As we discussed in the article ‘Succession Planning in India’, it implies the act of succeeding or inheritance for when it relates to wealth of a person. In the eyes of law however, it holds a different and particular meaning. It implies the transmission or passing of rights from one to another and comes into force upon death of a person in a family, for the purposes of a readjustment of assets and liabilities created over a lifetime of a person from one generation to another.

When a person doesn’t plan his/ her succession or dies without writing a Will, such person is said to have died intestate. Many a times, death comes suddenly, and many a times death comes due to age. But due to rigidness or lack of knowledge or procrastination, a person who dies without any succession planning, leaving fate of his loved ones to the decision of law. As there are provisions in Hindu Succession Act, 1956 for protection of interest of legal heirs, succession often takes place under the garb of Hindu Succession Act, 1956, when a person dies intestate. Accordingly, property of a deceased is devolving upon the legal heirs as per the provisions of Hindu Succession Act, 1956.

Hindu Succession Act, 1956 (‘the Succession Law’):

The Succession Law provides several rules that provides for inheritance of property depending upon the class they belong to. The class here would mean classes of relatives who can inherit the property in order of their belonging in respective class.

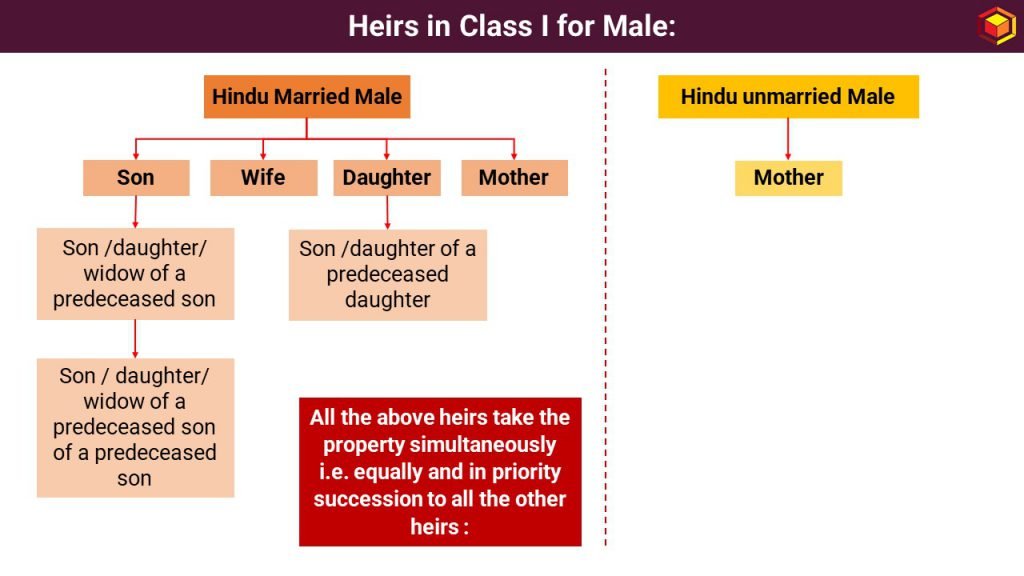

- Heirs in Class I for Hindu Male:

Heirs in Class I for Hindu Male, depends upon whether male deceased is married or unmarried. Accordingly, heirs are as under:

Heirs in Class I gets preference in terms of succession in equal manner, simultaneously. Few of the commonly asked questions in relation to succession here are as under:

- The adopted children (sons or daughters) are also to be counted as heirs;

- The children born out of void or voidable marriages are considered to be legitimate by virtue of Section 16, and hence they are entitled to succession;

- The widow is also entitled to property along with the other heirs and in case there is more than one widow, they will inherit jointly one share of the deceased’s property, which is to be divided equally among them;

- The widow is entitled to inherit from her deceased husband’s property even if she remarries after his death;

- The widow of the predeceased son will inherit with the other heirs. However, her right along with rights of the children of the predeceased son will exist to the extent of the share of the predeceased son, had he been alive. However, if she remarries before the death of the intestate, then she is not entitled to the property;

- The daughter inherits simultaneously along with the other heirs in her individual capacity. Moreover, even if she is married, she is entitled to such property;

- The mother also succeeds to her share along with other heirs by virtue of Section 14. It has been held in Jayalakshmi v. Ganesh Iyer that the unchastity of the mother is no bar as to her inheriting from her son. Even if she is divorced or remarried, she is entitled to inherit from her son. Here the term mother also includes an adoptive mother. Moreover, if there is an adoptive mother, the natural mother has no right to succeed to the property of the intestate. A mother is also entitled to inherit the property of her illegitimate son.

Accordingly, Class I heirs may be termed as preferential heirs of the intestate because the property first devolves upon them on the death of the intestate. All the Class I heirs succeed simultaneously and there is no question of any preference or any priority among them.

