Reliance Industries Limited (‘Reliance Industries’) is a company incorporated under the Companies Act, 1956 having its registered office at 3rd Floor, Maker Chamber IV, 222, Nariman Point, Mumbai- 400 021. Reliance Industries is one of India’s largest private sector industrial company in terms of turnover, total assets, net worth and net profit and is a Fortune 500 company. Reliance Industries ranks amongst the world’s top 10 producers for almost all its products and its activities span across hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, retail and digital services. The equity shares of Reliance Industries are listed on the Stock Exchanges. The global depository receipts (‘GDRs’) of the Reliance Industries are listed on Luxembourg Stock Exchange and are traded on the International Order Book (London Stock Exchange) and amongst qualified institutional investors on the over-the-counter market in the United States of America. The International Bonds / Debt instruments issued in international markets of Reliance Industries are listed on Stock Exchanges and its bonds are listed on Singapore Stock Exchange, Taipei Exchange and Luxembourg Stock Exchange.

Reliance Energy Generation and Distribution Limited (‘Reliance Energy’) is a company incorporated under the Companies Act, 1956 having its registered office at 4th Floor, Court House, Lokmanya Tilak Marg, Dhobi Talao, Mumbai 400 002. Reliance Energy is engaged in the business of wholesale trading of goods and investments in shares and securities. The shares of Reliance Energy are wholly owned by Reliance Industries. Certain debt securities (i.e. notes) issued by Reliance Energy and guaranteed by Reliance Industries are listed on the Singapore Stock Exchange.

Reliance Holding USA, Inc. (‘Reliance USA’) is a corporation incorporated in the State of Delaware, United States of America pursuant to and in accordance with the General Corporation Law of the State of Delaware (as amended from time to time), having its principal office at 2000, West Sam Houston Park Way S., Suite 700, Houston, TX 77042 in the United States of America. Reliance USA is primarily engaged in the business of exploration and production of oil and gas from minerals properties, commercialisation of gasoline and blended gasoline products and investment in bio fuel and technologies related businesses through its investments. Reliance USA also has investments in other businesses, including domain names and biotechnology. The shares of Reliance USA are wholly owned by Reliance Energy.

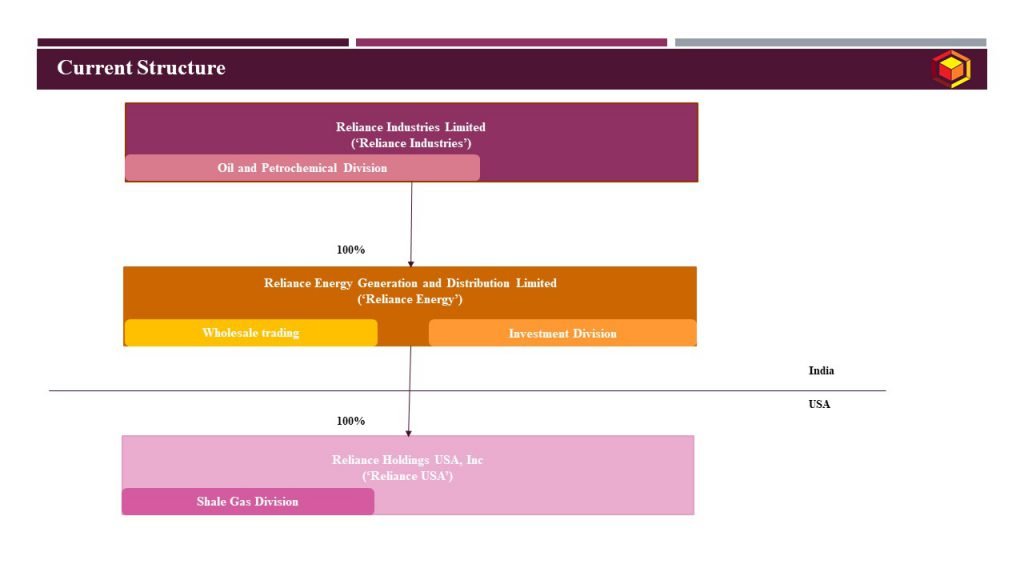

Current structure of the group is as under:

Management of the Company along with its group Companies has proposed to restructure business and shareholding of the group as under:

Transaction 1: Amalgamation of Reliance USA into Reliance Energy;

Transaction 2: Amalgamation of Reliance Energy into Reliance Industries.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction 1: Merger 1 | Transaction 2: Merger 2 |

Appointed Date | March 1, 2020 | March 1, 2020 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC | Date of filling of certified copy of approving authority being NCLT with ROC, immediately after effectiveness of Transaction 1 |

Jurisdictional Authority(ies) | Reliance Energy: National Company Law Tribunal (‘NCLT’), Mumbai Bench Registrar of Companies (‘ROC’) – Mumbai Regional Director (‘RD’), Mumbai Reliance USA: Government of jurisdiction in the State of Delaware, United States of America | Reliance Industries: Bombay Stock Exchange Limited; Securities and Exchange Board of India NCLT, Mumbai Bench ROC, Mumbai RD, Mumbai Reliance Energy: NCLT, Mumbai Bench ROC, Mumbai RD, Mumbai Official Liquidator as appointed by NCLT, Mumbai |

Consideration | No consideration as entire share-capital of Reliance USA is held by Reliance Energy | No consideration as entire share-capital of Reliance Energy is held by Reliance Industries |

Accounting Treatment | In the books of Reliance Energy – Pooling of interest method; In the books of Reliance USA – NA | In the books of Reliance Industries- Pooling of interest method; In the books of Reliance Energy – NA |

Taxation | Tax neutral transaction | Tax neutral transaction |

The Scheme is filled under section 230 to 232 read with section 234 of the Companies Act, 2013. Section 234 of the Companies Act 2013 provides for regulatory provisions in relation to merger of a Company incorporated outside India with an Indian incorporated Company. In the instant case, Reliance USA, which is incorporated in USA is merging with Reliance Energy. (‘Inbound Merger’) As per section 234 of the Companies Act, 2013, prior approval of Reserve Bank of India is required to be obtained for an Inbound Merger. However, as per Notification No. FEMA.389/2018-RB dated March 20, 2018, any transaction involving Inbound Merger, which are regulatory compliant shall be deemed to have prior approval of the Reserve Bank of India (‘RBI’). Accordingly, in the instant case, no prior approval of RBI is required to be obtained.

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Reliance Industries | 50.58% | 49.42% | 50.58% | 49.42% |

Reliance Energy | 100% | – | NA, since merged | NA, since merged |

Reliance USA | 100% | – | NA, since merged | NA, since merged |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

Reliance USA and Reliance Energy are indirect/ direct wholly owned subsidiaries of Reliance Industries and hold investments in the shale gas assets in the United States of America. Through the Scheme, Management of Reliance Group are desirous to consolidate and transfer the investments of both the Transferor Companies in shale gas assets into Reliance Industries.

Proposed amalgamation provides,

- integration of reserves, resources and exploration and production business of Reliance USA and Reliance Energy;

- potential opportunity to take advantage of the expected upturn of commodity cycle;

- a strong financial structure to all stakeholders including the creditors and lenders of Reliance USA and Reliance Energy as stake holders, become stake holders of Reliance Industries, which is a stronger entity;

- simplification to the corporate structure and to optimize capital structure and costs;

- ease of managing obligations of Reliance USA and Reliance Energy, in the hands of Reliance Industries; and

- reduction in the multiplicity of legal and regulatory compliances, administrative and record keeping by Reliance Industries, thus resulting in reduction of overheads.

For detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in