Prabhat Dairy Limited (‘the Company’ or ‘Prabhat Dairy’) was incorporated on November 25, 1988 under the provisions of the Companies Act, 1956. The Corporate Identification Number of the Company is L01100PN1998PLC013068 and its registered office is situated at Gat No. 122, at Ranjankhol, Post Tilaknagar, Taluka Rahata, Ahmednagar- 413720. The Company is a listed company and its securities are listed on the Indian stock exchanges viz. the National Stock Exchange of India and the Bombay Stock Exchange of India.

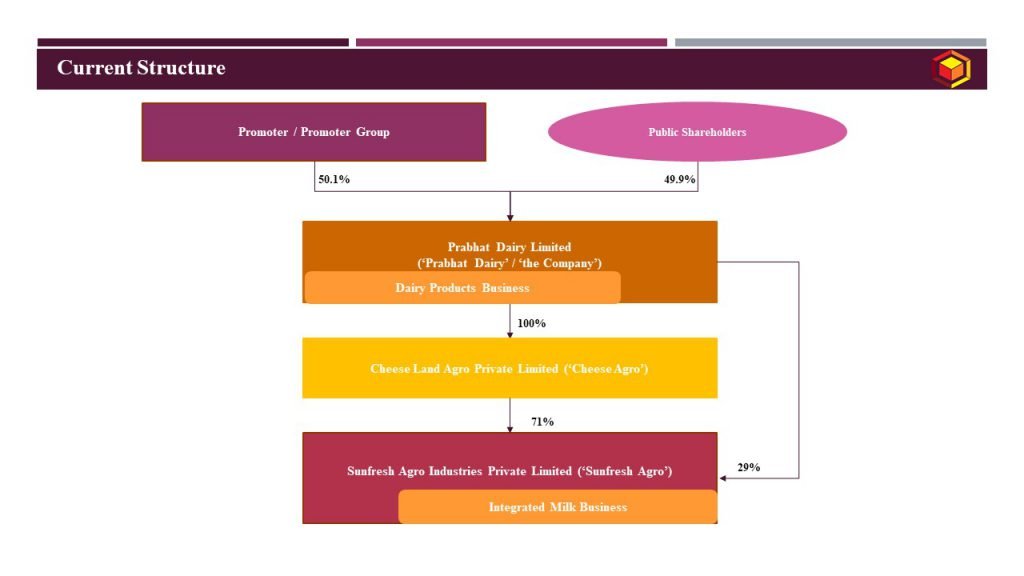

The current group structure of the Company is as under:

The Company is engaged in the dairy products business and through its step-down subsidiary, engaged in the integrated milk business. On January 9, 2019, Prabhat Dairy Limited made a media release stating to enter into Animal Nutrition business which would include cattle feed, nutrition supplements and animal genetics. The plan was to incorporate global best practices in relation to the cattle feed industry in India for its transition into an organised makeover using modern processes and sophisticated methods. Clearly opportunity was considered huge, as animal feed industry in India was anticipated to be worth USD 30 billion in 2020. The operational aspects of the animal nutrition business would be started once the project is out of pilot phase in 4-6 months.

