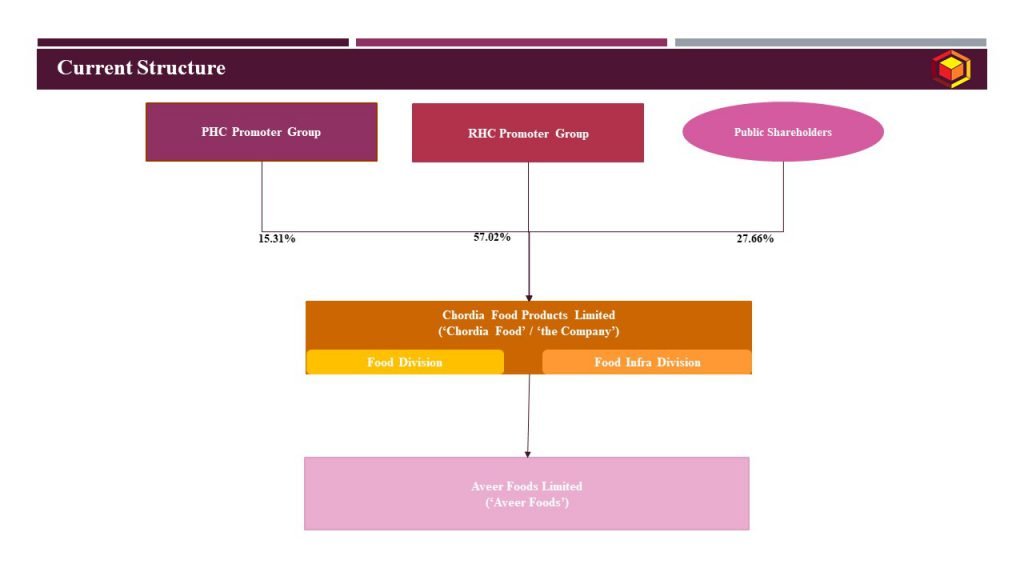

Chordia Food Products Limited (‘Chordia Food’ or ‘the Company’) was incorporated on 20th January 1982 under the Companies Act, 1956, in the State of Maharashtra. The Corporate Identity Number (CIN) of Chordia Food Products Limited is L15995PN1982PLC026173. The registered office of Chordia Food Products Limited is situated at Plot No 399/400 S. No. 398 Tal. Shirwal, Village Sangvi, Satara, Maharashtra 412801. The Company is a manufacturer of processed fruits and vegetables in Western India for more than three decades and has been successfully selling its products under the brand name of Pravin, Navin, Toofan and Suhana-Pravin. Currently, the company is having two business divisions;

- Food Division, which interalia includes the business of manufacturing of food products including manufacturing facilities, processes, recipes, technical know-how, for manufacturing of pickles, ketchups, papads and other food products manufactured & marketed by the Company under brand name ‘Pravin’,’Navin’, ‘Toofan’, ‘Suhana-Pravin’ (excluding the immovable property used therefor) including all current customers, data for all softwares; and

- Food Infra Division, which refers to immovable properties including wind mill and the land pertaining to it, all land and building and other immovable properties owned by the Company in the State of Maharashtra and Andhra Pradesh pertaining to the factories, offices, cold storages, warehouses, tiny units, agri-tech center, and the Infra business run thereon and all other businesses including contract manufacturing but other than business, assets and liabilities of the Food Division business undertaking.

The Company has acquired 100% shareholding in Aveer Foods Limited (‘Aveer Foods’) on August 14, 2019. Aveer Foods is incorporated under the Companies Act, 2013 on April 11th, 2019 with Corporate Identity Number (CIN), U15549PN2019PLC183457. The registered office of Aveer Foods Limited is situated at Plot 55/A/5 6, Hadapsar Industrial Estate,l Pune 411 013. Aveer Foods is incorporated to carry out the business of manufacturing of food products and dealing in Agricultural, Horticultural and Farm produce.

Current structure of the Company is as under:

Management of the Company along with its group Companies has proposed to restructure business and shareholding of the group as under:

Transaction 1: Demerger of Food Division business undertaking of Chordia Food into Aveer Food, and listing of Aveer Food.

