Tea Time Limited (‘Tea Time’ or ‘the Transferor Company 1’), is a public company incorporated under the Companies Act, 1956, having its registered office at Trinity Plaza, 3rd Floor, Topsia Road (South), Kolkata – 700046. The Corporate Identification Number of the Transferor Company 1 is L01132WB1979PL032246 and is inter-alia engaged in the following businesses:

- Business of dealing in varieties of tea including leaf tea, dust tea, instant tea, tea bags in India or elsewhere individually or in collaboration with others.

- Business of owning and maintaining tea gardens and tea plantations and also to produce and distribute all kinds of products and generally to deal in all kinds of plantation products such as rubber, shellac, timber, coffee, cocoa and cinchona among others in India or elsewhere.

- Business of warehousing, transporting, storing tea and other commodities and also to act as a commission agents, auctioneers, distributors, and recognized export house.

The Equity Shares of the Transferor Company 1 are listed on BSE Limited and Calcutta Stock Exchange.

Orient International Limited (‘Orient’ or ‘the Transferor Company 2’), is a public company incorporated under the Companies Act, 1956, having its registered office at Trinity Plaza, 3rd Floor, 84/1 A, Topsia Road (South), Kolkata – 700046 vide Corporate Identification Number, L27310WB1981PLC034139. It is engaged in the following businesses:

- Business of molding and dealing in Iron & Steel all forms, shapes and sizes and alloys thereof and of owning, operating and managing mini-steel plants.

- Business of molding and dealing in aluminum. copper, zinc and other metals and alloys.

- Business of manufacturing and dealing in material handling equipments, coal mining equipments and other engineering goods and to act boiler makers, mill, wrights, smiths metallurgists and mechanical engineers.

The Equity Shares of the Transferor Company 2 are listed on Calcutta Stock Exchange and Delhi Stock Exchange.

Neptune Exports Limited (‘Neptune’ or ‘the Transferor Company 3’), is a public company incorporated under the Companies Aet, 1956, having its registered office at Trinity Plaza, 3rd Floor, 34/1A, Topsia Road (South), Kolkata 700046. The Corporate Identification Number of the Transferor Company 3 is L51909WB1982PLC034494 and is inter-alia engaged in following businesses:

- Business of importers, exporters, recognised export house, indenting agents and commission agents in connection with export – import business of various goods and articles and to carry on the above activity in India or elsewhere either individually or collaboration with others.

- Carrying on the business of packaging, purchasing, selling and generally dealing in all kinds of goods and articles in connection with export import business and to act as retailers, wholesalers, godown keepers, stockists, aratdars or agents in connection with the above trade.

- Carrying on the business of buying, selling, importing exporting and otherwise, dealing in silk and silk products of every description, leather and leather goods of every kind ordinary tea, dust tea, packaged tea, tea bags and other kinds of tea India or elsewhere either individually or in collaboration others.

The Equity Shares of the Transferor Company 3 are listed on BSE Limited and Calcutta Stock Exchange.

Northern Projects Limited (‘Northern Projects’ or ‘the Transferor Company 4’), is a public company incorporated under the Companies Act, 1956, having its registered office at Trinity Plaza, 3rd Floor, 84/1A, Topsia, Road (South), Kolkata – 700046. The Corporate Identification Number of the Transferor Company 4 is LA5400WB1983PLC035987 and is inter-alia engaged in following businesses:

- Carrying on the business of manufacturers, importers, exporters and founders of ferrous and non-ferrous metals, sheet metal workers, mechanical, structural, electrical and metallurgical engineers, to carry on the work of cast Iron foundry for the manufacture of all types of constructions in relation to same.

- Carrying on the work of mechanical and electrical engineers and to run a workshop to undertake and execute all types of mechanical and structural jobs of manufacturing, fabrication and erection of buildings and articles.

- Carrying on the business of financing Industrial Enterprises whether by way of making loans or advances to or subscribing to the capital of Private Industrial Enterprises in

- Investing, buying, selling, transferring, hypothecation and disposing of any shares, stocks, securities, properties, bonds or any Government/Local Authority bonds & certificates, debentures whether perpetual or redeemable and debenture-stocks.

The Transferor Company 4 is a Non-Banking Financial Institution, registered with the Reserve Bank of India vide Certificate of Registration dated May 16th, 1938. The Equity Shares of the Transferor Company 4 are listed on BSE Limited and Calcutta Stock Exchange.

Hindusthan Udyog Limited (‘Hindusthan Udyog’ or ‘the Transferee Company’), is a public company incorporated under the Companies Act, 1956, having its registered office at Trinity Plaza, 3rd Floor, 84/1A, Topsia Road (South), Kolkata – 700046. The Corporate Identification of the Transferee Company is L27120WB1947PLC015767 and is inter-alia engaged in following businesses:

- Carrying on the business of steel fabrication, iron founders, cast iron castings, die & pressure die castings, to run, operate, steel foundries, mini steel plant and to manufacture and deal in artciles made out of such metals

- Carrying on the business of agricultural implements and related tools made out of above-mentioned metals.

