Jubilant Life Sciences Limited (‘JLSL’ or ‘the Company’) was incorporated on June 21, 1978 under the provisions of the Companies Act, 1956. The Corporate Identification Number of the Company is L24116UP1978PLC004624 and its registered office is situated at Bhartiagram Gajraula, District Amroha, Uttar Pradesh – 244223. The Company is a listed company and its securities are listed on the Indian Stock Exchanges.

The Company is an integrated global pharmaceutical and life sciences company engaged in the following business:

- Under the integrated global pharmaceuticals business,

- the Company, through its wholly owned subsidiary, Jubilant Pharma Limited, is engaged, directly or indirectly, through its subsidiaries, in the manufacture and supply of active pharmaceutical ingredients (‘APIs’), solid dosage formulations radio-pharmaceuticals, allergy therapy products and contract manufacturing of sterile injectables and non-sterile products through six United States Food and Drug Administration (USFDA) approved manufacturing facilities in the United States, Canada and India and a network of over 50 radio-pharmacies in the United States;

- The drug discovery and development solutions business, provides proprietary inhouse innovation and collaborative research and partnership for out-licensing through two world class research centers in India;

- India branded pharmaceuticals business. The sale of this business has been approved by the Company to its wholly-owned indirect subsidiary on or before January 1, 2020; and

- The life science ingredients business (‘LSI Business undertaking’) comprises of specialty intermediates, nutritional products and life science chemicals businesses through five manufacturing facilities in India and includes its subsidiaries as under:

Sr. no.

Name of Subsidiaries and address

1.

Jubilant Infrastructure Limited

IA, Sector-16A, Noida-201301, U.P.

2.

Jubilant Life Sciences (USA) Inc.

790 Township Line Road Suite 120 Yardley, PA 19067, USA

3.

Jubilant Life Sciences International Pte. Limited

9 Raffles Place, #27-00 Republic Plaza, Singapore 048619

4.

Jubilant Life Sciences (Shanghai) Limited

Room No: 401-A, No. 169, Tiagu Road, Wai Gao Qiao Free Trade zone, Shanghai2001317, China

5.

Jubilant Life Sciences NV

AXXES BUSNESS PARK, Guldensporenpark 22 – Blok C, B – 9820 Merelbeke, Belgium

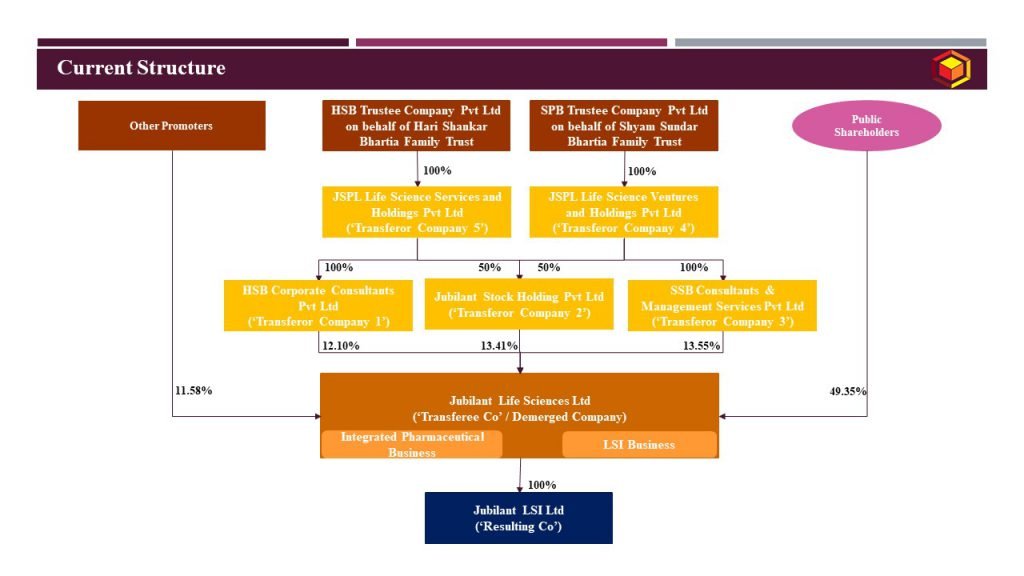

Current structure of the Company is as under:

HSB Corporate Consultants Pvt Ltd (Transferor Company 1), Jubilant Stock Holding Pvt Ltd (Transferor Company 2); SSB Consultants & Management Services Pvt Ltd (Transferor Company 3); JCPL Life Science Ventures and Holdings Pvt Ltd (Transferor Company 4) and JSPL Life Sciences and Holdings Pvt Ltd (Transferor Company 5) are together referred to as ‘Promoter Holding Companies’ are engaged in the business of making, holding, and nurturing investments in life science businesses.

