General Anti Avoidance Rules (‘GAAR’) were introduced in under the provisions of the Income Tax Act, 1961 (‘the ITA’) vide Finance Act, 2013. However, GAAR became effective from the financial year commencing April 1, 2017 only. Relevant rules in relation to GAAR provisions were also introduced in Income Tax Rules, 1962 (“IT Rules”) then only. The introduction of GAAR under the provisions of the ITA is to check aggressive tax planning especially that transaction or business arrangement which is/are entered into with the objective of avoiding tax. Thus, any business arrangement carried out with an intention of avoiding taxes are under scanner of revenue department through the lenses of GAAR. Thus, in the case of JCT Limited (‘the Assessee’) [1], revenue authorities applied provisions of GAAR for transactions entered into in the financial year 2010-11. Whether revenue authorities can apply provisions of GAAR retrospectively is discussed in this case study.

Facts of the case:

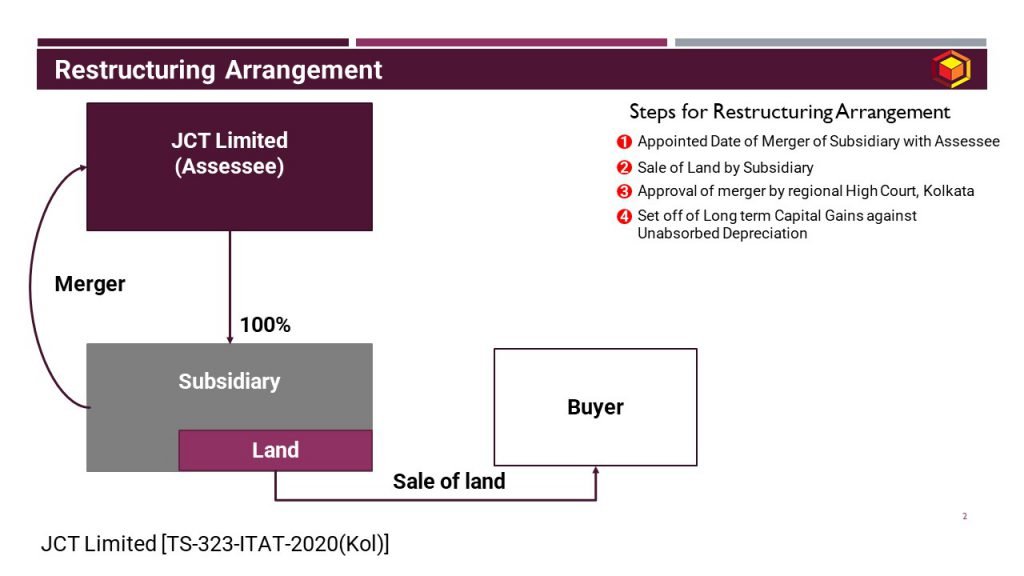

- Assessee had filed an application for the merger of its wholly owned subsidiary (‘the Subsidiary’) with itself under the court approved Scheme of Amalgamation under section 391-394 of the Companies Act 1956 with the High Court of Punjab and Haryana and of

Delhi. (‘the Scheme’). - Hon’ble High Court of Punjab and Haryana approved the Scheme on March 25, 2011 and Hon’ble High Court of Delhi, approved the Scheme on May 10, 2011 (‘the Effective Dates’) with the appointed date as April 1, 2010.

- In the interim, between the Appointed Date and the Effective Dates, the Subsidiary converted its leasehold land into freehold land and also entered into an arrangement where a piece of land parcel was sold which was liable to long term capital gains in the hands of the Subsidiary.

- While filling return of income for the assessment year 2011-12, which fell after the effective date, set off of unabsorbed depreciation of the Assessee Company was claimed against the long term capital gains of Subsidiary, in the hands of the Assessee Company, being Amalgamated Company.

Assessment Proceedings:

- During the Assessment Proceedings, Assessing Officer (‘AO’) disallowed the claim of the Assessee company for setting off of unabsoarbed depreciation against the long term capital gains. According to the AO, these gains were in the nature of short-term capital gains (“STCG”), considering that the Subsidiary got freehold rights of the said land only in 2010, after paying the required conversion charges. Prior to this, the Subsidiary only held leasehold rights in the land. Therefore, in his view, the period of holding had to be considered from the date of acquiring freehold rights, which was less than 36 months. Accordingly, the AO treated the gains as STCG and re-computed the tax payable by the Assessee.

- The CIT(A) upheld the order of AO and was of the view that the entire amalgamation was a colourable device to avoid payment of tax. CIT (A) was of the opinion that the entire transaction should be looked through, solely on the substance, rather than the form through lifting of piercing the corporate veil. CIT(A), while acknowledging the fact that GAAR provisions were not yet applicable, it was held that the merger was done to avoid capital gains tax on sale of land by setting off the gains with brought forward losses of the assessee.

- Aggrieved by the order of CIT(A), Assessee company preferred an appeal to Income Tax Appellate Tribunal, Kolkata bench (‘Kolkata ITAT’).

Issue under consideration:

Whether the gains arising on the sale of land in question would be LTCG or STCG under the provisions of the ITA?

Whether set off of unabsorbed depreciation can be allowed against long term capital gains in such an arrangement, by applying provisions of GAAR retrospectively?

Order of Kolkata ITAT:

With respect to determination of period of holding of the land, the Kolkata ITAT held that the Subsidiary had leasehold right on the land from the financial year (“FY”) 1996-97 and received freehold rights with effect from November 26, 2010, upon paying the requisite conversion charges. As these charges were not included while computing the cost of acquisition for the purposes of capital gains, the Kolkata ITAT allowed the gains to be treated as long terms capital gains.

Further, the Kolkata ITAT directed the AO to grant benefit of set off of unabsorbed depreciation in respect of the said long term capital gains. Observations made by Kolkata ITAT are as under:

- The Tribunal held that the income of the amalgamating company would be transferred to the amalgamated company pursuant to the Court approval of the scheme and therefore, by virtue of section 72 and section 74 of the ITA, the loss of the amalgamated company should be eligible for set off of against the income of the amalgamating company.

- The Kolkata ITAT relied on co-ordinate bench’s decision in the case of Electrocast Sales[2] in support of the view that once the scheme of amalgamation was approved by the Hon’ble High Court, it was fair to assume that the High Court had given its approval after conducting its due diligence. The revenue authorities were given an opportunity to oppose the scheme on the ground of lack of any commercial substance to it or any other reason. The Kolkata ITAT held that, after all the opportunities were given to the tax department and the HC had approved the scheme, questioning the same on the ground that it is a colorable device, is illegal and devoid of any factual or legal base.

- The Tribunal also held that the conclusion of the CIT(A) that the merger in question, approved by the High Court is a mere sham without any factual or legal base.

- Further, the Tribunal opined that invoking GAAR provisions, when they were not applicable, was bad in law. Thus, the Tribunal directed the AO to grant benefit of set off of unabsorbed depreciation in respect of the said long term capital gains.

For detailed discussion on the above case study, please feel free to connect at Contact@devadhaantu.in

_________________________________________________________________________

[1] JCT Limited [TS-323-ITAT-2020(Kol)]

[2] Electrocast Sales India Ltd. v. DCIT, ITA No. 2145/ Kol/ 2014, Kolkata ITAT