- Carrying on business of manufacturing and dealing in kitchen appliances made out of above-mentioned metals

- Carrying on business of cultivating and distribution of varieties of tea;

- Carrying on business of manufacturing and dealing in construction related appliances and tools attached to buildings.

The Equity Shares of the Transferee Company are listed on BSE Limited and Calcutta Stock Exchange.

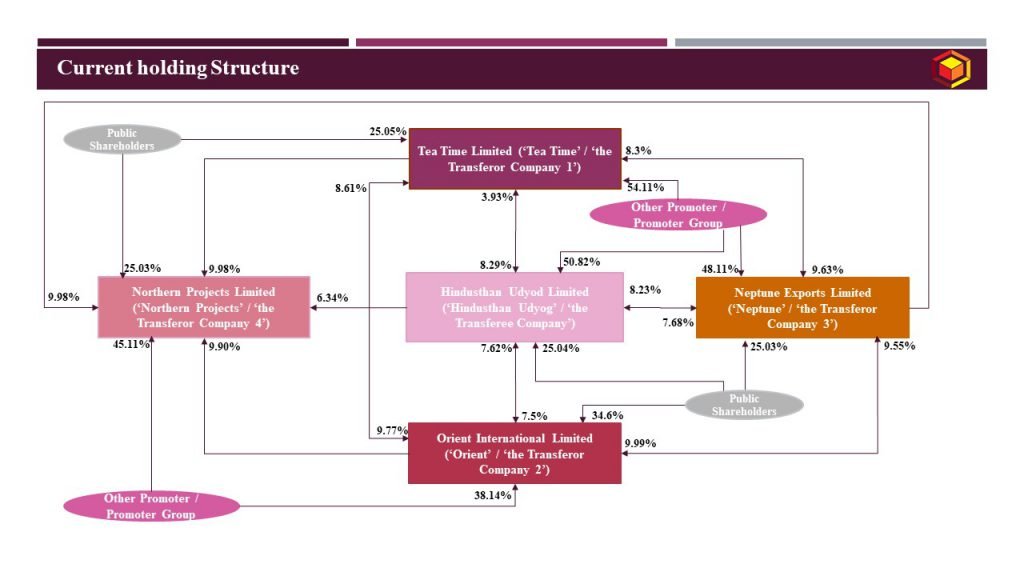

Current structure of the group is as under:

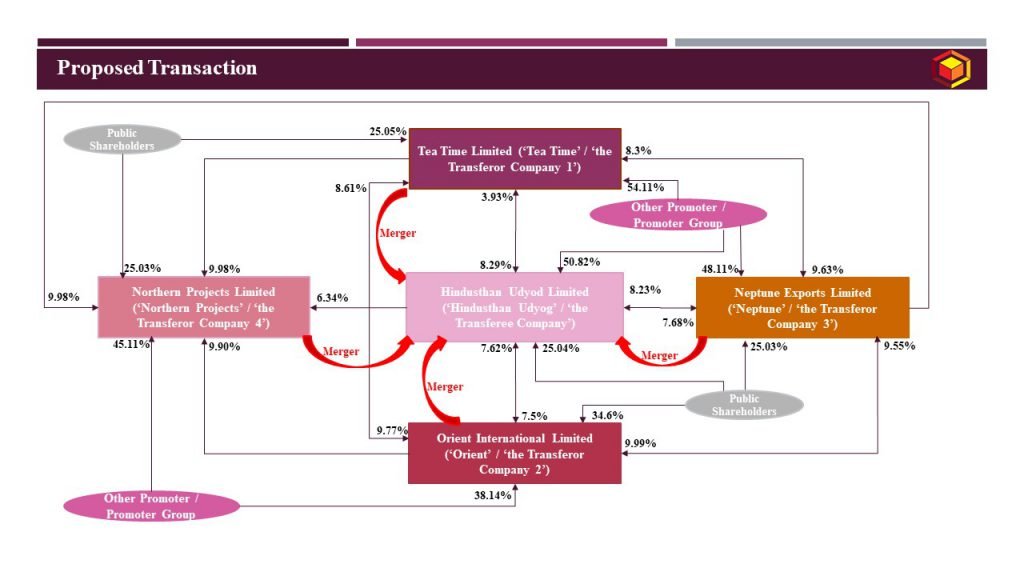

Management of the Company along with its group Companies has proposed to restructure business and shareholding of the group by way of Amalgamation of Transferor Company 1, Transferor Company 2, Transferor Company 3 and Transferor Company 4 with and into Transferee Company.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Amalgamation |

Appointed Date | April 1, 2019 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | BSE Limited; The Calcutta Stock Exchange Limited; Delhi Stock Exchange Association Ltd. Securities and Exchange Board of India Limited; Reserve Bank of India; National Company Law Tribunal (‘NCLT’), Kolkata Bench Registrar of Companies (‘ROC’), West Bengal Regional Director, West Bengal Official Liquidator as appointed by NCLT |