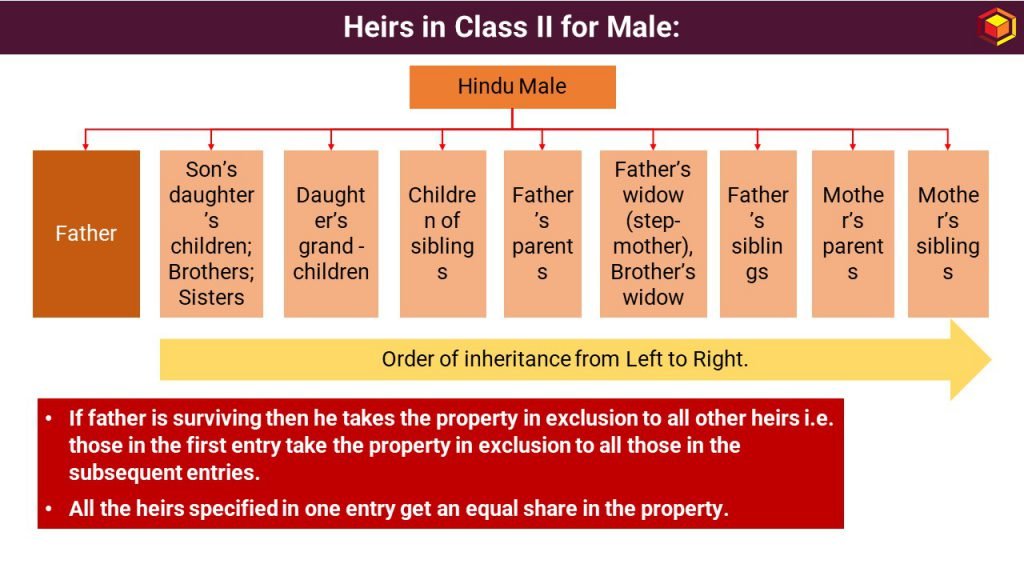

- Heirs in Class II for Hindu Male:

In the absence of Heirs in Class I, Class II Heirs will inherit the wealth of a deceased male. Class II Heirs are as under:

Further, few of the commonly asked questions in relation to succession here are as under:

- All heirs in Class II take cumulatively and not simultaneously, i.e. they succeed in the order of Entries from left to right as mentioned above, as held in the case of Kumuraswami v. Nanjappa. An heir in the higher entry excludes all the heirs in the lower entries.

- The father in Entry I includes an adoptive father. However, a father is not entitled to any property from the illegitimate son as opposed to the mother. However, he is entitled to share from children born out of void or voidable marriage under Section 16. Also, a step mother is not entitled to inherit from the step son.

- All brothers and sisters inherit simultaneously. Here the term ‘brother’ includes both a full and a half-brother. However, a full brother is always preferred to a half-brother (according to Section 18). Uterine brother is not entitled to the intestate’s property. However, when the intestate and his brother are illegitimate children of their mother, they are related to each other as brothers under this entry.

As stated above, in the absence of Class I, Class II heirs can inherit the property. Similarly, in the absence of Class II, Agnates can inherit and in the absence of Agnates, Cognates can inherit the property.

The term Agnate and Cognate are briefly described herein under:

Agnate:

A person is said to be the agnate of another if the two of them are related by blood or adoption entirely or wholly through males. What is to be noted is that agnates of the intestate do not include widows of lineal male descendants because the definition of agnates does not include relatives by marriage but only relatives by blood or adoption. Since these widows would be relatives by marriage hence they will not fall under the definition of agnates and hence, they will not be entitled to inherit in this capacity.

Moreover, there is no limit to the degree of relationship by which an agnate is recognized. Hence, an agnate however remotely related to the intestate may succeed as an heir. Also, this relationship does not distinguish between male and female heirs. There is also no distinction between those related by full and half blood. However, uterine relationship is not recognized.

Cognate:

A person is said to be the cognate of another if the two of them are related by blood or adoption, but not entirely through males. It does not matter if the intervention in the line of succession is by one or more females. As long as there is at least one female intervening, it is a cognate relationship. Just like an agnate relationship, cognate relationship is also not based on marriage and only on blood or adoption. Hence widow or widowers of those related by cognate relationship do not fall under this category and hence they are not entitled to succeed on this ground.

According to this Section, However, when there is no Class I heir, the property devolves upon the Class II Heirs enumerated in the Schedule in the nine Entries.

