Cerebra Integrated Technologies Limited (‘Cerebra’ or ‘the Company’) was incorporated on 31st December, 1993 in the State of Karnataka under the provisions of the Companies Act, 1956 and having its Registered Office at S5, Off 3rd Cross, Peenya Indl. Area, Peenya I Stage Bangalore 560058 vide CIN L85110KA1993PLC015091. The Company is a public limited company listed with NSE and BSE. The Company is engaged in the business of Computer components and accessories and peripherals.

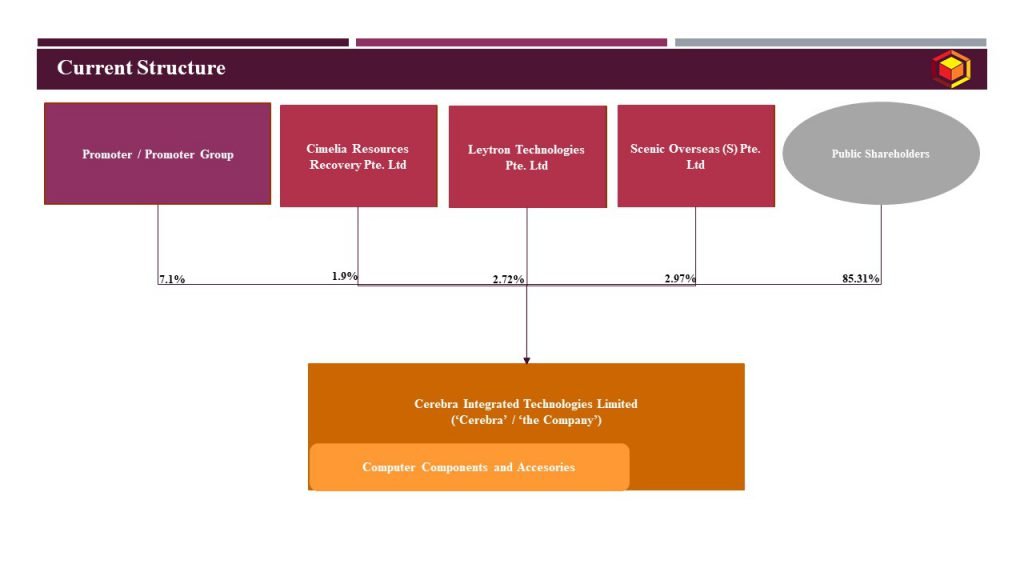

Current structure of the Company is as under:

The Company had entered into 3 Master Services Agreements with Cimelia Resource Recovery Pte Ltd, Leytron Technologies Pte Ltd and Restorer Corp Pte Ltd, all these 3 companies incorporated in Singapore. In relation to these master services agreements, it had allotted 92 lakhs Equity Shares on 24th May, 2011 for a consideration other than cash upon the receipt of FIPB approval as advances for setting up e-Waste plant in India for supply of Plant and Machinery, Implementation, installation; commissioning and proper working of plant and machineries and technical knowhow, setting up of plant & machinery, identification of suppliers etc. The above shares were allotted at a premium of INR 7.5 per share. Details of share allotment is as under:

Sr. No. | Details of Master Service Agreement | No. of Shares allotted | Credit of equity share capital | Securities Premium | Total value |

1 | Between the Company and Cimelia Resources Recovery Pte. Ltd, Singapore | 23,00,000 | 2,30,00,000 | 1,72,50,000 | 4,02,50,000 |

2 | Between the Company and Leytron Technologies Pte. Ltd, Singapore | 33,00,000 | 3,30,00,000 | 2,47,50,000 | 5,77,50,000 |

3 | Between the Company and Scenic Overseas (S) Pte. Ltd, Singapore | 36,00,000 | 3,60,00,000 | 2,70,00,000 | 6,30,00,000 |

Total | 92,00,000 | 9,20,00,000 | 6,90,00,000 | 16,10,00,000 |

Due to certain disputes arose among the above parties and the Company in respect of the performance of the Agreements and matters related thereto. Consequently, the Company initiated the proceedings against the parties claiming several reliefs before the Arbitral Tribunal under the Arbitration and Conciliation Act, 1996.

After considerable proceedings with multiple hearings, the parties decided to amicably settle their inter-se disputes and accordingly agreed for the settlement and filed the Compromise Petition under the Arbitration and Conciliation Act, 1993.

