Asian Hotels (East) Limited (‘Asian Hotels’ or ‘the Company’) was incorporated on January 8, 2007 under the provisions of the Companies Act, 1956. The Corporate Identification Number of the Company is L15122WB2007PLC162762 and its registered office is situated at Hyatt Regency, JA-I, Sector – 3, Salt Lake City, Kolkata, West Bengal 700098. The Company is a listed company and its securities are listed on the Indian Stock Exchanges.

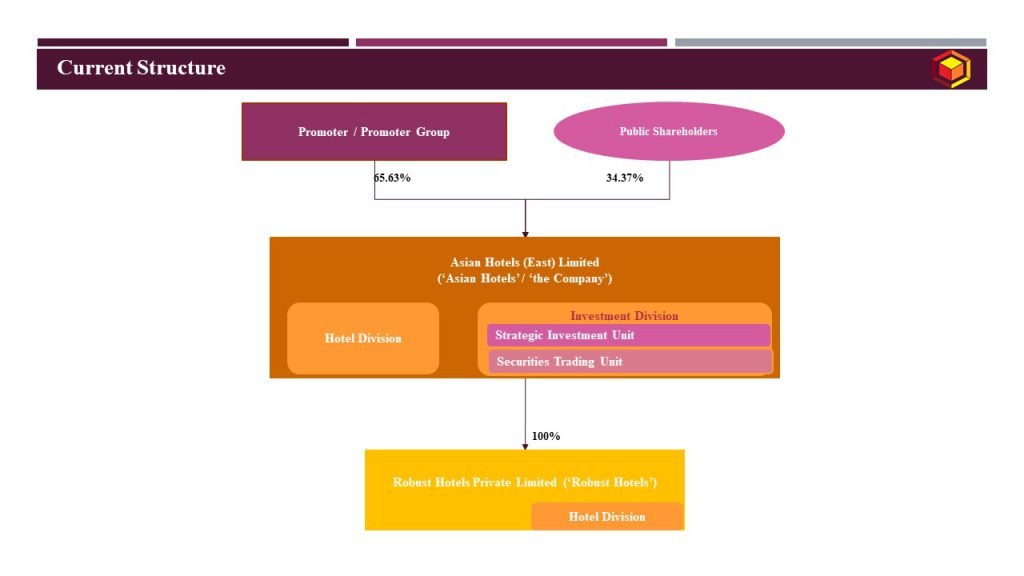

Asian Hotels is primarily engaged in two lines of business through separate divisions as follows:

- Hotel Division engaged in the operation and management of Hyatt Regency, Kolkata; and

- Investment Division which in-turn consists of (a) the Strategic Investments Unit, which inter alia includes its investments in and loans given to RHPL and GJS Hotels Limited (“Strategic Investments Unit”); and (b) Securities Trading Unit, which inter alia includes its treasury/liquid investments, which are regularly traded, and bonds, mutual funds, and shares of certain companies (which already are under an agreement of sale, part performance completed) (“Securities Trading Unit”).

Current Group Structure of Asian Hotels is as under:

Management of the Company along with its group Companies has decided to restructure business of the group by way of demerger of Securities Trading Unit business undertaking of the Company into its wholly owned subsidiary, followed by listing of same.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction: Demerger |

Appointed Date | Date of filling of certified copy of approving authority being NCLT with ROC |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC, immediately after effectiveness of Transaction 1 |

Jurisdictional Authority(ies) | Asian Hotels: National Company Law Tribunal, Kolkata Bench; Registrar of Companies – West Bengal; Regional Director – West Bengal; Robust Hotels: National Company Law Tribunal, Chennai Bench; Registrar of Companies – Chennai; Regional Director, Chennai Official Liquidator, Chennai |

Consideration | The New Company to issue shares to the shareholders of the Company in the ratio of 1:1; Shares held by the Company into the Robust Hotels to get cancelled |

Accounting Treatment | In the books of the Company and Robust Hotels – Pooling of interest method |

Taxation | Tax neutral transaction |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Asian Hotels (East) Limited | 65.63% | 34.37% | 65.63% | 34.37% |

Robust Hotels Private Limited | 100% | – | 65.63% | 34.37% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

- Proposed demerger facilitates,

- Creation of separate, distinct and focused entity housing Securities Trading unit undertaking leading to greater operational efficiencies for the same;

- Unlocking the value of Securities Trading unit of Asian Hotels shares to its shareholders, which is presently getting subdued on account of subdued performance and balance sheet of Robust Hotels;

- Provide scope for attracting and accessing targeted funding and investors for each of Asian Hotels and Robust Hotels and provide better flexibility in pursuing long term growth plans and strategies for the separate companies;

- Enable the management of both the entities to evaluate the performance of its business divisions on an independent basis and keep its risks (if any) ring-fenced; and

- Enable enhanced strategic flexibility and focus of the respective managements of Asian Hotels and Robust Hotels, thereby facilitating the separate managements to efficiently exploit opportunities for each of the said businesses.

Commercial considerations:

- Scheme enables back-door listing without requirement of following IPO procedures which are lengthy, time consuming and costlier.

- Additionally, demerger is tax neutral thereby eliminates any adverse tax liability in the hands of companies involved under the Scheme as well as in the hands of shareholders of such companies.

- Scheme facilitates monetization of Securities Trading unit and segregation of management for both the business undertaking. It would be pertinent to note that Securities Trading Unit is not classified as investment undertaking as demerger of investment undertaking would tantamount to non-tax neutral demerger as it does not constitute business undertaking. However, nonetheless, the demerger provides greater flexibility to each of the business units and growth potential by attracting right talent pool and investors funding in the respective entities.

For more detailed discussions on the above subject, please feel free to connect at contact@devadhaantu.in