 1956, vide corporate identification number, U93000KA2008PTC133410 and having its registered office at 3/3/2, Bellandur Gate, Sarjapur Main Road, Bangalore — 560 103.

MFX Infotech Private Limited (‘Transferor Company 3’ or ‘MFX Infotech’) is a company incorporated under the Companies Act, 2013, vide corporate identification number, U72200KA2014PTC074949 and having its registered office at 3/3/2, Ambalipura, Sarjapur Road, Bellandur, Bangalore — 560 102.

Trimax Smart Infraprojects Private Limited (‘Transferor Company 4’ or ‘Trimax’) is a company incorporated under the Companies Act, 2013, vide corporate identification number, U74999KA2017PTC135030 and having its registered office at 3/3/2, Bellandur Gate, Sarjapur Main Road, Bangalore – 560 103.

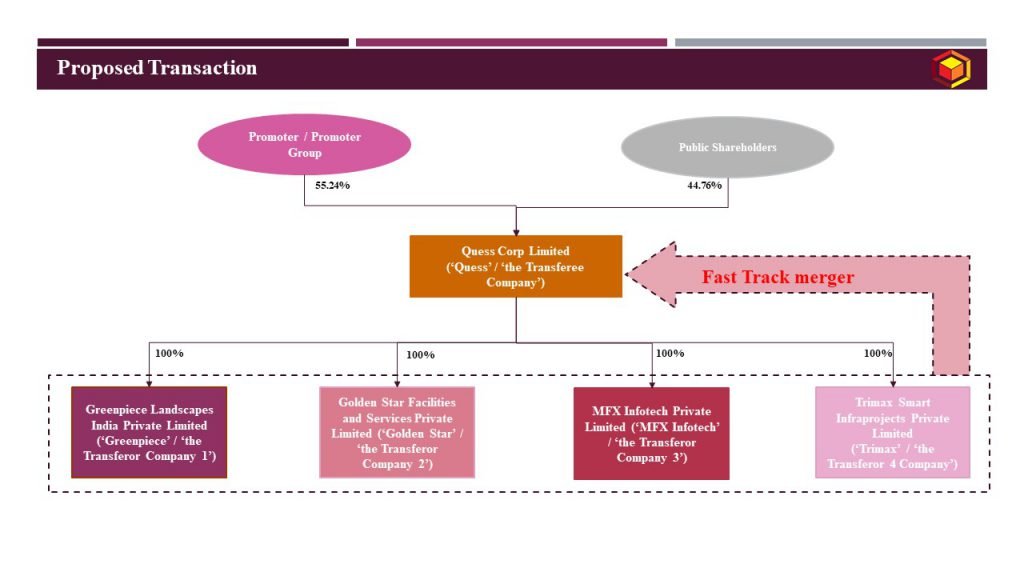

Current structure of the group is as under:

Management of the Company along with its group Companies has proposed to restructure business and shareholding of the group by way of Amalgamation of Transferor Company 1, Transferor Company 2, Transferor Company 3 and Transferor Company 4 with and into Transferee Company

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Amalgamation |

Appointed Date | April 1, 2020 |

Effective Date | Date of filling of certified copy of approving authority being Regional Director with ROC |

Jurisdictional Authority(ies) | Registrar of Companies (‘ROC’), Bangalore Regional Director, Hyderabad Official Liquidator as appointed by Regional Director |

Consideration | No Consideration shall be issued by the Transferee Company, as entire share capital of all the Transferor Companies is held by the Transferee Company. |

Accounting Treatment | In the books of Transferee Company – Pooling of interest method; In the books of Transferor Companies – NA |

Taxation | Tax neutral transaction |

The Scheme has been filed under section 233 of the Companies Act, 2013, which provides for fast -track merger. The concept of fast-track merger has been introduced under the Companies Act, 2013 in order to reduce compliance burden for a simple merger of wholly owned subsidiary(ies) into its holding company. As per section 233 of the Companies Act, 2013, approval of jurisdictional National Company Law Tribunal is not required to be obtained and approval of Regional Director is final order for obtaining approval subject to condition that an approval of 90% of the total shareholders and 90% of the total secured creditors and unsecured creditors is required to be obtained.

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Greenpiece Landscapes India Private Limited | 100% | – | NA, since merged | NA, since merged |

Golden Star Facilities and Services Private Limited | 100% | – | NA, since merged | NA, since merged |

MFX Infotech Private Limited | 100% | – | NA, since merged | NA, since merged |

Trimax Smart Infraprojects Private Limited | 100% | – | NA, since merged | NA, since merged |

Quess Corp Limited | 55.24% | 44.76% | 55.24% | 44.76% |

Resultant structure post approval of the Scheme is as under:

The proposed amalgamation benefits the Quess group in the following manner:

- Simplification in the management structure, leading to better administration and reduction in costs from more focused operational efforts, rationalization, standardization and simplification of business processes, elimination of duplication, reduction in multiplicity of legal and regulatory compliances and rationalization of administrative expenses.

- Greater integration and financial strength for Quess Corp, which would result in maximizing overall shareholders value.

- Simplification of group structure by eliminating multiple companies within the group.

For detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in