In India, joint family concept has been prevalent and so the concept of succession. For the succession, one of the mode of transfer of assets in the family and in the businesses is through private family trusts. In one such instance[1], transfer of shares held in a company which are transferred to private family trusts is under question for the tax purposes. Details which are as under:

Facts of the case:

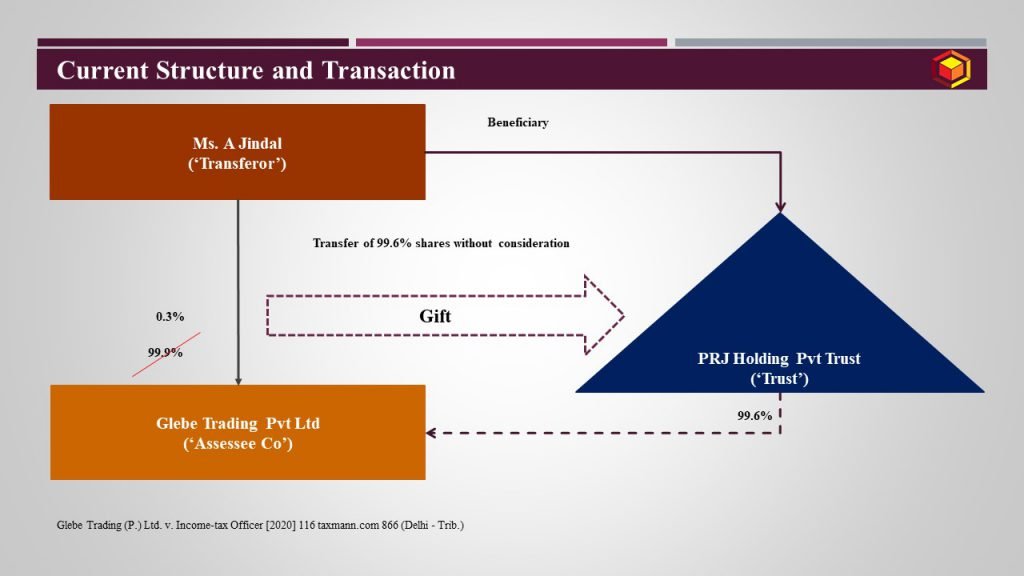

- Ms. A Jindal (‘the Transferor’) held 99.9% shares in Glebe Trading Private Limited (‘the Assessee Company’);

- Transferor is also a beneficiary in PRJ Holding Private Trust (‘the Trust’);

- Transferor transferred 99.6% investment held in the Assessee Company to the Trust without any consideration.

- The transfer was made under a Memorandum of Understanding for re-alignement of shares held by family members which included Transferor as a Family Member.

Current Structure and transaction is depicted as under:

Assessment Proceedings:

- During the assessment proceedings , the Assessing Officer (‘AO’) noticed such transaction and made addition in the hands of Transferor u/s 2(24)(iv) of the Income Tax Act, 1961 by stating that gifting of shares into Trust is benefit received by Assessee Company;

- No addition was made in the hands of Assessee Company, as AO considered such transfer as void and sham transaction;

- CIT(A) upheld the order of AO;

- Aggrieved by the order of the CIT(A), the Assessee Company preferred an appeal to Income Tax Appellate Tribunal, Delhi Bench (‘Delhi ITAT’)

Issue under consideration for Delhi ITAT:

Whether transfer of shares without consideration under family arrangement amounts to benefit or perquisite?

Order of Delhi ITAT:

The Delhi ITAT passed order in favour of Assessee Company and basis, MOU submitted by Assessee Company, concluded that family arrangement / internal shares realignment can not be regarded as Gift / benefit / perquisite. Observations made by Delhi ITAT are as under:

- The words benefit and perquisite are used in this clause of sub-section (24) to Section 2 of the Income Tax Act, 1961 (‘the Act’). Accordingly, whether gifting shares amounts any benefit or perquisite has to be looked into.

- In the present case at one point the AO has stated that there is benefit to the Assessee Company but at the same time states that the transaction of gift of shares held by Transferor in the Assessee Company to Trust was not valid and was a sham and void transaction which was undertaken to avoid tax.

- Delhi ITAT examined the MOU submitted by the Assessee Company, and stated that it can be clearly seen that it is a family arrangement and internal family realignment amongst the members of the family of Late Shri O.P. Jindal and cannot be taken as gift. The chart reproduced from the Assessment Order clearly shows that it is not a gift but a family arrangement and these kind of family arrangement cannot be termed as gift/benefit or perquisite. The Assessing Officer by lifting the corporate veil, without providing any cogent reasons, and without appreciating that the beneficiary never obtained any benefit from this transaction at any time cannot comment on the said transaction as sham and bogus.

- Delhi ITAT concluded that the observations made by the Assessing Officer in the present assessment order are without any jurisdiction. In fact, the Assessing Officer overstepped the provisions of the Act wherein the Assessment is nil in the case of present Assessee Company and commented on the third party assessee i.e. Transferor, which is not permissible under the Act.

For detailed discussion on the above case study, please feel free to connect at Contact@devadhaantu.in

________________________________________________________________________

[1] Yashovardhan Birla v. DCIT of Wealth Tax, W.T.A. No. 02 to 08/Mum/2020