In case of a merger, when a company gets merged into another company, the shareholders of the Transferor Company gets shares in the Transferee Company as a consideration issued in respect of such merger. So typically, in the books of shareholder, investment in the Transferor Company gets replaced by investment in the Transferee Company. Under Section 47(vii) of the Income Tax Act, 1961 (‘the ITA’), there is no adverse impact upon receipt of share in the Transferee Company in lieu of shares held in the Transferor Company in the scheme of merger.

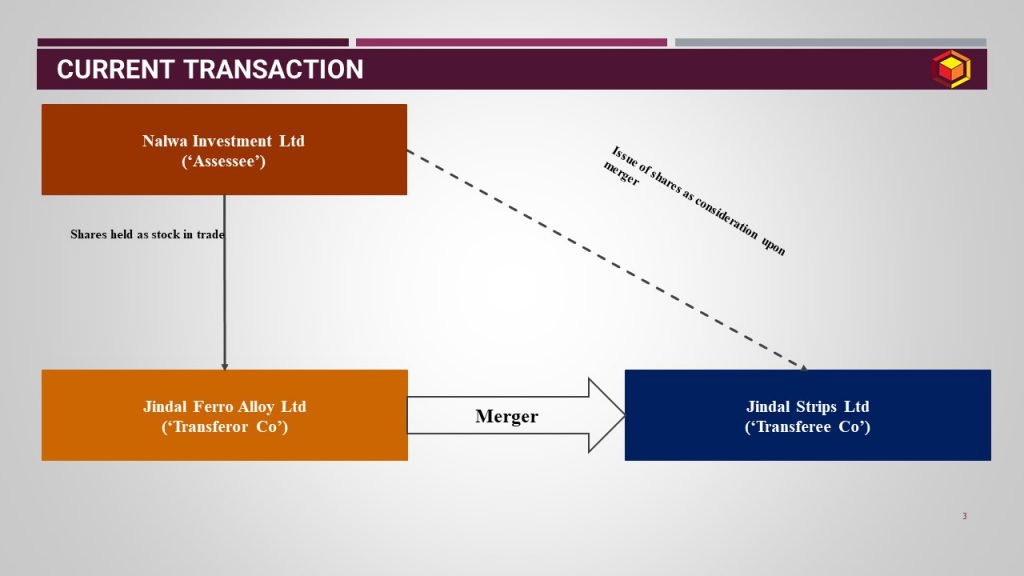

However, what if the original holding in the Transferor Company is held in the form of stock-in-trade ? Lets understand Delhi High Court’s decision in the case of Nalwa Investment Ltd (‘the Assessee’)[1].

Facts of the case:

- Assessee held shares in the Transferor Company as stock in trade

- Upon merger of the Transferor Company into the Transferee Company, assessee was allotted shares in the Transferee Company

- Upon such exchange of shares in the scheme of Merger, assessee claimed tax exemption u/s 47(vii) of the Income Tax Act, 1961.

Assessment Proceedings:

- During the assessment proceedings, Assessing Officer (‘AO’) noticed that shares of the Transferor Company were held as Stock-in Trade and not as Capital assets and hence, disallowed the claim of assessee u/s 47(vii) of the ITA;

- Basis above, AO brought the difference between market value of the shares of Transferee Company and book value of shares of the Transferor Company as Business Income;

- Upon appeal made to first appellate authority (‘CIT(A)’), order of AO was upheld;

- Upon further appeal to Income Tax Appellate Tribunal, Delhi Bench (‘Delhi ITAT’), it was held that no profit accrues when shares of the Transferee Company are received in lieu of shares of the Transferor Company, irrespective of the nature of holding. Accordingly, addition made by AO and CIT(A) were deleted by Delhi ITAT.

- Aggrieved by the order of Delhi ITAT, revenue preferred an appeal to High Court of Delhi (‘Delhi HC’).

Issue under consideration for Delhi High Court:

In the instant case, Revenue is in appeal against order of Delhi ITAT and question under consideration is as under:

Whether receipt of shares in the Transferee Co in lieu of shares in the Transferor Co constitutes a ‘transfer’, if originally, such shares were held as ‘Stock-in-trade’ in the Transferor Co.?

Decision of Delhi High Court:

Delhi HC passed decision in favour of Revenue and held that Market value of shares in the Transferee Company in excess of book value of shares in the Transferor Company would be liable to tax as ‘Business Income’.

Observations made by Delhi HC are as under:

- Transfers exempt from tax under section 47 of the ITA, nevertheless are a ‘transfer’ to begin with. Thus, if the assessee were to contend that the shares in question were held as ‘capital assets’ in order to take benefit of the exemption, the receipt of shares in the Transferee Company would have to be regarded as a transfer.

- Delhi HC placed reliance in the case of Grace Collis[2] wherein SC held that even when exchange is happening by operation of law – it should constitute transfer on the basis that such exchange results in ‘extinguishment of shares’ which forms a part of the definition of ‘transfer’ under section 2(47) of the ITA. Accordingly, the receipt of shares in the Transferee Company in exchange for shares of the Transferor Company constituted a ‘transfer’.

- Further, placing reliance in case of Orient Trading Co. Ltd.[3], wherein the shares held as stock-in-trade were transferred in lieu of shares in the Transferee Company. The apex court held that surrendering of shares in the first company in lieu of shares in the Transferee Company constituted ‘transfer’ and the profits realized so were to be taxed as business income.

- Accordingly, Delhi HC held that in case a ‘transfer’ is not taxable by virtue of section 47(vii), its taxability would be governed by section 28 of the ITA. Accordingly, income arising out of ‘transfer’ of stock-in-trade should be chargeable to tax under the head ‘profits and gains from business and profession’.

- Disregarding the assessee’s argument that only real income should be brought to tax and not a hypothetical income, Delhi HC stated that while appreciation in value of shares while remaining in the hands of the same person should not constitute real income, receipt of shares of a higher value in exchange for shares of a lower value should constitute real income. In the present case, it was the latter and hence, the ‘exchange’ resulted in actual profits accruing to the assessee.

For the detailed discussion on the above case law, please do not hesitate to connect at contact@devadhaantu.in

__________________________________________________________________________

[1] CIT v. Nalwa Investment Ltd., ITA 822, 853, 935, and 961 of 2005

[2] CIT vs Grace Collis [2001] 248 ITR 323 (SC)

[3] Orient Trading Co. Ltd. v. CIT [1997] 224 ITR 371 (SC)