Other Approvals | Approval from Board of Directors and Audit Committee has been obtained; Approval from shareholders and majority of public shareholders to be obtained |

Consideration | Consideration for issuance of shares to the shareholders of the Transferor Companies is determined based on fair market value of assets of each of the Transferor Companies |

Accounting Treatment | In the books of Transferee Company – Pooling of interest method; In the books of Transferor Companies – NA |

Taxation | Tax neutral transaction |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Tea Time Limited | 74.95% | 25.05% | NA, since merged | NA, since merged |

Orient International Limited | 65.40% | 34.60% | NA, since merged | NA, since merged |

Neptune Exports Limited | 74.97% | 25.03% | NA, since merged | NA, since merged |

Northern Projects Limited | 74.97% | 25.03% | NA, since merged | NA, since merged |

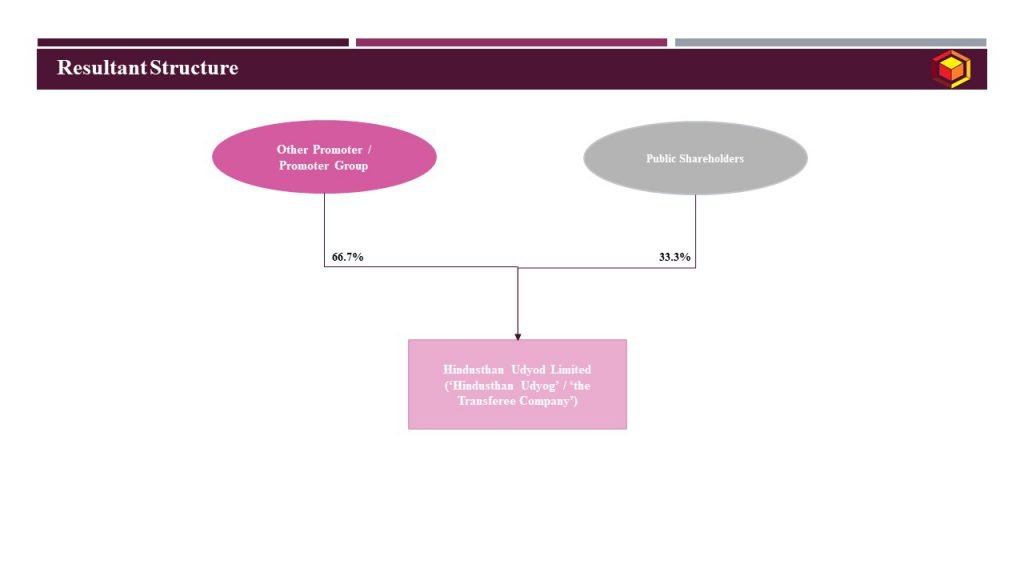

Hindusthan Udyog Limited | 74.96% | 25.04% | 66.70% | 33.30% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

The proposed amalgamation benefits the group in the following manner:

- Enabling pooling of resources of the companies involved in the amalgamation to their common advantage, resulting in more productive utilization of such resources, cost and operational efficiencies which would be beneficial for all stakeholders.

- Creation of a Transferee Company with larger asset base and net worth with strong financials enabling further growth and development of the Transferee Company and enable it to with the growing competition in the market scenario.

- Reduction in overhead and other expenses, reduction in administrative and procedural work and elimination of duplicating of work and will enable the companies concerned to effect internal economies and optimize productivity.

- Strengthening the credibility of the Transferee Company with the financial institutions, banker and general public and which would eventually benefit the shareholders of the Transferee Company and the Transferor Companies.

Commercial considerations:

- As observed above, the pattern of inter-company holding demonstrates diamond structure. With the scheme coming into effect, the complex inter-company holdings of all the 5 entities in the groups gets eliminated. However, it is pertinent to note that all the 5 companies involved in the scheme are into different business segment. The Transferee Company would need to amend its object clause in the memorandum of association in order to continue all the businesses of the Transferee Companies.

- As observed above, the Transferor Company 4 is a Non-Banking Financial Institution, registered with the Reserve Bank of India. As a regulatory requirement, for the merger of the Transferor Company 4 into the Transferee Company would require prior approval from Reserve Bank of India.

- All the Transferor Companies involved in the Scheme are listed on the recognized stock exchange. Under SEBI regulation, approval of majority of public shareholders is required to be obtained when listed company is involved in the Scheme.

- As it can be observed in the pre-and post-scheme shareholding pattern, shareholding % of public shareholders increases by 8.26% in absolute terms. Parallelly, shareholding % of promoters decreases by 8.25% in absolute terms. However, effectively, shareholding % of promoters increases by 15.88% considering that inter-company holding amongst all these Companies involved in the Scheme gets nullified upon this Scheme coming into effect.

For detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in