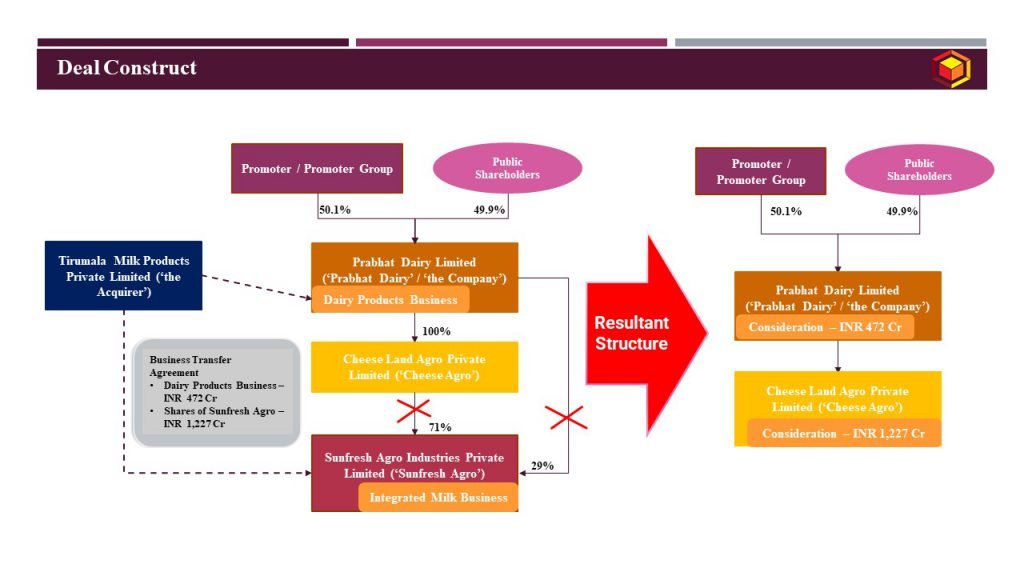

In the meanwhile, on January 21, 2019, the Company along with its wholly owned subsidiary viz., Cheese Land Agro Private Limited, entered into the Business Transfer Agreement with Tirumala Milk Products Private Limited (‘the Acquirer’) for,

- the sale of Sunfresh Agro Industries Private Limited (‘Sunfresh Agro’) to the Acquirer for a consideration of INR 1,227 Crores;

- the sale and transfer of dairy products business, together with all specified tangible and intangible assets, contracts, rights, personnel and employees, data and records, inventory and other assets, and liabilities by way of slump sale to Sunfresh Agro for a consideration of INR 472 Crores, only.

Deal construct is depicted as under:

Transaction Costs for the above transactions are as under:

Sr. no. | Type of Transaction Costs | Rate of tax |

1 | Sale of Sunfresh Agro: 1. Capital Gains Tax: Upon sale of shares of Sunfresh Agro, capital gains would be levied on the excess of consideration over cost of investment, in the hands of Prabhat Diary and Cheese Agro; 2. Slump Sale tax: Upon sale of dairy products business to Sunfresh Agro, income tax law provides for concept of slump sale whereby aggregate consideration received over and above the net-worth of the business undertaking is taxed under the head of Capital Gains | 23.30% |

2 | Stamp Duty: 1. Sale of shares: Fair market value of sale of shares is subject to stamp duty levy 2. Slump sale: Fair value of business undertaking |

0.015% 3% |

The combined sale of dairy products and integrated milk business constitutes 98.24% of the consolidated revenue of the Prabhat Dairy Group. Considering substantial portion of group’s business undertakings were getting hived off, management of Prabhat Dairy had stated that a substantial portion of the proceeds from the sale shall be shared with shareholders after meeting the customary closing adjustments, tax and transaction cost obligations. Furthermore, it was proposed that the funds received on sale will be kept in Escrow Account which operates on the decision of the ‘Transaction committee’ which is formed by the board of directors to monitor, oversee and manage the funds received on completion of the aforesaid transaction.

In order to share the sale proceeds with shareholders, Cheese Agro also needs to repatriate sale proceeds of its 71% holding into Sunfresh Agro. Such repatriation is further subject to dividend distribution tax at the effective rate of 20.56% for transaction of dividend declaration by Cheese Agro for the Financial year 2019-20. Additionally, considering after hiving off, Cheese Agro and Prabhat Dairy would be left with substantial bank balance, there is a risk of both the companies getting classified as Non-Banking Financial Companies (‘NBFC’) on the criteria of holding more than 50% of the assets and income in the financial assets and financial income respectively.