Jubilant LSI Limited (‘the New Company’ or ‘the Resulting Company’) is a newly incorporated company to house LSI business of the Company pursuant to proposed transaction as under:

Management of the Company along with its group Companies has decided to restructure business and shareholding of the group as under:

Transaction 1: Amalgamation of promoter holding companies into the Company;

Transaction 2: Demerger of LSI business undertaking into the New Company, and listing of the New Company.

Restructuring of the group can be depicted as under:

Key features of the above transactions:

Key features | Transaction 1: Merger | Transaction 2: Demerger |

Appointed Date | Date of filling of certified copy of approving authority being NCLT with ROC | Date of filling of certified copy of approving authority being NCLT with ROC |

Effective Date | Date of filling of certified copy of approving authority being NCLT with ROC | Date of filling of certified copy of approving authority being NCLT with ROC, immediately after effectiveness of Transaction 1 |

Jurisdictional Authority(ies) | National Company Law Tribunal, Allahabad Bench Registrar of Companies – Kanpur | National Company Law Tribunal, Allahabad Bench Registrar of Companies – Kanpur |

Consideration | The Company to issue shares to the shareholders of the Promoter Holding Company in the ratio of 1:1; Shares held by Promoter Holding Companies into the Company to get cancelled. | The New Company to issue shares to the shareholders of the Company in the ratio of 1:1; Shares held by the Company into the New Company to get cancelled |

Accounting Treatment | In the books of the Company – Pooling of interest method; In the books of Promoter Holding Companies – NA | In the books of the Company and the New Company – Pooling of interest method |

Taxation | Tax neutral transaction | Tax neutral transaction |

Pre and Post shareholding patterns of the group companies, pursuant to effectiveness of the Scheme:

Name of the Company | Pre-Scheme Shareholding | Post-Scheme Shareholding | ||

% Promoter Shareholding | % Public Shareholding | % Promoter Shareholding | % Public Shareholding | |

Promoter Holding Companies | ||||

| 100% | – | NA, since amalgamated | |

| 100% | – | NA, since amalgamated | |

| 100% | – | NA, since amalgamated | |

| 100% | – | NA, since amalgamated | |

| 100% | – | NA, since amalgamated | |

Jubilant Life Sciences Limited | 50.68% | 49.32% | 50.68% | 49.32% |

Jubilant LSI Limited | 100% | – | 50.68% | 49.32% |

Resultant structure post approval of the Scheme is as under:

Purpose of group restructuring:

- Proposed amalgamation facilitates simplification of structure whereby,

- it eliminates multitier holding structure and results in promoter companies holding shares directly in the Company;

- brings transparency in the promoters holding and demonstrate promoter’s direct commitment and engagement with the Company;

- consolidates group holding structure and provides reduction in compliance costs and assist in identification of ultimate beneficial ownership.

- Proposed demerger facilitates

- creation of separate, distinct and focused entity housing LSI undertaking leading to greater operational efficiencies for the LSI undertaking;

- independent setup of each of the integrated pharmaceutical business and LSI business undertaking of the Company ensures required depth and focus on each of the business undertaking and adoption of strategies necessary for the growth of the respective businesses. The structure shall provide independence to the management in decisions regarding the use of their respective cash flows for dividends, capital expenditure or other reinvestment in their respective businesses;

- unlocking of value for shareholders of the Company by transfer of the LSI Undertaking, which in turn, enables optimal exploitation, monetization and development of both, Residual Undertaking and the LSI Undertaking by attracting focused investors having the necessary ability, experience and interests in this sector and by allowing pursuit of inorganic and organic growth opportunities in such businesses; and

- enabling the business and activities to be pursued and carried on with greater focus and attention through two separate companies each having its own separate administrative set up and dedicated management.

Commercial considerations:

- The Scheme is designed to provide elimination of multi-tier holding structure, thereby reducing any adverse compliance burden under the Companies Act, 2013, as it eliminates the need of undertaking voluntary liquidation of such multi layered company structure which is time consuming.

- Further, scheme enables back-door listing without requirement of following IPO procedures which are lengthy, time consuming and costlier.

- Additionally, amalgamation and demerger are tax neutral thereby eliminates any adverse tax liability in the hands of companies involved under the Scheme as well as in the hands of shareholders of such companies.

- Scheme facilitates monetization of LSI business undertaking and segregation of management for both the business undertaking, thereby providing greater flexibility to each of the business units and growth potential by attracting right talent pool and investors funding.

For more detailed discussion, please feel free to connect at contact@devadhaantu.in