Transaction 2: Family Group shares realignment to result in segregation of holding of shares of Chordia Food and Aveer Food between 2 family members separately.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction 1: Demerger |

Appointed Date | April 1, 2020 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC, immediately after effectiveness of Transaction 1 |

Jurisdictional Authority(ies) | Bombay Stock Exchange Limited; The Securities and Exchange Board of India; National Company Law Tribunal, Mumbai Bench; Registrar of Companies, Mumbai; Regional Director, Mumbai |

Other Approvals | Approval from Board of Directors obtained; Approval from shareholders and majority of public shareholders to be obtained |

Consideration | The New Company to issue shares to the shareholders of the Company in the ratio of 1:1; Shares held by Chordia Food into Aveer Food to get cancelled |

Accounting Treatment | In the books of the Company and the New Company – Pooling of interest method |

Taxation | Tax neutral transaction |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Chordia Food | 72.34% | 27.66% | 72.34% | 27.66% |

Aveer Food | 100% | – | 72.34% | 27.66% |

Transaction 2: Family Group shareholding re-alignment

Pursuant to demerger, in order to facilitate family separation and with an object of achieving focused management for Chordia Foods and Aveer Foods which is an integral objective of the scheme, realignment of shareholding between RHC Promoter group & PHC Promoter group is planned to be executed. Realignment shall take place in following manner:

- Timeframe: Within 12 months of listing of Aveer Foods;

- Mechanism:

- PHC Promoter group will transfer in one or more tranches, on stock exchange or otherwise, such number of equity shares so that their total shareholding in Aveer Foods post-transfer will not exceed 5% of the total paid-up share capital of Aveer Foods post-demerger to RHC Promoter group; and

- the RHC Promoter group shall transfer in one or more tranches, on stock exchange or otherwise, all equity shares of Chordia Foods to PHC Promoter group.

Such inter-se transfer of shares as above and change in management and control of Chordia Foods and Aveer Foods is an integral part of the Scheme.

Tax and Regulatory concerns:

- Taxation: Upon transfer of shares of Chordia Foods and Aveer Foods, PHC promoter group and Aveer Promoter Group shall be chargeable to capital gains tax on the consideration over and above the proportionate value of the shares of Chordia Foods on the stock exchange as on January 31, 2018, as to be allocated between business undertaking held by Chordia Foods and Aveer Foods, respectively, post demerger. Further, based on judicial precedents, stand may be taken whereby such realignment of shares amongst the promoter group pursuant to family re-organization can be claimed to be exempt from imposition of tax.

- Stamp Duty: Stamp duty at the rate of 0.015% on the value of consideration is chargeable for transfer of shares;

- Open Offer requirement: Such transfer and change in control being exempt under Regulation 10 of the Takeover Code shall not trigger the open offer requirements in Chordia Foods and Aveer Foods under Regulation 3 or Regulation 4 of the SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 2011. For the purpose of availing exemption under Regulation 10 of the Takeover Code, the promoters of Chordia Foods shall be deemed to have been the promoters of Aveer Foods for the same duration they have been promoters of Chordia Foods and this recognition shall be available on the listing of equity shares of Aveer Foods. Accordingly, statutory exemption for the transfer of shares of the Resulting Company amongst the RHC & PHC Promoter group shall be deemed to be available to RHC & PHC Promoter group under the Takeover Code.

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

Proposed demerger facilitates

- Creation of separate, distinct and focused entity housing Food division Business undertaking and Food Infra Business undertaking leading to greater operational efficiencies for both the business undertakings;

- Independent setup of each of the business undertakings of the Company ensures required depth and focus on each of the business undertakings and adoption of strategies necessary for the growth of the respective businesses. The structure shall provide independence to the management in decisions making regarding the use of their respective cash flows for dividends, capital expenditure or other reinvestment in their respective businesses;

- Allow in creating the ability to achieve valuation based on respective risk-return profile and cash flow, attracting right investors and thus enhancing flexibility in accessing capital for both the business undertakings;

- Unlocking of value for shareholders of the Company by the transfer of the Food division business Undertaking, which would enable optimal exploitation, monetization and development of both the business undertaking by attracting focused investors having the necessary ability, experience and interests in this sector and by allowing pursuit of inorganic and organic growth opportunities in such businesses; and

- Enabling the business and activities to be pursued and carried on with greater focus and attention through two separate companies each having its own separate administrative set up and dedicated management.

Commercial considerations:

- Scheme enables back-door listing without requirement of following IPO procedures which are lengthy, time consuming and costlier.

- Additionally, demerger is tax neutral thereby eliminates any adverse tax liability in the hands of companies involved under the Scheme as well as in the hands of shareholders of the Company.

- Scheme facilitates monetization of Food division business undertaking and segregation of management for both the business undertaking, thereby providing greater flexibility to each of the business units and growth potential by attracting right talent pool and investors funding.

- Scheme also enables realignment of shareholding of the promoter’s family groups thereby gaining focused involvement of respective promoter family groups and cordial family separation without adversely affecting interest of public shareholders. As the Scheme also depends on obtaining approval, inter-alia from the majority of the public shareholders, it would be pertinent to see whether majority approval gets obtained especially from the perspective of family re-organization.

For more detailed discussion on the above case study, please do not hesitate to connect at contact@devadhaantu.in