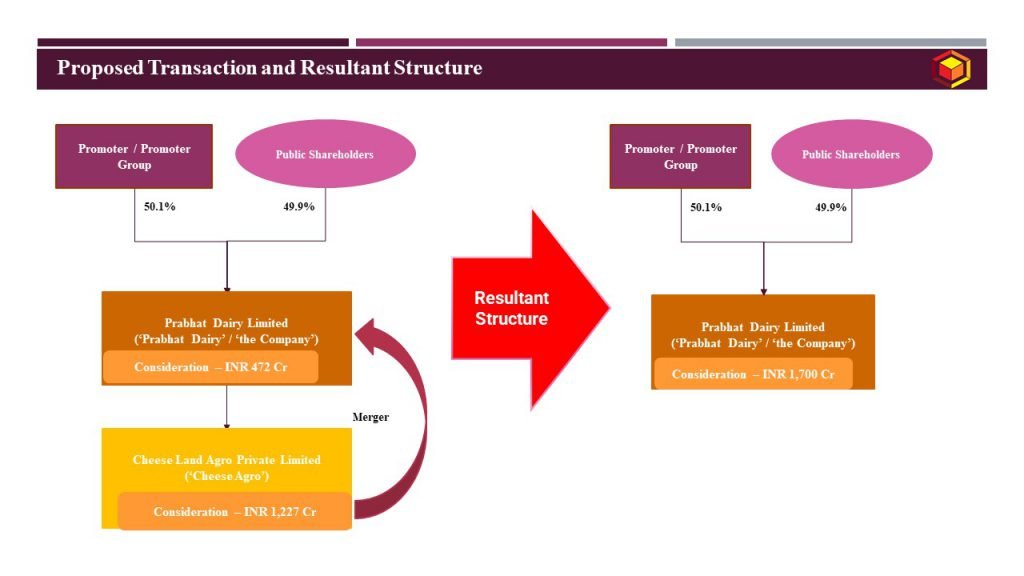

Under the restructuring arrangement, management of Prabhat Dairy, alongwith execution of BTS, has filed for amalgamation of Cheese Agro into Prabhat Dairy under Fast Track merger process under section 233 of the Companies Act, 2013 read with section 230 of the Companies Act, 2013. The scheme of amalgamation would address the dual concerns of the additional dividend distribution cost and potential NBFC classification.

Key features of the Scheme for Amalgamation are as under:

Key features | Transaction 1: Merger |

Appointed Date | October 1, 2018 |

Effective Date | Date of filling of certified copy of approving authority being Regional Director with Registrar of Companies |

Jurisdictional Authority(ies) | · Regional Director, Mumbai; · Registrar of Companies, Mumbai; · Official Liquidator for Cheese Agro as appointed by Regional Director |

Consideration | No consideration shall be discharged as Prabhat Dairy holds 100% share capital of Cheese Agro |

Accounting Treatment | In the books of Prabhat Dairy – Pooling of interest method; |

Taxation | Tax neutral transaction |

Resultant Structure after giving effect to the above transactions is as under:

The application of scheme of amalgamation has been filed under fast-track merger process which requires approval of 90% of the creditors and shareholders of the Company. As Cheese Agro being wholly owned subsidiary of Prabhat Dairy, there is no change in the shareholding of Prabhat Dairy. Further since the appointed date for scheme of amalgamation of Cheese Agro with and into Prabhat Dairy is with effect from October 1, 2018, effectiveness of the Scheme of Amalgamation would take place from the appointed date even-if approval for the Scheme of Amalgamation is obtained at a later date. This, clearly mutates the requirement of declaring dividend by Cheese Agro. It would be interesting to examine structuring option adopted by management of Prabhat Dairy for rewarding its shareholders, the entire aggregate gross sale proceeds of INR 1,700 Crores. Potential routes for rewarding public shareholders could be as under:

- Option 1: Dividend Declaration: As substantial business of the Company would be sold off, there is a question on the going concern concept of business in the entity until the time pilot project phase of animal nutrition business ends and operations starts;

- Option 2: Delisting of shares of Prabhat Dairy: under the delisting process, promoters of Prabhat Dairy would be required to acquire at least 90% of the shares of Prabhat Dairy. Additionally, Delisting process requires approval of 66% of the public shareholders and price for the delisting of shares gets determined based on reverse book building process. In the past, very few companies in India have successfully delisted their shares. Unsuccessful delisting process are often result of high premium quoted by public shareholders. Considering, if price offered by promoters in the delisting process is close to the proportionate net sale proceeds from the sale of dairy products and integrated milk business, process of delisting could be fair and successful.

- Option 3: Capital reduction of public shareholding: Selective capital reduction of public shareholding through a NCLT approved scheme of arrangement can be carried out.

All the options highlighted above are subject to detailed facts. An identification of ideal option would depend upon various tax, regulatory and commercial considerations.

For more detailed discussions, do not hesitate to connect at contact@devadhaantu.in