Based on the above said Petition, Awards have been passed by the Hon’ble Arbitral Tribunal in the matter of Arbitration Dispute under the Arbitration and Conciliation Act, 1996 on 22 nd March, 2019 for the Reduction of Share Capital of the Company by 92 Lakhs Equity Shares, read with the National Company Law ‘Tribunal (Procedure for Reduction of Share Capital) Rules, 2016 and subject to the approval of the Shareholders and confirmation by the Hon’ble National Company Law Tribunal, Bengaluru Bench.

The Company has already provided for the loss in the profit and loss account. The Scheme provides for setting off of accumulated debit balance in the profit and loss account against the share capital issued to Cimelia Resource Recovery Pte Ltd, Leytron Technologies Pte Ltd and Restorer Corp Pte Ltd respectively, in light of the arbitration award received by the Company.

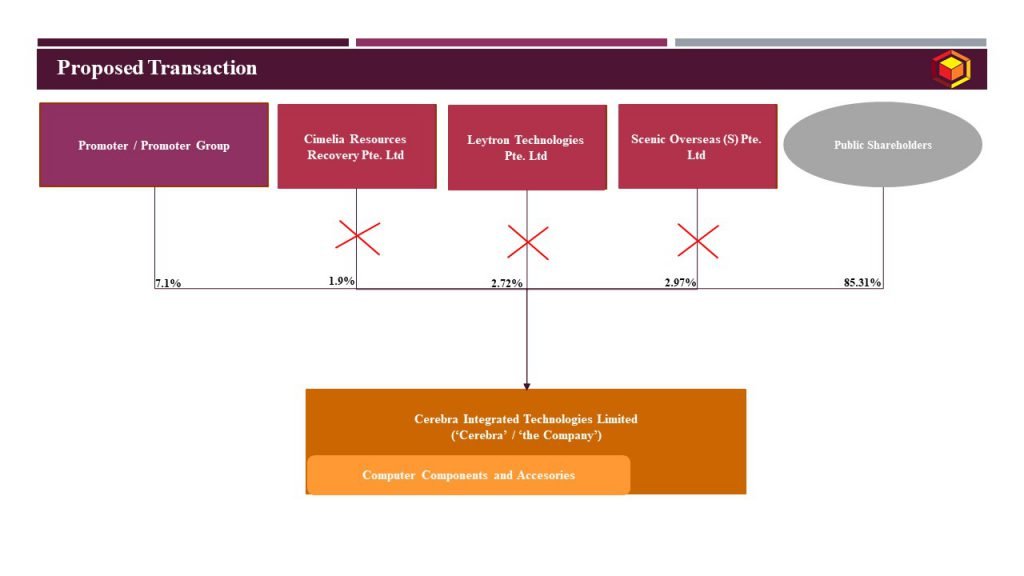

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Selective Capital Reduction |

Appointed Date | April 1, 2019 |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Jurisdictional Authority(ies) | National Company Law Tribunal, Bengaluru Bench Registrar of Companies – Bengaluru |

Consideration | No consideration shall be discharged by the Company for cancellation of share capital |

Accounting Treatment | In the books of the Company – debit share capital account against the accumulated profit and loss account |

Taxation | No adverse tax implications |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Cerebra Integrated Technologies Limited | 7.10% | 92.90% | 7.68% | 92.32% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

- Proposed capital reduction would represent true financial position which would benefit both the shareholders, promoter as well as public, as their holding will yield better results and value and also enable the Company to explore opportunities to benefit of the shareholders of the Company including in the form of dividend payment as per the applicable provisions of the Act.

- Further, the Scheme does not involve any financial outlay / outgo and therefore, would not affect the ability or liquidity of the Company to meet its obligations/ commitments in the normal course of business. Further, this Scheme would also not in any way adversely affect the ordinary operations of the Company.

- The true financial statement of the Company would ensure the Company to expand and smoothen the business activity and to attract new source of avenue and in turn enhancement of its shareholders’ value.

- The proposed reduction of the paid-up share capital of the Company does not involve any payment of the paid-up share capital to the Shareholders of the Company nor does it result in extinguishment of any liability or diminution of any liability.

- The Scheme does not envisage transfer or vesting of any of the properties and/or liabilities of the Company to any person or entity. The Scheme also does not involve any conveyance or transfer of any property of the Company.

Commercial considerations:

- Considering there is no capital outflow for settlement of the capital reduction arrangement, and also there are no accumulated reserves in the books of the Company, there is no adverse tax liability on the Company and no further compliance in relation to same.

- Further, the Scheme has been filed in accordance with the order of the Arbitration Court thereby eliminating legal dispute and reducing any controversy at management level. Management of the Company can focus on the business of the Company and thus, ensure sound future for the growth of the Company.

For more detailed discussion on the above case study, do not hesitate to connect at contact@devadhaantu.in