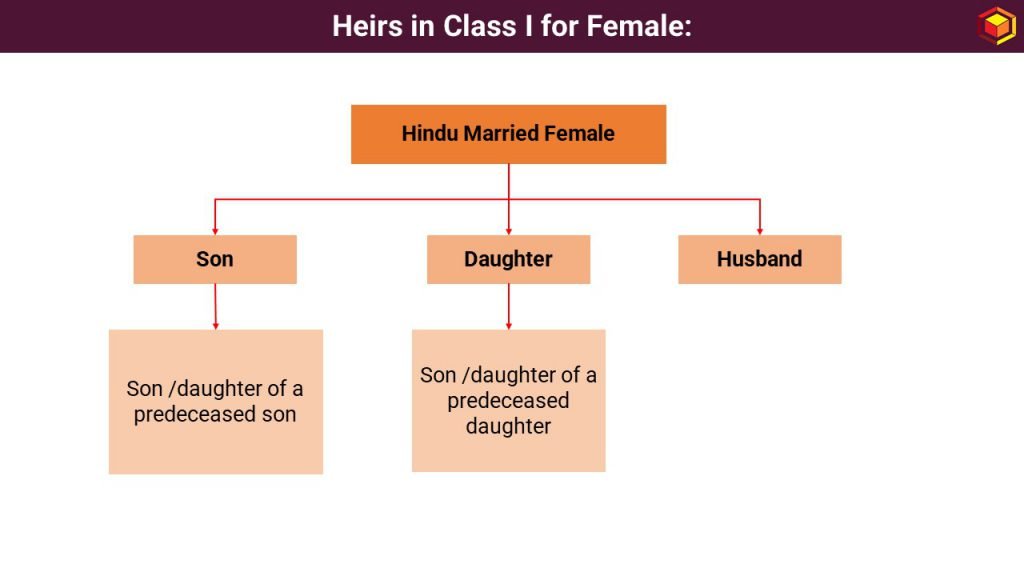

- Heirs in Class I for Hindu Female:

Heirs in Class I for Hindu Female, who is married are as under:

Heirs in Class I for female gets preference in terms of succession in equal manner, simultaneously.

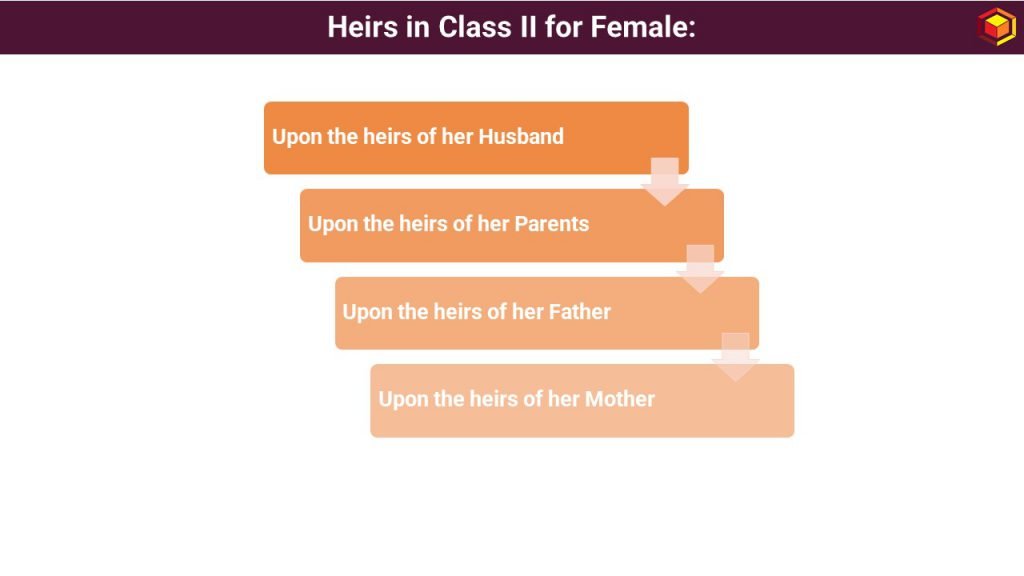

- Heirs in Class II for Hindu Female:

In the absence of Heirs in Class I, Class II Heirs will inherit the wealth of a deceased female in order as mentioned below simultaneously i.e. equally and in priority succession to all the other heirs:

Heirs in Class I for female gets preference in terms of succession in equal manner, simultaneously. Few of the commonly asked questions in relation to succession of female property are as under:

- Any property inherited by a female Hindu from her father or mother shall devolve, in the absence of any son or daughter of the deceased (including the children of any pre-deceased son or daughter) not upon the other heirs referred to in class II, but upon the heirs of the father; and

- Any property inherited by a female Hindu from her husband or from her father-in-law shall devolve, in the absence of any son or daughter of the deceased (including the children of any predeceased son or daughter) not upon the other heirs referred to in class II, but upon the heirs of the husband.

It is important to note that the two exceptions herein referred are confined to only the property inherited from the father, mother, husband and father-in-law of the female and does not affect the property acquired by her by gift or other by other device. The Section has changed the entire concept of stridhana and the mode and manner of acquisition of property by the female, which earlier determined how the property would be inherited, has been changed and amended by the Section.

As observed above, the Succession Laws in India are highly complicated and prone to litigation even. It becomes highly difficult to identify source of wealth creation and then allocate it amongst the heirs as mentioned above. Thus, intestate succession are not at all recommendatory as it involves higher costs and painful procedures.

For more discussion on the above subject, please feel free to connect at contact@devadhaantu.in